GARFIELD, INC. Comparative Income Statement Years Ended December 31, 2018 ard 2017 2018 2017 Net Sales Revenue $ 461,000 $ 424,000 Cost of Goods Sold 241,000 211,000 Gross Profit 220,000 213,000 Operating Expenses 137,000 135,000 Income from Operations 83,000 78,000 Interest Expense 9,000 13,000 Income Before Income Tax 74,000 65,000 Income Tax Eхрепse 18,000 24,000 Net Income $ 56,000 $ 41,000 GARFIE.D, INC. Comparative 3alance Sheet December 31, 2018 and 2017 2018 2017 2016* Assets Current Assets: Cash $ 99,000 $ 98,000 Accounts Receivable, Net 108,000 114,000 $ 107,000 Merchandise Inventory 146,000 164,000 202,000 Prepaid Expenses 20,000 9,000 Total Current Assets 373,000 385,000 Property, Plant, and Equipment, Net 211,000 181,000 Total Assets $ 584,000 5 566,000 $ 602,000 Liabilities Total Current Liabilities $ 227,000 $ 246,000 Long-term Liabilities 117,000 100,000 Total Liabilities 344,000 346,000 Stockholders' Equity Preferred Stock, 3% 98,000 98,000 Common Stockholders' Equity, no par 142,000 122,000 89,000 Total Liabilities and Stockholders' Equity $ 584,000 $ 566,000 Selected 2016 amounts

GARFIELD, INC. Comparative Income Statement Years Ended December 31, 2018 ard 2017 2018 2017 Net Sales Revenue $ 461,000 $ 424,000 Cost of Goods Sold 241,000 211,000 Gross Profit 220,000 213,000 Operating Expenses 137,000 135,000 Income from Operations 83,000 78,000 Interest Expense 9,000 13,000 Income Before Income Tax 74,000 65,000 Income Tax Eхрепse 18,000 24,000 Net Income $ 56,000 $ 41,000 GARFIE.D, INC. Comparative 3alance Sheet December 31, 2018 and 2017 2018 2017 2016* Assets Current Assets: Cash $ 99,000 $ 98,000 Accounts Receivable, Net 108,000 114,000 $ 107,000 Merchandise Inventory 146,000 164,000 202,000 Prepaid Expenses 20,000 9,000 Total Current Assets 373,000 385,000 Property, Plant, and Equipment, Net 211,000 181,000 Total Assets $ 584,000 5 566,000 $ 602,000 Liabilities Total Current Liabilities $ 227,000 $ 246,000 Long-term Liabilities 117,000 100,000 Total Liabilities 344,000 346,000 Stockholders' Equity Preferred Stock, 3% 98,000 98,000 Common Stockholders' Equity, no par 142,000 122,000 89,000 Total Liabilities and Stockholders' Equity $ 584,000 $ 566,000 Selected 2016 amounts

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.14P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Using ratios to evaluate a stock investment

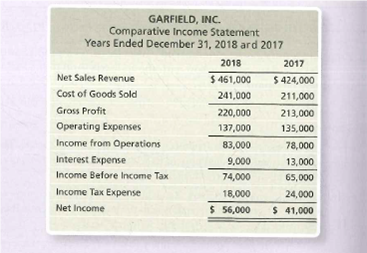

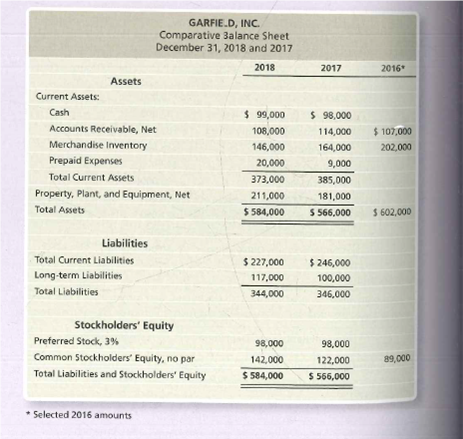

Comparative financial statement data of Garfield Inc. follow:

- Market price of Garfield’s common stock:$69.36 at December 31 2018 and $38.04 at December 31, 2017.

- Common shares outstanding 14, 000 on December 31, 2018 and 12,000 on December 31 2017 and 2016.

- All sales are on credit.

Requirements

- Compute the following ratios tor 2018 and 2017:

a.

b. Cash ratio

c. Times-interest-earned ratio

d. Inventory turnover

e. Gross profit percentage

f. Debt to equity ratio

g.

h. Earnings per share of common stock

i. Price/earnings ratio

2. Decide (a) whether Garfield’s ability to pat debts and to sell inventory improved or deteriorated during 2018 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased.

Transcribed Image Text:GARFIELD, INC.

Comparative Income Statement

Years Ended December 31, 2018 ard 2017

2018

2017

Net Sales Revenue

$ 461,000

$ 424,000

Cost of Goods Sold

241,000

211,000

Gross Profit

220,000

213,000

Operating Expenses

137,000

135,000

Income from Operations

83,000

78,000

Interest Expense

9,000

13,000

Income Before Income Tax

74,000

65,000

Income Tax Eхрепse

18,000

24,000

Net Income

$ 56,000

$ 41,000

Transcribed Image Text:GARFIE.D, INC.

Comparative 3alance Sheet

December 31, 2018 and 2017

2018

2017

2016*

Assets

Current Assets:

Cash

$ 99,000

$ 98,000

Accounts Receivable, Net

108,000

114,000

$ 107,000

Merchandise Inventory

146,000

164,000

202,000

Prepaid Expenses

20,000

9,000

Total Current Assets

373,000

385,000

Property, Plant, and Equipment, Net

211,000

181,000

Total Assets

$ 584,000

5 566,000

$ 602,000

Liabilities

Total Current Liabilities

$ 227,000

$ 246,000

Long-term Liabilities

117,000

100,000

Total Liabilities

344,000

346,000

Stockholders' Equity

Preferred Stock, 3%

98,000

98,000

Common Stockholders' Equity, no par

142,000

122,000

89,000

Total Liabilities and Stockholders' Equity

$ 584,000

$ 566,000

Selected 2016 amounts

Expert Solution

Trending now

This is a popular solution!

Step by step

Solved in 10 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning