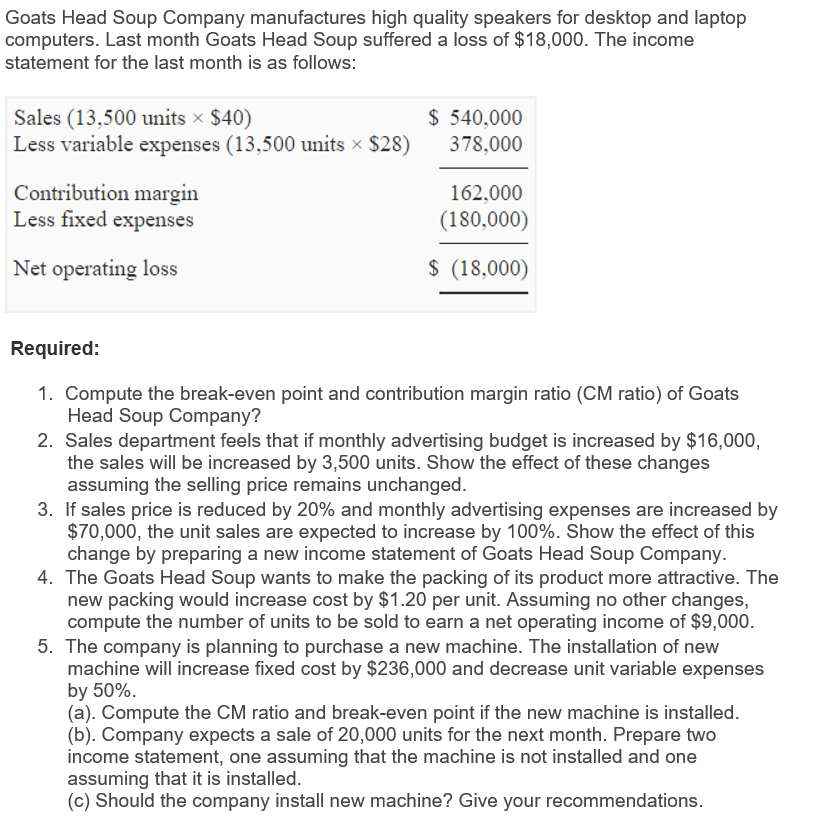

Goats Head Soup Company manufactures high quality speakers for desktop and laptop computers. Last month Goats Head Soup suffered a loss of $18,000. The income statement for the last month is as follows: Sales (13,500 units x $40) Less variable expenses (13,500 units x $28) $540,000 378,000 Contribution margin Less fixed expenses 162,000 (180,000) Net operating loss (18,000) Required: 1. Compute the break-even point and contribution margin ratio (CM ratio) of Goats Head Soup Company? 2. Sales department feels that if monthly advertising budget is increased by $16,000, the sales will be increased by 3,5000 units. Show the effect of these changes assuming the selling price remains unchanged. 3. If sales price is reduced by 20% and monthly advertising expenses are increased by $70,000, the unit sales are expected to increase by 100%. Show the effect of this change by preparing a new income statement of Goats Head Soup Company. 4. The Goats Head Soup wants to make the packing of its product more attractive. The new packing would increase cost by $1.20 per unit. Assuming no other changes, compute the number of units to be sold to earn a net operating income of $9,000. 5. The company is planning to purchase a new machine. The installation of new machine will increase fixed cost by $236,000 and decrease unit variable expenses by 50% (a). Compute the CM ratio and break-even point if the new machine is installed (b). Company expects a sale of 20,000 units for the next month. Prepare two income statement, one assuming that the machine is not installed and one assuming that it is installed. (c) Should the company install new machine? Give your recommendations.

Goats Head Soup Company manufactures high quality speakers for desktop and laptop computers. Last month Goats Head Soup suffered a loss of $18,000. The income statement for the last month is as follows: Sales (13,500 units x $40) Less variable expenses (13,500 units x $28) $540,000 378,000 Contribution margin Less fixed expenses 162,000 (180,000) Net operating loss (18,000) Required: 1. Compute the break-even point and contribution margin ratio (CM ratio) of Goats Head Soup Company? 2. Sales department feels that if monthly advertising budget is increased by $16,000, the sales will be increased by 3,5000 units. Show the effect of these changes assuming the selling price remains unchanged. 3. If sales price is reduced by 20% and monthly advertising expenses are increased by $70,000, the unit sales are expected to increase by 100%. Show the effect of this change by preparing a new income statement of Goats Head Soup Company. 4. The Goats Head Soup wants to make the packing of its product more attractive. The new packing would increase cost by $1.20 per unit. Assuming no other changes, compute the number of units to be sold to earn a net operating income of $9,000. 5. The company is planning to purchase a new machine. The installation of new machine will increase fixed cost by $236,000 and decrease unit variable expenses by 50% (a). Compute the CM ratio and break-even point if the new machine is installed (b). Company expects a sale of 20,000 units for the next month. Prepare two income statement, one assuming that the machine is not installed and one assuming that it is installed. (c) Should the company install new machine? Give your recommendations.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 14E: Sports-Reps, Inc., represents professional athletes and movie and television stars. The agency had...

Related questions

Question

Please answer the last 2 subparts labeled 4 & 5 in the picture

- The Goats Head Soup wants to make the packing of its product more attractive. The new packing would increase cost by $1.20 per unit. Assuming no other changes, compute the number of units to be sold to earn a net operating income of $9,000.

- The company is planning to purchase a new machine. The installation of new machine will increase fixed cost by $236,000 and decrease unit variable expenses by 50%.

(a). Compute the CM ratio and break-even point if the new machine is installed.

(b). Company expects a sale of 20,000 units for the next month. Prepare two income statement, one assuming that the machine is not installed and one assuming that it is installed.

(c) Should the company install new machine? Give your recommendations.

Transcribed Image Text:Goats Head Soup Company manufactures high quality speakers for desktop and laptop

computers. Last month Goats Head Soup suffered a loss of $18,000. The income

statement for the last month is as follows:

Sales (13,500 units x $40)

Less variable expenses (13,500 units x $28)

$540,000

378,000

Contribution margin

Less fixed expenses

162,000

(180,000)

Net operating loss

(18,000)

Required:

1. Compute the break-even point and contribution margin ratio (CM ratio) of Goats

Head Soup Company?

2. Sales department feels that if monthly advertising budget is increased by $16,000,

the sales will be increased by 3,5000 units. Show the effect of these changes

assuming the selling price remains unchanged.

3. If sales price is reduced by 20% and monthly advertising expenses are increased by

$70,000, the unit sales are expected to increase by 100%. Show the effect of this

change by preparing a new income statement of Goats Head Soup Company.

4. The Goats Head Soup wants to make the packing of its product more attractive. The

new packing would increase cost by $1.20 per unit. Assuming no other changes,

compute the number of units to be sold to earn a net operating income of $9,000.

5. The company is planning to purchase a new machine. The installation of new

machine will increase fixed cost by $236,000 and decrease unit variable expenses

by 50%

(a). Compute the CM ratio and break-even point if the new machine is installed

(b). Company expects a sale of 20,000 units for the next month. Prepare two

income statement, one assuming that the machine is not installed and one

assuming that it is installed.

(c) Should the company install new machine? Give your recommendations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,