Income Statement For the year Ended December 31, 2020 Sales $ 390,000 235,000 Cost of Goods Sold Gross Profit S 155,000 Wages Expenses Depreciation Expense Other Operating Expenses Income Tax Expense 14,000 26,000 17,000 120,000 Net Income $15000 Tery Company Balance Sheets Dec. 31, 2020 Dec. 31 2019 Assets Cash Accounts Receivable (net) Inventory Prepaid Expense Plant Assets Accumulated Depreciation S16.000 28,000 110,000 12,000 178,000 26.000 $ 30,000 35,000 84,000 8,000 130,000 2.000) Total Assets $ 268,000 $ 225,000 Liabilities and Stockholders' Equity S 14,000 Accounts Payable Wages Payable Income Tax Payable Common Stock Retained Earmings 22.000 6,000 3,000 135,000 97,000 2,500 4500 125,000 79,000 ILiabilities and 8,000 225,000 Stockholders' Equity Cash dividends of $17,000 were declared and paid during 2020 Plant assets of $48,000 were purchased for cash, and later in the year, an additional $10,000 common stock was ind for cash REQUIRED Prepare only the Cash Flows from Operation section of the Cash Flow Stutement using the indirect method.

Income Statement For the year Ended December 31, 2020 Sales $ 390,000 235,000 Cost of Goods Sold Gross Profit S 155,000 Wages Expenses Depreciation Expense Other Operating Expenses Income Tax Expense 14,000 26,000 17,000 120,000 Net Income $15000 Tery Company Balance Sheets Dec. 31, 2020 Dec. 31 2019 Assets Cash Accounts Receivable (net) Inventory Prepaid Expense Plant Assets Accumulated Depreciation S16.000 28,000 110,000 12,000 178,000 26.000 $ 30,000 35,000 84,000 8,000 130,000 2.000) Total Assets $ 268,000 $ 225,000 Liabilities and Stockholders' Equity S 14,000 Accounts Payable Wages Payable Income Tax Payable Common Stock Retained Earmings 22.000 6,000 3,000 135,000 97,000 2,500 4500 125,000 79,000 ILiabilities and 8,000 225,000 Stockholders' Equity Cash dividends of $17,000 were declared and paid during 2020 Plant assets of $48,000 were purchased for cash, and later in the year, an additional $10,000 common stock was ind for cash REQUIRED Prepare only the Cash Flows from Operation section of the Cash Flow Stutement using the indirect method.

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

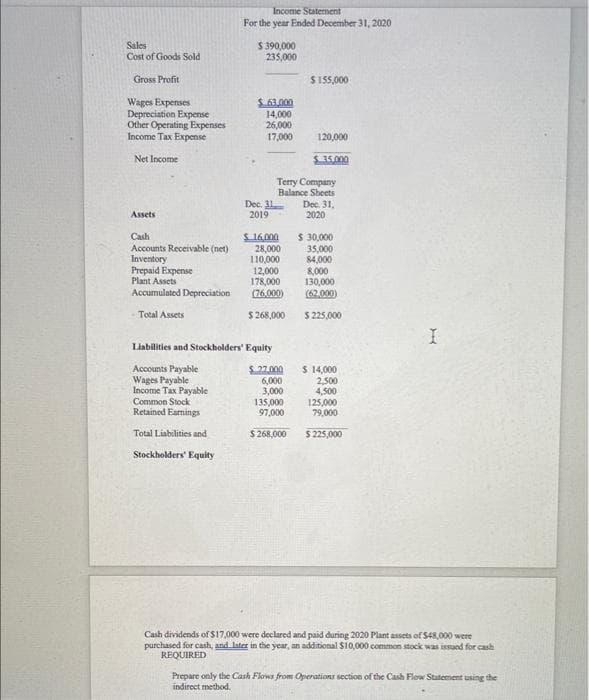

Transcribed Image Text:Income Statement

For the year Ended December 31, 2020

Sales

Cost of Goods Sold

$ 390,000

235,000

Gross Profit

S 155,000

Wages Expenses

Depreciation Expense

Other Operating Expenses

Income Tax Expense

S61000

14,000

26,000

17,000

120,000

Net Income

$35000

Terry Company

Balance Sheets

Dec. 31,

2020

Dec. 1L

Assets

2019

$ 30,000

35,000

84,000

8,000

130,000

(62.000)

Cash

Accounts Receivable (net)

Inventory

Prepaid Expense

Plant Assets

Accumulated Depreciation

S16.000

28,000

110,000

12,000

178,000

(76,000)

Total Assets

$ 268,000

$ 225,000

I

Liabilities and Stockholders' Equity

Accounts Payable

Wages Payable

Income Tax Payable

Common Stock

Retained Earnings

$ 27.000

6,000

3,000

135,000

97,000

S 14,000

2,500

4,500

125,000

79,000

Total Liabilities and

S 268,000

$ 225,000

Stockholders' Equity

Cash dividends of $17,000 were declared and paid during 2020 Plant assets of $48,000 were

purchased for cash, and later in the year, an additional $10,000 common stock was issued for cash

REQUIRED

Prepare only the Cash Flows from Operations section of the Cash Flow Statement using the

indirect method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,