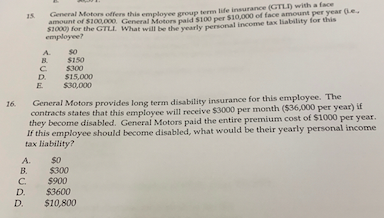

General Motors offers thhis employee group term amount of $100,000. General Motors paidS100 per S10.000 of face amount per year (e s1000) for the GTLL What will be the vearly personal income tax liability for this employee? A. B. so $150 $300 D. $15,000 S30,000 E

Q: Mianel, an employee of XYZ Corp. is receiving regular monthly compensation in the amount of…

A: Monthly Compensation = 100,000 Non taxable deductions: GSIS = 9,000 Philhealth = 687.50 HDMF =…

Q: Suppose you made $98,296 of income from wages and $567 of taxable interest. You also made…

A: Income from Wages= $98296 Taxable Interest= $567 Contribution to tax-deferred retirement account=$…

Q: ual to $320,000. Tiptop had interest expenses of $80,000 and depreciation expenses of $75,000 durin…

A: Explanation of concept Tax:- A tax is the compulsory payment which is imposed by the government on…

Q: Vergo Company acquired a motor vehicle for P1,000,000 for the use of one of its on-call employees.…

A: If the Employer owns and maintains a motor vehicle for the use by employee for the business…

Q: 1. Pepe is a Manager working at Ayala Malls Legazpi for Taxable year 2020. He had the following…

A: In the context of the given question, we are going to compute the final tax to be withheld by the…

Q: An employer is required to withhold 7.65 percent of the first $62,700 of an employee's income for…

A: Social tax security is a compulsory contribution of employer and employee. It funds the retirement,…

Q: 40 year old Taxpayer: Salary 100,000 Bonus 20,000 ER Paid Health Insurance 10,000 ER Paid Parking…

A: Taxable Compensation or Taxable Income = Gross Salary ( Basic Pay + Dearness Allowance + HRA +…

Q: Mary Gonzalez had total cumulative gross earnings of $5,800 as of 1/31/20X1. Her gross earnings for…

A: State unemployment and Federal unemployment taxes are employer payroll taxes. These taxes are not…

Q: 4. Mr. Monreal earned a gross compensation income of P200,000, exclusive of P20,000 non-taxable…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: In the taxable year 2020, the following data pertain to a corporate business organization: • 90,000…

A: Fringe benefits are the additional benefits and compensation, that is being provided to employee by…

Q: Hobby Hut has three employees. Find the amount subject FUTA and the amount of the FUTA for this pay…

A: >FUTA stands for Federal Unemployment Tax Act. It is an act that imposes a payroll tax on…

Q: a) A (45 years), a salaried private sector employee, wants to know the amount of tax liability in…

A: Since, nothing is mentioned regarding Tax Regime. It is assumed that Mr. A has not opted for New tax…

Q: Calculate the tax liability for Andre, a single tax resident, receiving $1,000 dividend (80%…

A: Tax is a liability for an individual or a company that has to be paid on the income earned and it is…

Q: d. f. Pre-tax financial profit is P10,000,000 and income tax rate is 30% for the current and future…

A: "Since you have posted a question with multiple subparts, we will solve the first three subparts for…

Q: .Pedro earned and incurred the following income and expenses: |Compensation (exclusive of mandatory…

A: Taxable income: Taxable income refers to the sum of gross income from all the sources that indicate…

Q: Harold is a resident Citizen,vat tax payer. taxable period:2020 Gross sales php 5,000,000 other…

A: Optimal Tax - It is a tax amount calculated on the income without considering any deduction out of…

Q: 1 Jacqueline Cruz generated annual compensation income of 455,000 net of statutory payments Tax…

A: Disclaimer: Since this is a multiple question, we can answer only to the first question. If you want…

Q: (b) Mr. Suntan Ahmed has filed his Income Tax Return for the year ending on 30-06-2020 showing the…

A: The taxable income is calculated by combining income from all the sources and deducting exempted…

Q: Ms. Cumacaliua is concurrently employed at Cumanan Corporation an Paatras Company. She received the…

A: Business tax in the Philippines has to be paid by the corporates and also by those individuals who…

Q: 1. General Motors offers this employee group term life insurance (GTLI) with a face amount of…

A: Hello. Since your question has multiple parts, we will solve first question for you. If you want…

Q: A private employee had the following remuneration in 2019: Gross salaries, net of P11,000 mandatory…

A: Payroll- Payroll is the procedure for paying a company's employees. This procedure entails…

Q: In the taxable year 2020, the following data pertain to a corporate business organization: De…

A: In taxable year 2020, Date pertains to a corporate business organization are : 1. De minimis…

Q: Mark resigned in 2021 after 12 years of service. He had the following income during the year:…

A: The separation pay is included in the gross income together with the salary because the separation…

Q: A taxpayer registered in 2020 made available the following financial information for TY2021 :…

