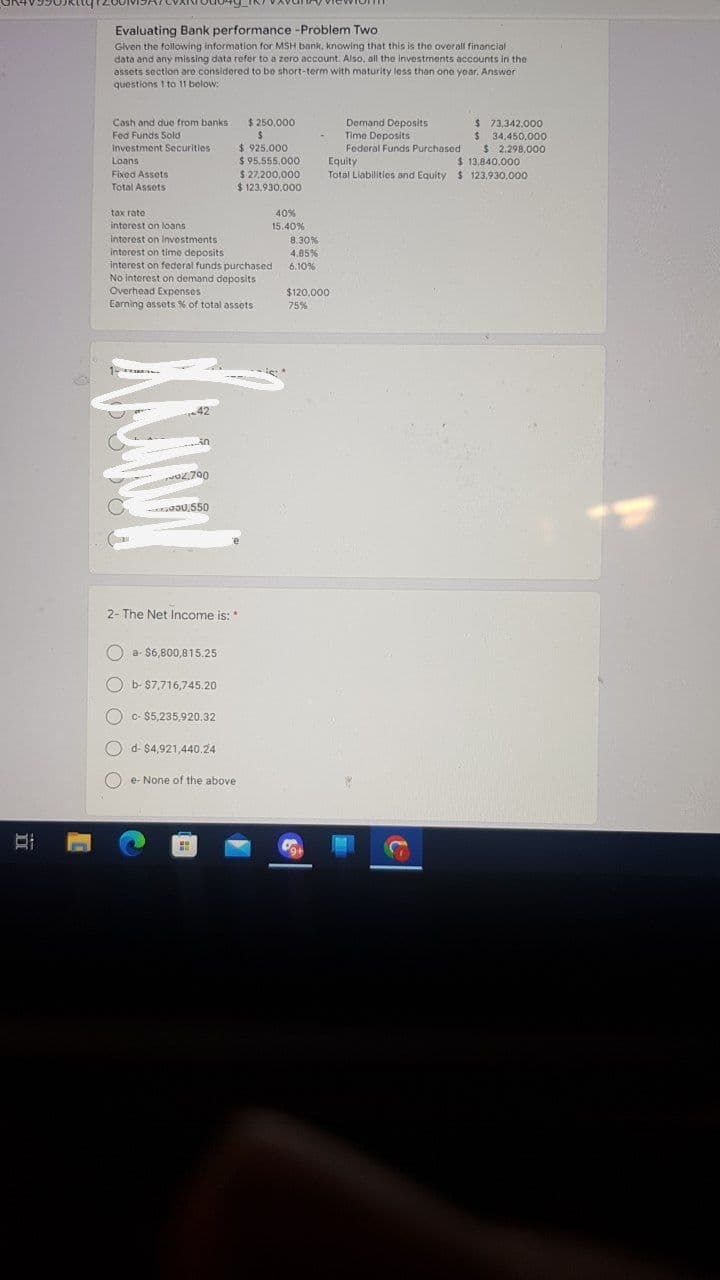

Given the following information for MSH bank, knowing that this is the overall financial data and any missing data refer to a zero account. Also, all the investments accounts in the assets section are considered to be short-term with maturity less than one year. Answer questions 1 to 11 below: Cash and due from banks $250,000 Fed Funds Sold Investment Securities Loans Fixed Assets Total Assets tax rate interest on loans interest on investments $ $925,000 $ 95,555,000 $ 27,200,000 $123,930,000 40% 15.40% 8.30% 4.85% 6.10% $120,000 75% interest on time deposits interest on federal funds purchased No interest on demand deposits Overhead Expenses Earning assets % of total assets Demand Deposits Time Deposits Federal Funds Purchased Equity $ 73,342,000 34,450,000 $ $ 2,298,000 $ 13,840,000 Total Liabilities and Equity $123,930,000

Given the following information for MSH bank, knowing that this is the overall financial data and any missing data refer to a zero account. Also, all the investments accounts in the assets section are considered to be short-term with maturity less than one year. Answer questions 1 to 11 below: Cash and due from banks $250,000 Fed Funds Sold Investment Securities Loans Fixed Assets Total Assets tax rate interest on loans interest on investments $ $925,000 $ 95,555,000 $ 27,200,000 $123,930,000 40% 15.40% 8.30% 4.85% 6.10% $120,000 75% interest on time deposits interest on federal funds purchased No interest on demand deposits Overhead Expenses Earning assets % of total assets Demand Deposits Time Deposits Federal Funds Purchased Equity $ 73,342,000 34,450,000 $ $ 2,298,000 $ 13,840,000 Total Liabilities and Equity $123,930,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 12C: Researching GAAP Situation Hamilton Company operates in an industry with numerous competitors. It is...

Related questions

Question

Transcribed Image Text:Evaluating Bank performance -Problem Two

Given the following information for MSH bank, knowing that this is the overall financial

data and any missing data refer to a zero account. Also, all the investments accounts in the

assets section are considered to be short-term with maturity less than one year. Answer

questions I to 11 below:

Cash and due from banks

$ 250,000

$ 73,342.000

$ 34,450,000

$ 2,298,000

$ 13,840,000

Total Llabilities and Equity $ 123,930,000

Demand Deposits

Time Deposits

Federal Funds Purchased

Fed Funds Sold

$ 925.000

$ 95,555.000

$ 27,200,000

$ 123,930.000

Investment Securities

Loans

Equity

Fixod Assets

Total Assets

tax rate

40%

interest on loans

15.40%

interest on investments

Interest on time deposits

interest on federal funds purchased

No interest on demand deposits

Overhead Expenses

Earning assets % of total assets

8.30%

4.85%

6.10%

$120,000

75%

42

O2,700

Z.700

JOU, 550

2- The Net Income is:

a- $6,800,815.25

O b- $7,716,745.20

O c- $5,235,920.32

O d- $4,921,440.24

e- None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning