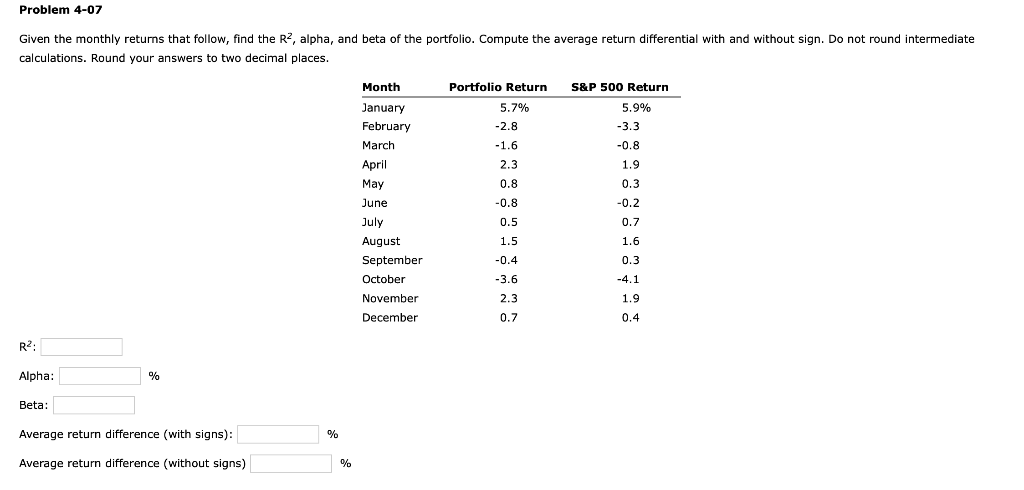

Given the monthly returns that follow, find the R2, alpha, and beta of the portfolio. Compute the average return differential with and without sign. Do not round intermediate calculations. Round your answers to two decimal places. R²: Alpha: Beta: % Average return difference (with signs): % Month January February March April May June July August September October November December Portfolio Return 5.7% -2.8 -1.6 2.3 0.8 -0.8 0.5 1.5 -0.4 -3.6 2.3 0.7 S&P 500 Return 5.9% -3.3 -0.8 1.9 0.3 -0.2 0.7 1.6 0.3 -4.1 1.9 0.4

Q: Find the future value of the following annuity due. Payments of $600 for 9 years at 5% compounded…

A: To Find: Future Value

Q: Project C0 C1 C2 C3 C4 A -5,000 +1,000 +1,000 +3,000 0 B -1,000 0 +1,000 +2,000…

A: The NPV analysis is used for finding the profitability of a project. It uses the concept of the time…

Q: Dr. Zhivago Diagnostics Corporation's income statement for 20X1 is as follows: $ 2,800,000 1,780,000…

A: Formula for profit margin = net income / net sales

Q: he New England Cheese Company produces two cheese spreads by blending mild cheddar cheese with extra…

A:

Q: A family has a net worth of $165,000 and liabilities of $176,000. What is the amount of their…

A: Net worth can be defined as the accurate worth of an individual or an organization after adjusting…

Q: i. Derive the revenue function. ii. Derive a cost function. iii. What is the total cost of producing…

A: Revenue function gives an equation to determine the revenue generated from selling a good.This is…

Q: 5-5 TIME TO REACH A FINANCIAL GOAL. You have $33,566.25 in a brokerage account, and you plan to…

A: Here, Present value in a brokerage account = $33,566.25 Annual deposits = $5,000 Total future value…

Q: The following investment has a net present value of zero at i-8% per year. Which of the following is…

A: The formula for computing Net equivalent annual worth = NPV/Annuity (t,r).

Q: Jerry Rice and Grain Stores has $4,780,000 in yearly sales. The firm earns 4.5 percent on each…

A: Given, Sales $4,780,000 Net profit margin is 4.5%

Q: Draw the timeline presenting discount factor in Net present value in 5 years.

A: With discount factor you can forecast future cash flows that could arise from a project. It is more…

Q: The Lancaster Corporation’s income statement is given below. LANCASTER CORPORATION Sales $…

A: Solution:- Times-interest-earned ratio is the financial ratio which measures that how much time is…

Q: How Net present value, interest rate, and benefit change if cost increases.

A: Net present value means difference between present value of the cash inflows and present value of…

Q: The Griggs Corporation has credit sales of $908,950. Total assets turnover Cash to total assets…

A: Formula to be used: i) Total asset turnover= Sales / Total assets ii) Cash to total assets = Cash /…

Q: What are the five variables that affect the value of an option, and how do changes in each of these…

A: Option price refers to the price at which buyers purchase the stock or have the right to buy or sell…

Q: Five years after you graduate from MSU, you receive a promotion that increases your salary to…

A: Income = $120,000/12 months = $10,000 per month Monthly mortgage payment = $10,000*25% = $2,500…

Q: Mike’s Camping Supply is considering the purchase of new equipment for $750,000. The equipment will…

A: Cash back period = Initial investment/Cash flows per year Cash flows per year = Cash revenues - Cash…

Q: The level of the Syldavian market index is 21,600 at the start of the year and 26,100 at the end.…

A: Risk premium Investors expect higher returns on their investments to make up for the higher risks…

Q: Related to Checkpoint 5.4) (Present-value comparison) You are offered $100.000 today or $300,000 in…

A: Information Provided: Future value = $300,000 Years = 13 Interest rate = 11%

Q: The balance sheet of XYZ Company is shown below. What is the Net Working Capital for the company?…

A: Net working capital can be computed as follows = Current Asset - Current Liabilities

Q: You are considering investing in a security that will pay you $2,000 in 35 years. a. If the…

A: We have the cash flows associated with the security. We need to first determine the present value of…

Q: An investor needs $17,000 in 13 years. (a) What amount should be deposited in a fund at the end of…

A: Amount needed " FV" is $17,000 Time period is 13 years Interest rate is 7% Compounded Quarterly To…

Q: A. Piglin enters into the short position (maké delivery) on 100 futures contracts, each for delivery…

A: Margin requirement It is the minimum amount of money that has to be deposited by the investor or…

Q: The market value of the equity of Nina, Incorporated, is $588,000. The balance sheet shows $27,000…

A: Solution:- EBITDA multiple measures that how much times is the enterprise value of a firm against…

Q: P10,000 IS BORROWED FOR 75 DAYS AT 20% PER ANNUM SIMPLE INTEREST. HOW MUCH WILL BE DUE AT THE END OF…

A: Simple interest The method in which interest is charged only above the actual amount borrowed is…

Q: The common shares of Twitter, Incorporated (TWTR) recently traded on the NYSE for $75 per share. You…

A: Black Scholes Merton model Black-Scholes is a pricing model that uses six factors, including…

Q: Gordon has a goal of purchasing a new second hand car valued at approximately $14,000 financed from…

A: Solution:- When money is invested somewhere, the investor earns two types of returns- Periodic…

Q: New World has total assets of $31,300, long-term debt of $8,600, net fixed assets of $20,300, and…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: A company has a liability of 410,000,000 that is must pay in 26 years. If it can round up the annual…

A: Present Value Can be computed using the formula given below Present Value = 1/(1+r)^1 + 1/(1+r)^2 +…

Q: The ABC Corporation is considering purchasing a machine to manufacture mobile phones. The purchase…

A: The operating income is calculated after tax for the purpose of calculating the present value of a…

Q: 5-21 EVALUATING LUMP SUMS AND ANNUITIES. Kristina just won the lottery, and she must choose among…

A: As per Bartleby guidelines,If a question with multiple sub-parts are posted, first 3 sub-parts will…

Q: b)Assume that Angostura is currently operating at fullcapacity. All costs/expenses/income and net…

A: Additional funds needed: When a company needs to expand when it is functioning at full capacity, it…

Q: 43 Portfolio Weight on Weight on Portfolio Portfolio 44 AMZN BAC Return 45 46 47 48 -49 50 51 52 53…

A: Portfolio Return, Risk, and Beta: A portfolio's return is the weighted average of the returns of its…

Q: Compute the following ratios. Note: Use a 360-day year. Do not round intermediate calculations.…

A: As per the honor code we are bound to give the answer of first three sub part only, please post the…

