he following items are taken from the financial statements of Blue Spruce Company for the year ending December 31, 2022: Accounts payable $ 17,200 Accounts receivable 7,000 Accumulated depreciation—equipment 5,000 Bonds payable 17,000 Cash 22,000 Common stock 26,400 Cost of goods sold 27,600 Depreciation expense 5,700 Dividends 5,200 Equipment 40,000 Interest expense 2,000 Patents 5,180 Retained earnings, January 1, 2022 5,700 Salaries and wages expense 5,300 Sales revenue 51,500 Supplies 2,820 Prepare a classified balance sheet for Blue Spruce Company. (List Current assets in order of liquidity.) Net income is $10,900.

he following items are taken from the financial statements of Blue Spruce Company for the year ending December 31, 2022: Accounts payable $ 17,200 Accounts receivable 7,000 Accumulated depreciation—equipment 5,000 Bonds payable 17,000 Cash 22,000 Common stock 26,400 Cost of goods sold 27,600 Depreciation expense 5,700 Dividends 5,200 Equipment 40,000 Interest expense 2,000 Patents 5,180 Retained earnings, January 1, 2022 5,700 Salaries and wages expense 5,300 Sales revenue 51,500 Supplies 2,820 Prepare a classified balance sheet for Blue Spruce Company. (List Current assets in order of liquidity.) Net income is $10,900.

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 11P: RATIO CALCULATIONS Assume the following relationships for the Caulder Corp.: Sales/Total assets 1.3...

Related questions

Question

The following items are taken from the financial statements of Blue Spruce Company for the year ending December 31, 2022:

| Accounts payable | $ 17,200 | ||

| 7,000 | |||

| Accumulated |

5,000 | ||

| Bonds payable | 17,000 | ||

| Cash | 22,000 | ||

| Common stock | 26,400 | ||

| Cost of goods sold | 27,600 | ||

| Depreciation expense | 5,700 | ||

| Dividends | 5,200 | ||

| Equipment | 40,000 | ||

| Interest expense | 2,000 | ||

| Patents | 5,180 | ||

| 5,700 | |||

| Salaries and wages expense | 5,300 | ||

| Sales revenue | 51,500 | ||

| Supplies | 2,820 |

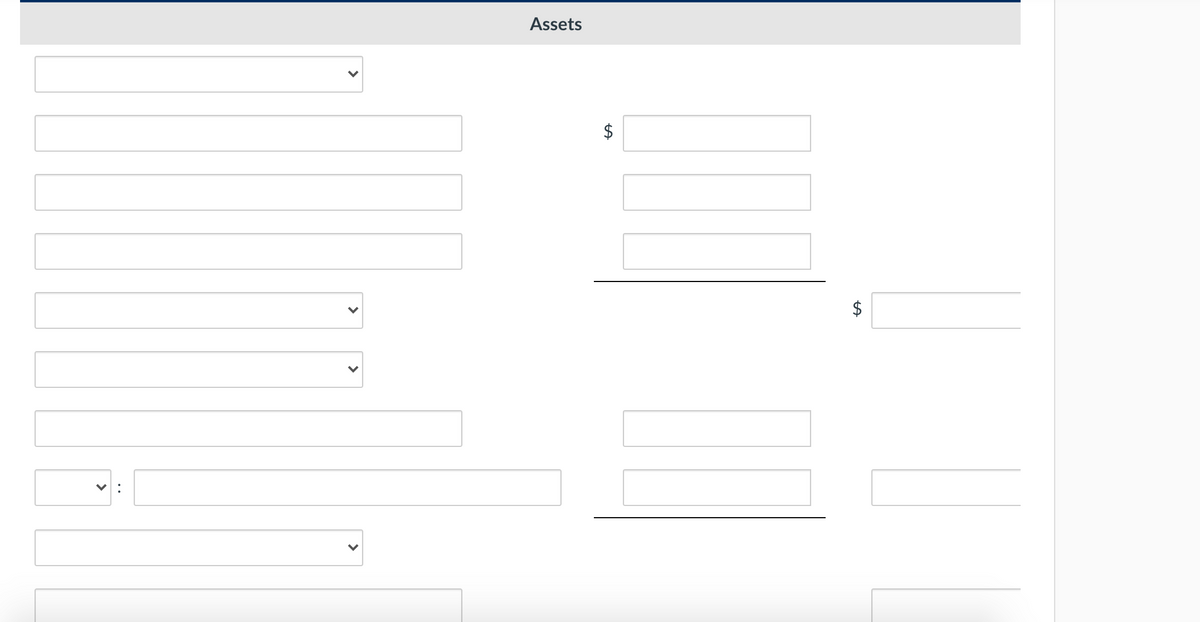

Prepare a classified

Transcribed Image Text:Assets

%24

%24

>

>

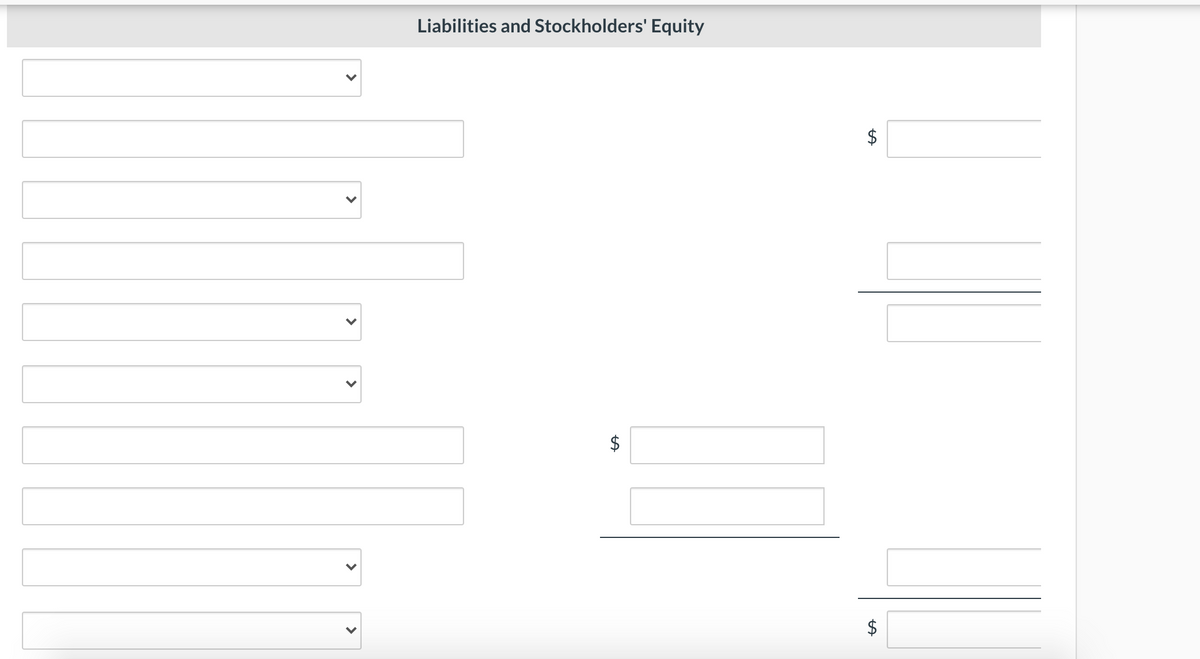

Transcribed Image Text:Liabilities and Stockholders' Equity

$

%24

%24

>

>

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning