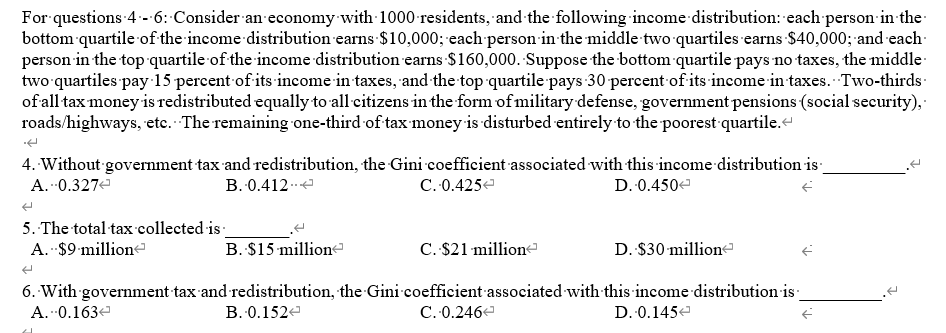

For questions 4 -6: Consider an economy with 1000 residents, and-the following income distribution: each person in the- bottom quartile of the income distribution earns $10,000; each person in the middle two quartiles earns $40,000; and each- person in the top quartile of the income distribution earns $160,000. Suppose the bottom quartile pays no taxes, the middle two quartiles pay 15 percent-of its income in taxes, and the top quartile pays 30 percent of its income in taxes. Two-thirds- of all tax money is redistributed equally to all citizens in the form of military defense, government pensions (social security), roads/highways, ete. The remaining one-third of tax money is disturbed entirely to the poorest quartile. 4. Without government tax and redistribution, the Gini coefficient associated with this income distribution is A. 0.327e B. 0.412-e C. 0.425e D. 0.450- 5. The total tax collected is A. $9 millione B. $15 millione C. $21 millione D. $30 millione 6. With government tax and redistribution, the Gini coefficient associated with this income distribution is A. 0.163e C. 0.246e D. 0.145e B. 0.152e

For questions 4 -6: Consider an economy with 1000 residents, and-the following income distribution: each person in the- bottom quartile of the income distribution earns $10,000; each person in the middle two quartiles earns $40,000; and each- person in the top quartile of the income distribution earns $160,000. Suppose the bottom quartile pays no taxes, the middle two quartiles pay 15 percent-of its income in taxes, and the top quartile pays 30 percent of its income in taxes. Two-thirds- of all tax money is redistributed equally to all citizens in the form of military defense, government pensions (social security), roads/highways, ete. The remaining one-third of tax money is disturbed entirely to the poorest quartile. 4. Without government tax and redistribution, the Gini coefficient associated with this income distribution is A. 0.327e B. 0.412-e C. 0.425e D. 0.450- 5. The total tax collected is A. $9 millione B. $15 millione C. $21 millione D. $30 millione 6. With government tax and redistribution, the Gini coefficient associated with this income distribution is A. 0.163e C. 0.246e D. 0.145e B. 0.152e

Economics (MindTap Course List)

13th Edition

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Roger A. Arnold

Chapter11: Fiscal Policy And The Federal Budget

Section: Chapter Questions

Problem 5WNG

Related questions

Question

1

Transcribed Image Text:For questions 4 - 6: Consider an economy with 1000 residents, and the following income distribution: each person-in the

bottom quartile of the income distribution earns $10,000; 'each person in the middle two quartiles earns $40,000; and each:

person in the top quartile of the income distribution earns $160,000. Suppose the bottom quartile pays no taxes, the middle

two quartiles pay 15 percent of its income in taxes, and the top quartile pays 30 percent of its income in taxes. Two-thirds:

of all tax money is redistributed equally to all citizens in the form of military defense, government pensions (social security),

roads/highways, etc. The remaining one-third of tax money is disturbed entirely to the poorest quartile.

4. Without government tax and redistribution, the Gini coefficient associated with this income distribution is

A. 0.327e

B. 0.412.e

C. 0.425e

D. 0.450e

5. The total tax collected is

A. $9 million

B. $15 million-

C. $21 million

D. $30 million

6. With government tax and redistribution, the Gini coefficient associated with this income distribution is:

C. 0.246e

A. 0.163e

B. 0.152e

D. 0.145e

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning