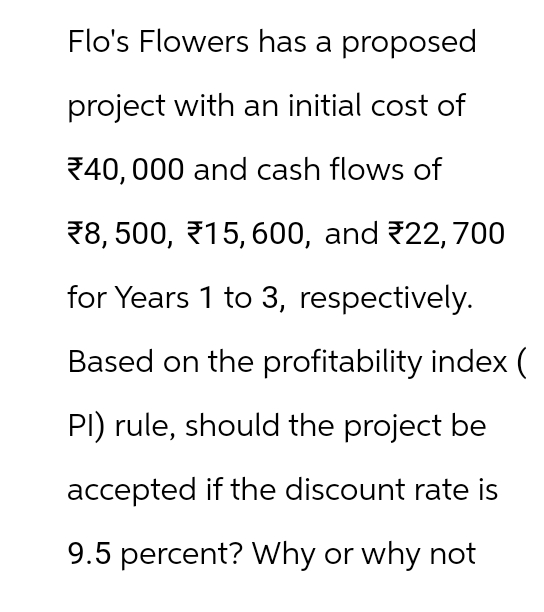

Flo's Flowers has a proposed project with an initial cost of 40,000 and cash flows of ₹8, 500, 15, 600, and 22, 700 for Years 1 to 3, respectively. Based on the profitability index ( PI) rule, should the project be accepted if the discount rate is 9.5 percent? Why or why not

Q: None

A: The incremental annual cash flow in this problem is the after tax savings from the decrease in…

Q: Your uncle has $260,000 invested at 7.5%, and he now wants to retire. He wants to withdraw $35,000…

A: The above answer can be explained as under - For finding the number of years, the excel function to…

Q: None

A: Step 1:Final answer short: System A: NPV = $562,795.80System B: NPV = $1,279,931.39

Q: Given the information in the table below, what is the covariance between the return series of stock…

A:

Q: Federal Express (FedEx) is considering adding 18 used Boeing 757 jets by buying the twin engine…

A: By contrasting the present value of an investment's anticipated cash inflows with the present value…

Q: You have $90,979 to invest in two stocks and the risk-free security. Stock A has an expected retu of…

A: Total investment = $90,979Amount investment in stock B = $26,820Expected return of stock A =…

Q: What is the expected capital gains yield?

A: Dividend yield is = (Next dividend payment/Current stock price)*100Dividend yield is =…

Q: Keys Corporation's 5-year bonds yield 6.20% and 5-year T-bonds yield 4.40%. The real risk-free rate…

A: Given information: Real risk free rate (r*) = 2.5% Inflation premium (IP) = 1.50% Maturity risk…

Q: Leah is considering repositioning some of the investments in her bond portfolio. Of the bonds shown…

A: Approach to solving the question:Bond duration Detailed explanation:To determine which bond has the…

Q: Three years ago, you founded Outdoor Recreation, Inc., a retailer specializing in the sale of…

A: Step 1: Final answer: a. The IPO price per share will be $15.50.b. You will own 31.3% of the firm…

Q: Suppose the current exchange rate between the US dollar (USD) and the euro (EUR) is 1 USD = 0.85…

A: The ability of international investors to swiftly switch between domestic and foreign assets exerts…

Q: None

A:

Q: Suppose the economy could be either strong or weak next year, each with a 50% probability. In a…

A: Probability of a strong economy = 50%Probability of a weak economy = 50%Stock S return in a strong…

Q: he NFF Corporation has announced plans to acquire LE Corporation. NFF is trading for $ 64 per…

A: Step 1:

Q: Atlanta Nashville 51140 51720 53266 44721 51640 37428 46430 51538 53016 45369 51486 42094 50527…

A: Step 1: State the Null and Alternative HypothesesNull hypothesis:In symbols:Ho: µ1 = µ2In words:The…

Q: Exercises. 1. Three 2-year bonds have the following cash flows and prices: A. (2,3), PA = 2.5 B. (3,…

A: The objective of the question is to identify if there is any arbitrage opportunity in the given bond…

Q: Show steps to calculation with screenshots of exce!!!! - A lender wants to achieve a 8.5% yield…

A: Definition: Mortgage Equivalent Yield (MEY) is used in real estate and finance to compare the yield…

Q: Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following…

A: Here,FCF of Year 1 is -$17FCF of Year 2 is $30FCF of Year 3 is $50Growth Rate is 7%WACC is 14%

Q: The accompanying data file shows the square footage and associated property taxes for 20 homes in an…

A: Step 1: Step 2: Step 3:

Q: 9. A perpetuity due pays 600 in the first year, and in each subsequent year, the payment is 1%…

A: Given: PV = P + (1.01P)/(1 + i) + (1.02P)/(1 + i)^2 + (1.03P)/(1 + i)^3 + ...PV = 152,100 then use…

Q: Vijay

A: In conclusion, the preliminary pro forma financials for Robust Properties were prepared considering…

Q: Suppose a 10% 3years bond with a FV of $1000 Spot rates r1= 10%, r2= 12%, r3=13%. Calculate the…

A: The objective of the question is to calculate the forward rate 1f2 for a 10% 3-year bond with a face…

Q: Here, we want to work through a proforma income statement to determine the cash flows from the…

A: The prompt provides a detailed scenario for analyzing the Johnson & Johnson (JNJ) Heart Flow…

Q: 3) Steve just traded in his old car for a new Tesla. To help him pay off the monthly car loan,…

A: The objective of the question is to identify which of the provided statements about car insurance…

Q: Please show the appropriate formula and step-by-step calculations and working for the following:…

A: Calculations:1. Operating Cash Flow (OCF) for Years 1-7Formula: OCF = Sales Revenue - Variable Cost…

Q: None

A: Approach to solving the question: For better clarity of the solution, I have attached the Excel…

Q: None

A:

Q: A European firm borrows MXN from a Mexico bank at a 7% interest rate. Over that same time, the Euro…

A: Here's how to calculate the European firm's euro-denominated equivalent cost of borrowing:1.…

Q: Based on the table below, the 2-year implied spot rate is closest to: Forward rate 1 year forward…

A: The objective of the question is to calculate the 2-year implied spot rate based on the given…

Q: John and Marsha are buying their first home. It has three bedrooms, two baths, and a two car garage.…

A: Total cost of home is $ 266,500/.Down payment is $ 35,000/.Balance amount to be paid using loan is =…

Q: Plan I: Shares outstanding Debt 1,100 16,500 Plan II: Shares outstanding 900 Debt outstanding $…

A: Given Data: Plan IShares Outstanding 1100Debt16500Plan IIShares Outstanding 900Debt27500Interest…

Q: (NPV, PI, and IRR calculations) Fijisawa Inc. is considering a major expansion of its product…

A: Step 1:NPV or Net present value is the present value of cash inflows minus initial investment. PI or…

Q: son.1

A: Detailed explanation:To compute the total monthly housing payment for Ben and Carla Covington, we've…

Q: int rences 8 00 Gook Suppose you are 35 and have a $90,000 face amount, 15-year, limited-payment,…

A: Step 1: Finding the FV of annuity of $810 for 15 years @ 8% pa Formula for future value of…

Q: Suppose you want to have $500,000 for retirement in 35 years. Your account earns 6% interest. How…

A: Step 1: Step 2: Step 3: Step 4:

Q: What information does the payback period provide? Suppose you are evaluating a project with the…

A: Payback period2.50 yearsYearCash flows1$350,000.002$400,000.003$475,000.004$425,000.00WACC = 9%

Q: Raghubhai

A: Here's a detailed calculation for better understanding. The NPV formula for each cash flow…

Q: Your company is worried that it will not be able to fully support the 28% growth in sales that has…

A: The objective of the question is to calculate the amount of additional external financing needed by…

Q: On Thursday 25th August, 2022, George deposited a cheque from Second Hand Cars Limited for…

A: i. Approach to solving the question: The approach to solving this case involves carefully analyzing…

Q: Bauer Industries is an automobile manufacturer. Management is currently evaluating a proposal to…

A: (Since you have posted a question with multiple sub parts, we will provide the solution only to the…

Q: Didn't get answer

A: Step 1:a)We have to fill this table and calculate profit and return on different options. (i) The…

Q: What is the dividend yield for each of these four stocks? What is the expected capital gains…

A: The objective of the question is to calculate the dividend yield and the expected capital gains…

Q: $10,000 debt is repaid by payments of $800 at the end of each quarter for five years. What…

A: Given Data: ParticularsValuePresent value10000Quarterly Payment800Years5

Q: A 15-year loan requires month-end payments of $587.33 including interest at 8.4% compounded monthly.…

A:

Q: The debt is amortized by the periodic payment shown. Compute (a) the number of payments required to…

A: The objective of this question is to calculate the number of payments required to amortize a debt…

Q: A firm currently is an all-equity firm with a market value of $30,000,000. The firm is contemplating…

