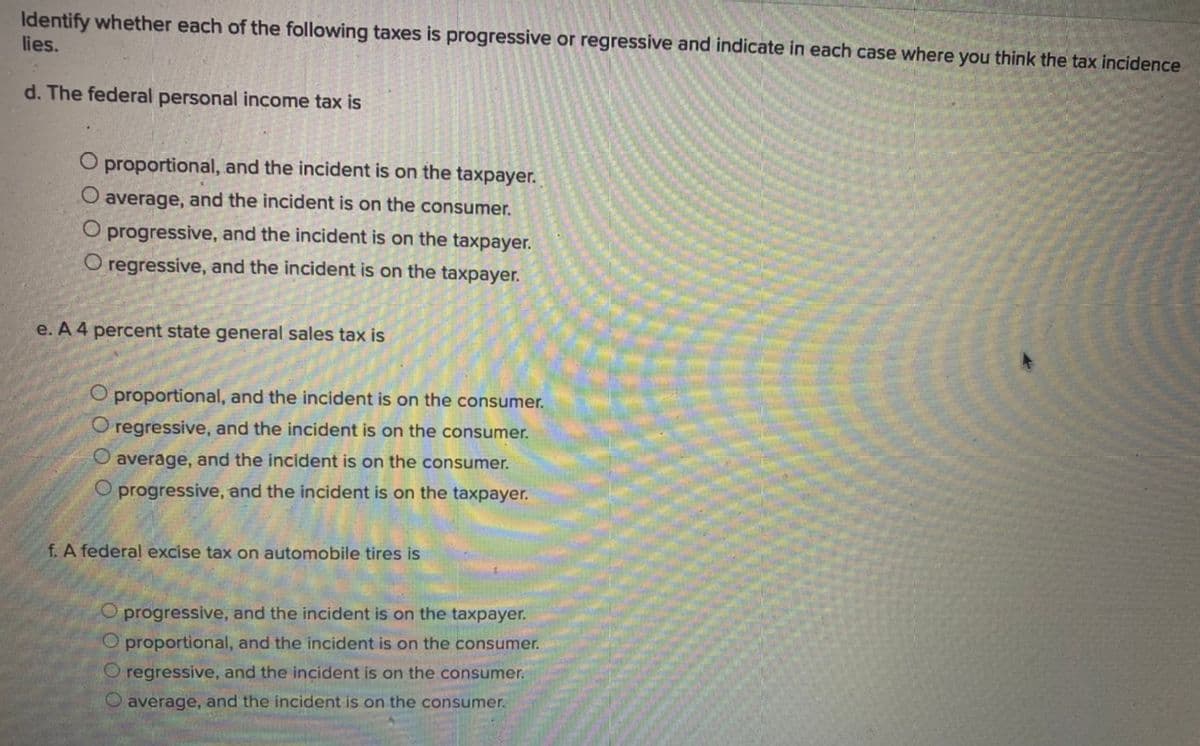

Identify whether each of the following taxes is progressive or regressive and indicate in each case where you think the tax incidence lies. d. The federal personal income tax is O proportional, and the incident is on the taxpayer. O average, and the incident is on the consumer. O progressive, and the incident is on the taxpayer. O regressive, and the incident is on the taxpayer. e. A 4 percent state general sales tax is O proportional, and the incident is on the consumer. O regressive, and the incident is on the consumer. O average, and the incident is on the consumer. O progressive, and the incident is on the taxpayer. f. A federal excise tax on automobile tires is O progressive, and the incident is on the taxpayer. O proportional, and the incident is on the consumer. O regressive, and the incident is on the consumer. O average, and the incident is on the consumer.

Identify whether each of the following taxes is progressive or regressive and indicate in each case where you think the tax incidence lies. d. The federal personal income tax is O proportional, and the incident is on the taxpayer. O average, and the incident is on the consumer. O progressive, and the incident is on the taxpayer. O regressive, and the incident is on the taxpayer. e. A 4 percent state general sales tax is O proportional, and the incident is on the consumer. O regressive, and the incident is on the consumer. O average, and the incident is on the consumer. O progressive, and the incident is on the taxpayer. f. A federal excise tax on automobile tires is O progressive, and the incident is on the taxpayer. O proportional, and the incident is on the consumer. O regressive, and the incident is on the consumer. O average, and the incident is on the consumer.

Economics (MindTap Course List)

13th Edition

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Roger A. Arnold

Chapter11: Fiscal Policy And The Federal Budget

Section: Chapter Questions

Problem 5WNG

Related questions

Question

Transcribed Image Text:Identify whether each of the following taxes is progressive or regressive and indicate in each case where you think the tax incidence

lies.

d. The federal personal income tax is

O proportional, and the incident is on the taxpayer.

O average, and the incident is on the consumer.

O progressive, and the incident is on the taxpayer.

O regressive, and the incident is on the taxpayer.

e. A 4 percent state general sales tax is

O proportional, and the incident is on the consumer.

O regressive, and the incident is on the consumer.

O average, and the incident is on the consumer.

O progressive, and the incident is on the taxpayer.

f. A federal excise tax on automobile tires is

O progressive, and the incident is on the taxpayer.

O proportional, and the incident is on the consumer.

O regressive, and the incident is on the consumer.

O average, and the incident is on the consumer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning