2018 Financial Statement 299,000 135,000 Sales Cost of goods sold Operating expenses, other than depreciation expense Depreciation expense Gain on sale of plant assets 27,000 17,000 16,500 136.500 Net Income Dec. 31, 2017 43,400 1,800 21,250 1,150 Dec. 31, 2018 45,300 1,600 22,500 900 Accounts receivable Inventory Accounts payable Accrued liabilities

Q: C. Klein Inc. Income Statement For years ended December 31, 2017 and 2018 2018 $469,000 $422,000…

A: Vertical analysis mainly refers to the method of financial statement analysis that, helps in figure…

Q: SWEET VALLEY, INC. Comparative Balance Sheet December 31, 2018 and 2017 2018 2017 Assets $ 26,300…

A: Statement of cash flows: This statement reports all the cash transactions which are responsible for…

Q: artial balance sheets and additional information are listed below for Monaco Company. Monaco…

A: A balance sheet can be defined as a statement that provides a summary of the Assets, Liabilities,…

Q: Sheffield Company’s income statement for the year ended December 31, 2020, contained the following…

A: Cash flows from operating activities: It is a section of Statement of cash flow that explains the…

Q: for the year ended December 31, 2020, for Dela Rosa Company Company contains the llowing condensed…

A: Cash flow statement is the statement which shows the total data in relation to the business cash…

Q: The condensed Net sales Cost of goods sold 2018 $168,500 106,553 $ 61,947 $ 22,301 Gross profit from…

A: Particulars Current ratios December 31,2020 2.4 to 1 December 31,2019 1.9 to 1 December…

Q: Income Statement For the Year Ended June 30, 2020 Net of goods sold (including depreciation of…

A: In the direct method of a cash flow statement, cash flow from operating activities is calculated by…

Q: Using ratios to evaluate a stock investment Comparative financial statement data of Garfield Inc.…

A: Ratio analysis refers to the analysis of the company by computing the various ratios like current…

Q: 13. During the year 2018, the Belleview Company had generated total sales revenue of P1,000,000, of…

A: Cash flows from operating activities: It is a section of Statement of cash flow that explains the…

Q: Operating data for Azam Corporation are presented below…

A: Formula: Gross profit = Sales - Cost of goods sold Deduction of cost of goods sold from sales value…

Q: The Following is the Comparative Balance sheet Data of Radiant Co. 2019 2018 Assets Cash 25,000…

A: Cash flows from operating activities : 1. Decrease in Accounts receivables = $60000 - $50000 =…

Q: 2018 852,000 otal revenue expenses osts of goods sold elling/general experies 232,000 9,200 $402,000…

A: Formula used: Amount Increase = 2018 Amount - 2017 Amount

Q: Balance Sheet 2019 2018 Income Statement 2019 2018 Assets Sales $ 51,000,000 $ 47,000,000 Cash…

A: common stock gives the holder the ownership of the firm. formula to find the number of common stock:…

Q: Finance date of Adams Stores, Inc. for the year ending 2016 and 2017. Items 2016 2017 $3,432,000…

A: Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the…

Q: Only the Market Value Ratio. Lan & Chen Technologies: Income Statements for Year Ending…

A: Market Value Ratio are those ratios that helps in deciding whether market price of share is…

Q: Hello, For the following accounting records ending on 12/31/2016: Selling, general and Admin…

A: Gross income equals to Net sales minus Cost of goods sold.Net income equals to Gross income minus…

Q: Partial balance sheets and additional information are listed below for Funk Company. Funk…

A: Given, Sales = $820,000 Beginning accounts receivable = 90,800 Ending accounts receivable = 95,000…

Q: Selected items from Lemus Enterprises 12-31-2019 and 12-31-2018, financial statements are presented…

A: Assets Turnover Ratio determines the ability of a firm or company to generate revenue from its…

Q: Lan & Chen Technologies: Income Statements for Year Ending December 31…

A: Hey, since there are multiple sub-part questions posted, we will answer the first three questions.…

Q: Prepare a statement of cash flows (direct method) for the year 2018. Use the minus sign to indicate…

A: answer with all workings are as follows

Q: BALANCE SHEET INCOME STATEMENT Current Assets: 2017 2018 2018 Cash $ 143,000 $ 154,775 $ 178,000 $…

A: Free cash Flows refers to Net cash flow from Operating Activities less Capital Expenditure. It is…

Q: Income Statement (Extract) for the year ended 31 March 2018 2019 £ £ Sales 3,000,000…

A: Financial ratio is an arithmetic expression used to describe the significant relationship between…

Q: Saturn Company Income Statement for ycar cnded Dec. 31, 2018 Sales Revenue Cost of Goods Sold…