A: All the entity needs funds to invest in the assets that are used in business operations to generate…

Q: Mokoko Ltd. is considering a number projects and thus need to estimate its cost of capital in order…

A: Capital structure:Capital structure refers to the mix of a company's financing sources, including…

Q: Projects S and L are equally risky, mutually exclusive, and have normal cash flows. Project S's IRR…

A: Given Data:WACC = 7%Project S's IRR = 15%Project L's IRR = 12%

Q: Assume that the Pure Expectation Theory determines interest rates in the markets. Today's market…

A: The objective of the question is to find the implied interest rate for a 1-year investment starting…

Q: None

A: The problem requires finding the interest rate needed on an ordinary annuity to achieve the same…

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- Redbird Company is considering a project with an initial investment of $265,000 in new equipment that will yield annual net cash flows of $45,800 each year over its seven-year life. The companys minimum required rate of return is 8%. What is the internal rate of return? Should Redbird accept the project based on IRR?Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?Markoff Products is considering two competing projects, but only one will be selected. Project A requires an initial investment of $42,000 and is expected to generate future cash flows of $6,000 for each of the next 50 years. Project B requires an initial investment of $210,000 and will generate $30,000 for each of the next 10 years. If Markoff requires a payback of 8 years or less, which project should it select based on payback periods?

- Jasmine Manufacturing is considering a project that will require an initial investment of $52,000 and is expected to generate future cash flows of $10,000 for years 1 through 3, $8,000 for years 4 and 5, and $2,000 for years 6 through 10. What is the payback period for this project?There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment or $28.000 and is expected to generate the following cash flows: If the discount rate is 5% compute the NPV of each project and make a recommendation of the project to be chosen.There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: If the discount rate is 12%, compute the NPV of each project.

- Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a net cash inflow one year from now of 810,000. Assume the cost of capital is 10 percent. Required: 1. Break the 810,000 future cash inflow into three components: a. The return of the original investment b. The cost of capital c. The profit earned on the investment 2. Now, compute the present value of the profit earned on the investment. 3. Compute the NPV of the investment. Compare this with the present value of the profit computed in Requirement 2. What does this tell you about the meaning of NPV?Project B cost $5,000 and will generate after-tax net cash inflows of $500 in year one, $1,200 in year two, $2,000 in year three. $2,500 in year four, and $2,000 in year five. What is the NPV using 8% as the discount rate? For further instructions on net present value in Excel, see Appendix C.In an unrelated analysis, you have the opportunity to choose between the following two mutually exclusive projects, Project T (which lasts for 2 years) and Project F (which lasts for 4 years): The projects provide a necessary service, so whichever one is selected is expected to be repeated into the foreseeable future. Both projects have a 10% cost of capital. (1) What is each projects initial NPV without replication? (2) What is each projects equivalent annual annuity? (3) Apply the replacement chain approach to determine the projects extended NPVs. Which project should be chosen? (4) Assume that the cost to replicate Project T in 2 years will increase to 105,000 due to inflation. How should the analysis be handled now, and which project should be chosen?

- Roberts Company is considering an investment in equipment that is capable of producing more efficiently than the current technology. The outlay required is 2,293,200. The equipment is expected to last five years and will have no salvage value. The expected cash flows associated with the project are as follows: Required: 1. Compute the projects payback period. 2. Compute the projects accounting rate of return. 3. Compute the projects net present value, assuming a required rate of return of 10 percent. 4. Compute the projects internal rate of return.Clearcast Communications Inc. is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated operating income, and net cash flow for each proposal are as follows: The companys capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average rate of return of 12% is required on all projects. If the preceding standards are met, the net present value method and present value indexes are used to rank the remaining proposals. Instructions 1. Compute the cash payback period for each of the four proposals. 2. Giving effect to straight-line depreciation on the investments and assuming no estimated residual value, compute the average rate of return for each of the four proposals. Round to one decimal place. 3. Using the following format, summarize the results of your computations in parts (1) and (2). By placing the computed amounts in the first two columns on the left and by placing a check mark in the appropriate column to the right, indicate which proposals should be accepted for further analysis and which should be rejected. 4. For the proposals accepted for further analysis in part (3), compute the net present value. Use a rate of 12% and the present value table appearing in Exhibit 2 of this chapter. 5. Compute the present value index for each of the proposals in part (4). Round to two decimal places. 6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4). 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). 8. Based on the analyses, comment on the relative attractiveness of the proposals ranked in parts (6) and (7).Falkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?