A: As per CREATE law, if income of domestic corporation is less than 5 million, then tax rate will be…

Q: Atty. Diokno owns 30% of the capital and profits of his law office. The law office reported…

A: IAtty. Diokono holds 30% of the capital and profits of his law office

Q: Eduard Montes generated annual compensation income of ₱ 455,000, net of statutory payments. Tax…

A: Tax obligation seems to be the sum of money owed to tax authorities with in manner of a tax debt.…

Q: Mang Panday, a resident citizen taxpayer approached you and presented the following- * Description…

A:

Q: Balance Sheet: Asset – Php 500,000 Liability – Php 100,000 Stockholders' Equity – Php 400,000…

A: Income tax is a tax that is paid on the income of a company, individual, AJP, BOI (i.e.on person)…

Q: Mr. Raya earns purely compensation income for the year 2021 with an annual basic salary of…

A: Given, Government Mandatory Contributions – Php21,900.00, Holiday, OT and Night Differential Pay –…

Q: Ms. V is currently employed in VVV Company. She has the following income and withheld income tax in…

A: Compensation is the cash or non-cash revenue received by the employee from the employer over and…

Q: Sparrow Corporation (a calendar year, accrual basis taxpayer) had the follow ing transactions in…

A: Answer - Particulars Amount Taxable income $330,000 330000 Less :Federal income tax…

Q: An employee has year-to-date earnings of $115,400. The employee’s gross pay for the next pay period…

A: FICA--OASDI Tax: FICA--OASDI stands for Federal Insurance Contributions Act for Old Age, Survivor…

Q: Compute for the tax due of the following individuals using the RA 10963 tax table. Show…

A: In the United States of America, the taxable income is all gross income of the entity that includes…

Q: In the following problems, use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.…

A: FUTA tax for the year = (Total payroll for the year - wages paid in excess of $7,000) x FUTA tax…

Q: Layla has $200,000 of QBI from her neighborhood clothing store (a sole proprietorship). Her…

A: 1. Calculation of Taxable Income Note: W2 wages and Investment in property do not exceed thier…

Q: 1. Pepe is a Manager working at Ayala Malls Legazpi for Taxable year 2020. He had the following…

A: The gross compensation for Pepe would be the amount received from the employer including mandatory…

Q: Z Corporation paid P 136, 000 cash fringe benefit for the year 2019 representing 80 % of the car…

A: Fringe benefit refers to those extra or additional benefits provided to employees from their…

Q: Suppose you made $70,390 of income from wages and $178 of taxable interest. You also made…

A: Taxable Income is income on which tax is calculated o be paid to government for a particular after…

Q: Finthe olanks Mr. Pluto had the following income during the year: Gross compensation income…

A: Gross income is the one in which the deductions and expenses are yet to be adjusted.

Q: Pedro has the following income in 2020. Compensation income including 65,000 for SSS-365,000…

A: Answer: As per Q/A guidelines, only first question is to be answered. Please repost remaining…

Q: You are an employee in the private sector. For the year 20x1, you received a 13th month pay of…

A: Taxable income is the amount on which the income tax needs to be paid as per slab applicable for…

Q: Arndt, Ic., reported the following for 2018 and 2019 ($ in millions): 2018 2019 $ 995 $1,073 840 $…

A: Solutoin 6: Tax schedule showing reconciliation between pre tax financial income, taxable income,…

Q: An employee has year-to-date earnings of $115,400. The employee’s gross pay for the next pay period…

A:

Q: A single person has taxable income of $52,000 per year. He contributes $1,000 to his company’s…

A: Flexible Spending Account : It is a type of account which is like savings account for keeping aside…

Q: Record the payroll entry and payroll tax entry for the pay of the week ended June 7 (his…

A: Tax refers to the amount charged by the government on individuals, partnership firms, HUF’s or any…

Q: monthly compensation in the amount of ₱100,000. The monthly nontaxable deductions would be GSIS (₱…

A: Given Monthly Compensation = 100,000 Non taxable deductions: GSIS = 9,000 Philhealth = 687.50…

Q: -4) Mrs. Reena earns a salary of $58,500 in a year. P.AY.E deducted at source was $2100.00.…

A: Tax payable/(Refund) = Total Tax Due - P.A.Y.E deducted at source

Step by step

Solved in 2 steps with 1 images

- On January 1, 2019, Kunto, a cash basis taxpayer, pays 46,228 for a 24-month certificate. The certificate is priced to yield 4% (the effective interest rate) with interest compounded annually. No interest is paid until maturity, when Kunto receives 50,000. In your computations: a. Compute Kuntos gross income from the certificate for 2019. b. Compute Kuntos gross income from the certificate for 2020. Round any amounts to the nearest dollar.Lemur Corp. is going to pay three employees a year-end bonus. The amount of the year-end bonus and the amount of federal income tax withholding are as follows. Lemurs payroll deductions include FICA Social Security at 6.2%, FICA Medicare at 1.45%, FUTA at 0.6%, SUTA at 5.4%, federal income tax as previously shown, state income tax at 5% of gross pay, and 401(k) employee contributions at 2% of gross pay. Record the entry for the employee payroll on December 31.LO.2 In 2019, Chaya Corporation, an accrual basis, calendar year taxpayer, provided services to clients and earned 25,000. The clients signed notes receivable to Chaya that have a fair market value of 22,000 at year-end. In addition, Chaya sold a 36-month service contract on June 1, 2019, and received payment in full of 12,000. How much gross income does Chaya report from these transactions in 2019?

- Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses 760 800 Pretax accounting income (income statement) $ 128 $ 180 Taxable income (tax return) $ 116 $ 200 Tax rate: 25% Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. Expenses include $2 million insurance premiums each year for life insurance on key executives. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint: View this as two temporary differences—one reversing in 2021; one originating in 2021. 2021…Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses 760 800 Pretax accounting income (income statement) $ 128 $ 180 Taxable income (tax return) $ 116 $ 200 Tax rate: 25% Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. Expenses include $2 million insurance premiums each year for life insurance on key executives. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint: View this as two temporary differences—one reversing in 2021; one originating in 2021. 2021…Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses 760 800 Pretax accounting income (income statement) $ 128 $ 180 Taxable income (tax return) $ 116 $ 200 Tax rate: 25% Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. Expenses include $2 million insurance premiums each year for life insurance on key executives. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint: View this as two temporary differences—one reversing in 2021; one originating in 2021. 2021…

- Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): 2021 2022 Revenues $ 888 $ 980 Expenses 760 800 Pretax accounting income (income statement) $ 128 $ 180 Taxable income (tax return) $ 116 $ 200 Tax rate: 25% Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. Expenses include $2 million insurance premiums each year for life insurance on key executives. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million ($10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint: View this as two temporary differences—one reversing in 2021; one originating in 2021. 2021…HANGANG Park has life insurance policies on its officers’ lives. Annual premiums amount to P50,000. At the end of 2020, cash surrender value of the policies totaled P182,000. Dividends received by HANGANG from the insurance company amounted to P5,000 in 2020. The insurance expense recognized by HANGANG Park in 2020 was P35,000.What was the amount of cash surrender value of these policies on January 1, 2020? a. P172,000 b. P162,000 c. P142,000 d. P102,000An individual has an RSP that they are drawing money out of during 2020. TheRRSP has earned dividends of $10,000. The individual withdraws $32,000 from theRRSP. To obtain that much cash, the RSP sells investments worth $32,000 thathave a cost basis of $20,000. What is the individual's 2020 taxable income as aresult of the RRSP? A) 42000 B) 16000 C)19800 D)32000

- Robin Corp. had the following in 2020: Taxable Income: $330,000 Federal income tax: $69,300 Interest on state gov’t (muni) bond: $5,000 Interest on corporate bond: $10,000 Meals expense (total): $3,000 Key person life insurance premiums: $3,500 Key person life insurance proceeds: $130,000 Ordinary & necessary business expenses: $250,000 Dividends (from a less-than-20%-owned US corp.; hint: make sure to include the 50% DRD in your E&P calculations): $35,000 What is Robin Corp.’s current E&P? Assume that there is no cash surrender value on the life insurance policy. Ans: 425,700 Q1. Same facts as previous question (use the current E&P from the previous question). Robin Corp. had the following in 2020: In addition to the current year E&P, Robin Corp. had accumulated E&P of $50,000. At the end of 2020, Robin Corp. distributed $450,000 cash to its sole shareholder, Robyn. Robyn’s stock basis prior to the distribution was…General Motors provides long term disability insurance for this employee. The contract states that this employee will earn $3000 per month ($36,000 per year) if they become disabled. General Motors paid the entire premium cost of $1000 per year. If this employee should become disabled, what would be their yearly personal income tax liability?A. $0B. $300C. $900D. $3600E. $10,800Export-Import Corporation paid the amount of P13,000.00 to Hernando’s Hideaway Resort Corporation for the vacation expenses of Mr. Leandro Lopez, its warehouse manager, in April 2020. The journal entry to record the fringe benefit expense and fringe benefit tax expense is: a. Debits: Fringe benefit expense, P13,000.00; Fringe benefit tax expense, P7,000.00. Credits: Cash, P13,000.00; Fringe benefit tax payable, P7,000.00. b. Debits: Fringe benefit expense, P20,000.00; Fringe benefit tax expense, P7,000.00. Credits: Cash, P20,000.00; Fringe benefit tax payable, P7,000.00. c. Debits: Fringe benefit expense, P13,000.00; Fringe benefit tax expense, P7,000.00. Credits: Fringe benefit expense payable, P13,000.00; Fringe benefit tax payable, P7,000.00. d. Debits: Fringe benefit expense, P13,000.00; Fringe benefit tax expense, P7,000.00. Credit: Cash, P20,000.00.