A: Cash flows statement is one of the financial statement which shows about all the cash inflows and…

Q: (In millions) 2019 2018 2017 Revenue $9,575 $9,300 $8,975 cost of goods sold $6,250 $6,000…

A: Horizontal analysis of the financial statements determines the changes of a particular item over the…

Q: Mesflo Enterprise, Income Statement For the Year Ended 31t December, 2020 Sales $442 500 Cost of…

A: Cash Flow Statements: It is a part of financial statement that shows how company is generated cash…

Q: Satum Company Income Statement for year ended Dec. 31, 2018 $238,000 153,000 Sales Revenue Cost of…

A: Cash flows statement is one of the financial statement which shows all cash inflows and cash…

Q: The income statem Sales revenues Cost of goods sold Gross profit Operating expenses Loss before…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: Computing investing and financing cash flows Preston Media Corporation had the following income…

A: 1. Compute the acquisition of plant assets for Preston Media Corporation during 2018.

Q: (Preparation of Operating Activities Section—Direct Method) Krauss Company’s income statement for…

A: Calculate Cash receipts from customers. Calculate Cash payment for operating expenses.

Q: Description Year 2016 500,000 Sales 300,000 Cost of goods sold Depreciation 65,000 Interest expense…

A: Operating cash flow is the cash flow available to companies after payment of the operating expenses…

Q: MARIN COMPANY Comparative Balance Sheets December 31 Assets 2010 2009 $ 41,000 $ 57,000 64,000…

A: Schedule for changes in working capital 2010 2009 Difference Accounts Payable…

Q: One Stop, Inc. Comparative Balance Sheet December 31, 2018 and 2017 2018 2017 Assets Current…

A: Cash flow statement: It is a statement which reports the cash inflows and outflows of a business…

Q: 2018 Income Balance Statement Sheets $ 455,000 (221,500) (58,600) (24,000) 23,500 174,400 Sales Cost…

A: Cash flow statement is prepared to know how adjustment in income and balance sheet effects the cash…

Q: Tiwala Lhungz Company Tiwala Lhung Company Balance Sheet Income Statement As of December 31, 2016…

A: Ratio Analysis: Company's liquidity, operational efficiency, and profitability of the company is…

Q: Preparing the statement of cash flows—indirect method with non-cash transactions The 2018 income…

A: Prepare the statement of cash flows:

Q: Question Description The following income statement and selected balance sheet account data are…

A: A company has to maintain their books of accounts in order to present the financial statements to…

Q: Prepare Morganson's statement of cash flows using the indirect method. Include an accompanying…

A: Cash Flow StatementCash flow statement is one of the financial statement of the company. Cash flow…

Q: ABC Manufacturing Company Balance Sheet as at 31 March 2019 2018 750 10,000 12,750 _31,200 53,950…

A: The analysis which is used for the evaluation of the performance of an entity is known as ratio…

Q: COMPARITIVE for years ended 31 December INCOME STATEMENT *Sales revenue *Interest revenue…

A: Note: The amount of Total expenses and losses given in Question is 321,195 but in actually the total…

Q: Using a spreadsheet to prepare the statement of cash flows—indirect method The 2018 comparative…

A:

Q: Income Statement Dec. 31, 2022 Company A Company B Sales P850,000 P1,350,000 Less: Cost of Goods…

A: Debt to asset ratio refers to the ratio of total debt of a company to its total assets which is…

Q: Use the following information from Eiffel Company’s financial statements. 2018 Income Statement…

A: Cash flows from operating activities means cash inflows and cash outflows related to operations of…

Q: Finance date of Adams Stores, Inc. for the year ending 2016 and 2017. Items 2016 2017 $3,432,000…

A: It is the statement that shows cash generated from three activities.

Q: KINGPIN COMPANY INCOME STATEMENT YEAR ENDED 12/31/20 Sales $300,000 Cost of Goods Sold -150,000…

A: Introduction: Statement of cash flows (SCF) is one of the financial statements prepared for…

Q: e and Environment of Financial Management The Congo Mining Company Income Statement for Years Ending…

A: The Balance Sheet is given as under Required Calculation Total Assets turnover Ratio, Operating…

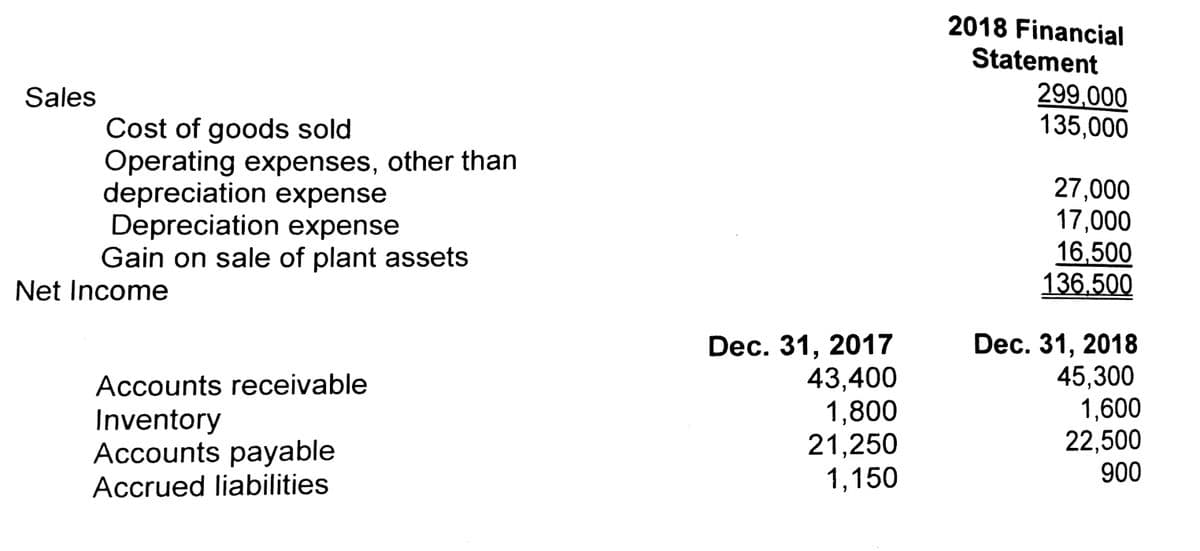

Use the following excerpts from Company's financial information to prepare the operating section of the statement of cash flows (indirect method) for the year 2018.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000Dr.Cr.(GH₵)(GH₵)Stated capital310Income surplus at 1 January 2017456Inventory at 1 January 2017236Turnover1,468Purchases856Salaries46Directors salaries (admin expense)116Land & building at cost550Plant & equipment at cost578Land & building- accumulated depreciation as at 1 January 2017154Plant & equipment –accumulated depreciation as at 1 January 2017266Bank interest received6Sundry expenses56Trade receivables110Trade payables122Accruals42Cash at bank43Dividends paid36Administrative expenses183Interest paid142,8242,824The following information is also relevant:(1) Inventory at 31st December 2017 is GH₵256(2) The tax liability for the year is estimated to be 20% of the profit before tax.4(3) The original cost of land and buildings is made up of GH₵100 land and GH₵450 buildings. Buildings are used in administration and depreciation is charged on a straight line basis over the estimated useful life of 50 years.(4) Plant & equipment are used in distribution and…Topic: Intangible Assets (Goodwill) England Company assembled the following data relative to a certain entity in determining the amount to be paid for net assets and goodwill: Assets at fair value before goodwill 2,600,000 Liabilities 900,000 Shareholders' Equity 1,700,000 Net Earnings after elimination of unusual or infrequent items: 2017 200,000 2018 230,000 2019 300,000 2020 250,000 2021 270,000 Required: Calculate the amount of goodwill under the following: 1. Average earnings are capitalized at 10%. 2. A return of 8% is considered normal on net assets at fair value. Excess earnings are capitalized at 15%. 3. A return of 10% is considered normal on net assets at fair value. Goodwill is measured at 5 years excess earnings. 4. A return of 10% is considered…

- Complete the Form 4562 using the following information provided. Himple RetailFixed Asset Rollforward12/31/2019(book basis) DEPR COST 2017 2018 2019 ACCUM NET BOOK ASSET IN SERVICE METHOD LIFE BASIS DEPR DEPR DEPR DEPR VALUE CASH REGISTER 2/15/2017 SL 5 9,900.00 1,815.00 1,980.00 1,980.00 5,775.00 4,125.00 2017 TOTAL ADDITIONS 9,900.00 1,815.00 1,980.00 1,980.00 5,775.00 4,125.00 RETAIL FIXTURES 10/12/2018 SL 7 4,750.00 169.64 678.57 848.21 3,901.79 FURNITURE 10/12/2018 SL 7 3,900.00 139.29 557.14 696.43 3,203.57 2018 TOTAL ADDITIONS 8,650.00 - 308.93 1,235.71 1,544.64 7,105.36 TOTAL 18,550.00 1,815.00 2,288.93 3,215.71 7,319.64 11,230.36 DELIVERY TRUCK 6/1/2019 SL 5 37,500.00 4,375.00 4,375.00 33,125.00 DESK AND CABINETRY 6/1/2019 SL 7 11,900.00 991.67 991.67 10,908.33 COMPUTER 6/1/2019 SL 5 2,800.00 326.67 326.67 2,473.33 2019 TOTAL ADDITIONS 52,200.00 - - 5,693.34 5,693.34 46,506.66 TOTAL…Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Income Statements for 2020 and 2021 (including dividends paid and retained earnings).