Q: Given the following information ZO12345 N 0 Net cash flow 500 0 500 0 500 0 a. Determine the equal…

A: A time series of cash flow is given. We have to find the equivalent annual cash flow over 6 years…

Q: Given 1-year par rate = 3.2% 2-year par rate = 5.2% 3-year par rate = 6.1% 4-year par rate = 7.5%…

A: Given 1-year par rate = 3.2% 2-year par rate = 5.2% 3-year par rate = 6.1% 4-year par rate = 7.5%

Q: . The firm is facing a lot of downtime issues with the current cloud computing provider. The firm…

A: In the above question we are given Future value of payment=100000 Required rate or discount…

Q: 5-5 TIME TO REACH A FINANCIAL GOAL. You have $33,566.25 in a brokerage account, and you plan to…

A: Here, To Find: Number of years of deposits =?

Q: Using the table below create SinCo's Income Statement and Balance Sheet for the Prior Year and…

A: We need to cast the financial statements for both they years first. Then based on the financial…

Q: You want to have $300,000 in 15 years. You want to know how much you need to invest each month at…

A: Amount required or accumulated value (AV) = $300,000 Monthly interest rate (r) = 0.00416666666666667…

Q: e CAPM holds for all assets, and that the debt of Dropbox, Ikea, Group is risk-free. None of these…

A: Sign inRegister Home My Library Modules Books Studylists…

Q: In computing debt servicing a number of methods are employed. Discuss the following methods used in…

A: There are different methods to repay principal amount along with interest.

Q: Case, Part 2: Suppose you decide that you will not submit an application for an ARM due to Velma’s…

A: Adjustable rate mortgage or ARM is also known by the name variable rate mortgages. Under the…

Q: If the Premier Corporation has an ROE of 8 percent and a payout ratio of 16 percent, what is its…

A: ROE is 8% Payout ratio is 16 percent We need, to Find: Sustainable growth rate

Q: Marriott Hotels purchased seven iRobot Roomba i7+ for $970 each. It received a 15% discount for…

A: Discount received The deduction from the actual price of the goods received from the seller is…

Q: Wallace Driving School's 2020 balance sheet showed net fixed assets of $5.4 million, and the 2021…

A: Net Capital Spending is the net amount the company pays to acquire the fixed assets during a…

Q: A recent IBM research of 585 mobile application developers and managers revealed that just one-third…

A: Now a days there is an excessive rise in the mobile app development sector. Everyone is coming up…

Q: Nataro, Incorporated, has sales of $676,000, costs of $338,000, depreciation expense of $82,000,…

A: Here, To Find: Net Income =?

Q: Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This…

A: Initial cash outlay $ 55,00,000.00 Net cash inflows $ 9,00,000.00 Time Period (Years) 9…

Q: The most recent financial statements for Mandy Company are shown here: Income Statement Balance…

A: To calculate the growth rate we will use the below formula Growth rate = (Net…

Q: What is the future worth of a uniform series payment?

A: The future worth is the value of an asset at a predefined future date which increases at a specific…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- INV 2 -1 You are considering an investment in a portfolio P with the following expected returns in three different states of nature: Recession Steady Expansion Probability 0.10 0.55 0.35 Return on P -15% 20% 40% The risk-free rate is currently 4%, and the market portfolio M has an expected return of 16% and standard deviation of 20%, and its correlation with P is .7. Is P an efficient portfolio relative to the market?Question content area top Part 1 (Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, LOADING... Month Sugita Corp. Market 1 2.4 % 1.0 % 2 −1.0 2.0 3 0.0 3.0 4 0.0 0.0 5 7.0 7.0 6 7.0 1.0 , compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.84 and the risk-free rate is 6 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset…INV2 P1 3b You are considering an investment in a portfolio P with the following expected returns in three different states of nature: Recession Steady Expansion Probability 0.10 0.55 0.35 Return on P -15% 20% 40% The risk-free rate is currently 4%, and the market portfolio M has an expected return of 16% and standard deviation of 20%, and its correlation with P is .7. Would you characterize P as a buy or sell and why?

- (Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, LOADING... , compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.89 and the risk-free rate is 6 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? Month Sugita Corp. Market 1 2.4 % 1.0 % 2 −0.8 2.0 3 1.0 2.0 4 −1.0 −1.0 5 6.0 7.0 6 6.0…Problem 11-25 Portfolio Returns and Deviations [LO 1, 2] Consider the following information on a portfolio of three stocks: State of Economy Probability of State of Economy Stock A Rate of Return Stock B Rate of Return Stock C Rate of Return Boom .13 .02 .32 .50 Normal .55 .10 .22 .20 Bust .32 .16 −.21 −.35 If your portfolio is invested 40 percent each in A and B and 20 percent in C, what is the portfolio’s expected return, the variance, and the standard deviation? Note: Do not round intermediate calculations. Round your variance answer to 5 decimal places, e.g., .16161. Enter your other answers as a percent rounded to 2 decimal places, e.g., 32.16. If the expected T-bill rate is 4.25 percent, what is the expected risk premium on the portfolio? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.Question 2: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10. (could be done on word document or excel). Assume that as a result of recent economic events, inflationary expectations have declined by 3%, lowering RF and RM to 5% and 9%, respectively. Draw the new SML on the axes in part a, and calculate and show the new required return for asset A. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A. From the previous changes, what conclusions can be drawn about the impact of (1) decreased inflationary expectations and (2) increased risk aversion on the required returns of risky assets?

- Question No. 5: A rates of return of asset and market have the following distribution: Steady of Economy Probability Stock A Stock B Market Return Boom 0.3 20% 15% 15% Normal 0.4 5 5% 9 Recession 0.3 12 -10% 18 Correlation Coefficient with market -0.3 0.3 Calculate the standard deviation of return for the stock A,B and market. Calculate Beta Coefficient of stock A and B. Calculate the required rate of return of stock A & B, if you know the risk-free return 6% and market return represents expected return of market.Problem 3: Given six years of percentage return of Stock A and Stock B, identify the expected return, and risk of each instrument. Assume that each year, has equal chances of reoccurrence. Stock A Stock B 20X1 10 20 20X2 -15 -20 20X3 20 -10 20X4 25 30 20X5 -30 -20 20X6 20 60 Which of the two stocks is riskier? Why? Which of the stocks is expected to yield a higher return? Why? Where will you invest?Question 3: You are an active investor in the securities market and you have established an investment portfolio of two stock A and B five years ago. Required: a) If your portfolio has provided you with returns of 9.7%, -6.2%, 12.1%, 11.5% and 13.3% over the past five years, respectively. Calculate the geometric average return of the portfolio for this period?b) AssumethatexpectedreturnofthestockAinyourportfoliois14.6%.The risk premium on the stocks of the same industry are 5.8%, the risk-free rate of return is 5.9% and the inflation rate was 2.7. Calculate beta of this stock using Capital Asset Pricing Model (CAPM)? D) Assume that the following data available for the portfolio, calculate the expected return, variance and standard deviation of the portfolio given stock A accounts for 45% and stock B accounts for 55% of your portfolio?AB 12.5% 18.5%Expected returnStandard Deviation of return Correlation of coefficient (p) 0.415% 20%

- Question 4 The risk-free rate of return is 2.7 percent, the inflation rate is 3.1 percent, and the market risk premium is 6.9 percent.What is the expected rate of return on a stock with a beta of 1.08?Select one:A. 12.22 percentB. 11.47 percentC. 10.15 percentD. 10.92 percentProblem 3:Here are the annual returns for five different stocks. Determine the expected return and risk for a period of five years for each of the stocks. Problem 4:a. Find the coefficient of variation (CV) for each of the actions in problem 3.b. Explain which of the investments a risk averse investor would prefer and which a risk lover investor would prefer. Answer clearly and in detail. Show all the computations that led to the result.INV2 P1 2 You are considering an investment in a portfolio P with the following expected returns in three different states of nature: Recession Steady Expansion Probability 0.10 0.55 0.35 Return on P -15% 20% 40% The risk-free rate is currently 4%, and the market portfolio M has an expected return of 16% and standard deviation of 20%, and its correlation with P is .7. What is the portfolio P’s beta?