The following items are taken from the financial statements of Blue Spruce Company for the year ending December 31, 2022: Accounts payable $ 17,200 Accounts receivable 7,000 Accumulated depreciation—equipment 5,000 Bonds payable 17,000 Cash 22,000 Common stock 26,400 Cost of goods sold 27,600 Depreciation expense 5,700 Dividends 5,200 Equipment 40,000 Interest expense 2,000 Patents 5,180 Retained earnings, January 1, 2022 5,700 Salaries and wages expense 5,300 Sales revenue 51,500 Supplies 2,820 Net income/loss is $10,900. Prepare a classified balance sheet for Blue Spruce Company. (List Current assets in order of liquidity.) Net income is $10,900.

The following items are taken from the financial statements of Blue Spruce Company for the year ending December 31, 2022: Accounts payable $ 17,200 Accounts receivable 7,000 Accumulated depreciation—equipment 5,000 Bonds payable 17,000 Cash 22,000 Common stock 26,400 Cost of goods sold 27,600 Depreciation expense 5,700 Dividends 5,200 Equipment 40,000 Interest expense 2,000 Patents 5,180 Retained earnings, January 1, 2022 5,700 Salaries and wages expense 5,300 Sales revenue 51,500 Supplies 2,820 Net income/loss is $10,900. Prepare a classified balance sheet for Blue Spruce Company. (List Current assets in order of liquidity.) Net income is $10,900.

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter4: Completing The Accounting Cycle

Section: Chapter Questions

Problem 4.10EX: Classifying assets Identify each of the following as (A) a current asset or (B) property, plant, and...

Related questions

Question

The following items are taken from the financial statements of Blue Spruce Company for the year ending December 31, 2022:

| Accounts payable | $ 17,200 | ||

| 7,000 | |||

| 5,000 | |||

| Bonds payable | 17,000 | ||

| Cash | 22,000 | ||

| Common stock | 26,400 | ||

| Cost of goods sold | 27,600 | ||

| Depreciation expense | 5,700 | ||

| Dividends | 5,200 | ||

| Equipment | 40,000 | ||

| Interest expense | 2,000 | ||

| Patents | 5,180 | ||

| 5,700 | |||

| Salaries and wages expense | 5,300 | ||

| Sales revenue | 51,500 | ||

| Supplies | 2,820 |

Net income/loss is $10,900.

Prepare a classified

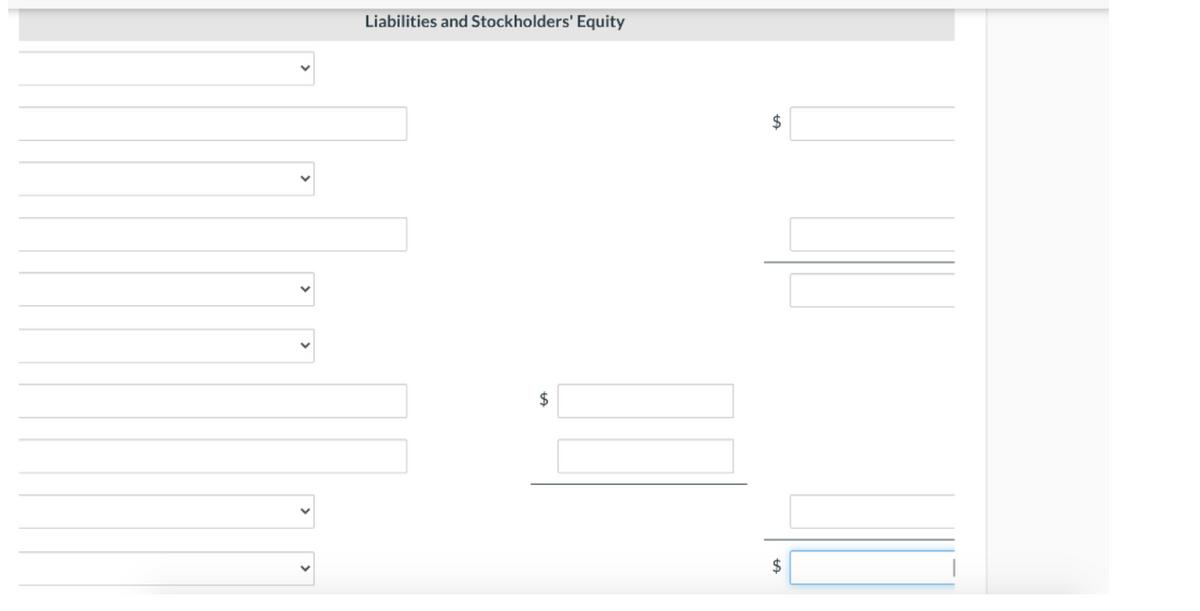

Transcribed Image Text:Liabilities and Stockholders' Equity

$

$

$

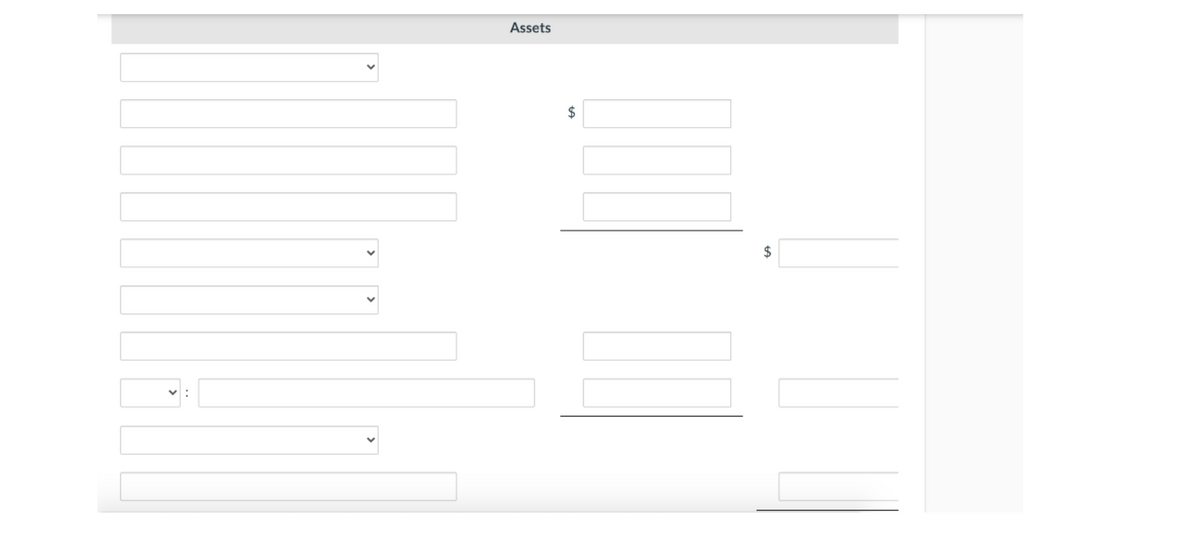

Transcribed Image Text:Assets

$

2$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,