- Coronado Industries Comparative Balance Sheets . December 31, 2022 2021 Assets: Current Assets: Cash $ 1380000 $1100000 Accounts Receivable (net) 3100000 2170000 Inventory 3950000 2510000 Prepaid Expenses 704000 631000 Total Current Assets 9134000 6411000 Long-Term Investments 450000 Plant Assets: Property, Plant & Equipment 4360000 2879000 Accumulated Depreciation (901000 ) (539000 ) Total Plant Assets 3459000 2340000 Total Assets $13043000 $8751000 . Equities: Current Liabilities: Accounts Payable $2550000 $2190000 Accrued Expenses 617000 566000 Dividends Payable 403000 Total Current Liabilities 3570000 2756000 Long-Term Notes Payable 1648000 Stockholders' Equity:…Determine the missing amount: cash$239,186;short term investment$353,700;acct receiv$504,944;inventory? Prepaid exp$83,259;total current asset$1,594927; property&equipment? what is the inventory amount and property& equipment amount?Prepare an Income Statement of Company Alfex as at 31 Dec. 2020.a) Write off (in minus) of short-term financial assets 9 000b) Other costs by nature 4 000c) Change in inventories of traded goods + 2 000d) Revenue from sale of building 50 000e) Income tax 10%f) Revenue from sale of traded goods 12 000g) Retained profits from previous years 10 000h) Accumulated depreciation of building 49 000i) Historical cost of building 102 000

- Balance sheet extracts as at 31/12/2018 & 31/12/2019 2018(RO) 2019(RO) Non-current assets Land 210000 210000 Machinery 45000 74000 Intangible Assets 56000 52000 Current assets Inventories 4000 5000 Account receivables 2500 2000 Prepaid Expenses 300 500 Current liabilities Trade payables 5000 4000 Accruals 1200 700 The operating profit for 2019 was RO 17,000 and the depreciation for the year was RO 8,000( Machinery & amortisation on intangible assets) The depreciation & loss on sale of fixed asset RO 3500 on asset sold originally costing RO 10000 What was the net cash generated from Operations for 2019? What was the net cash generated from Investing Activity?Prepare the income statements and balance sheets for years 2018 and 2019 for Thompson Company using the following information. The balance sheet numbers are at the end of year figures.Item20182019Accounts Payable120.0150.0Accounts Receivable150.0180.0Accumulated Depreciation330.0360.0Cash & Cash Equivalents10.012.0Common Stock150.0200.0Cost of Goods Sold750.0850.0Depreciation25.030.0Interest Expense30.033.0Inventory200.0180.0Long-term Debt150.0150.0Gross Plant & Equipment650.0780.0Retained Earnings208.5225.0Sales1,500.01,700.0SG&A Expenses500.0570.0Notes Payable51.567.0Tax Rate21%21%(2) Answer the following questions:(a) How much did Thompson Company spend in acquiring fixed assets in 2019?(b) How much dividend did Thompson Company pay out during 2019?(c) Using the end of year numbers, did the long-term solvency ratios improve or deteriorate from 2018 to 2019? Answer this question using at least two long-term solvency ratios.(d) Using the end of year numbers, did the asset…ShafNita Sdn. Bhd. Statement of Financial Position as at 31 December2019 2020RM RM RM RM Non Current AssetsBuilding 100,000 100,000Fixtures less accumulated depreciation 3,600 4,000Van less accumulated depreciation 7,840 14,800111,440 118,800 Current AssetInventory 11,200 24,800Trade account receivable 12,800 16,400Bank 1,800 -Cash 440 400 26,240 41,600Total assets 137,680 160,400Finance by:Capital account:Balance at 1 January 74,080 105,080Add: Net profit for the year 70,400 42,320Cash introduced - 20,000144,480 167,400Less: Drawings (39,400) (43,200)105,080 124,200 Non Current LiabilitiesLoan (repayable in 10 years time) 20,000 30,000Current LiablitiesAccount Payable 12,600 6,012Bank overdraft - 188Retained earnings 32,600 36,200Total liabilities and equity 137,680 160,400 Additional information at 31 December 2020: Fixtures bought in 2020 cost RM800. Van bought in 2020 cost RM11,000. Required: Prepare statement of cash flow for ShafNita Sdn. Bhd. for the year ended 31 December…