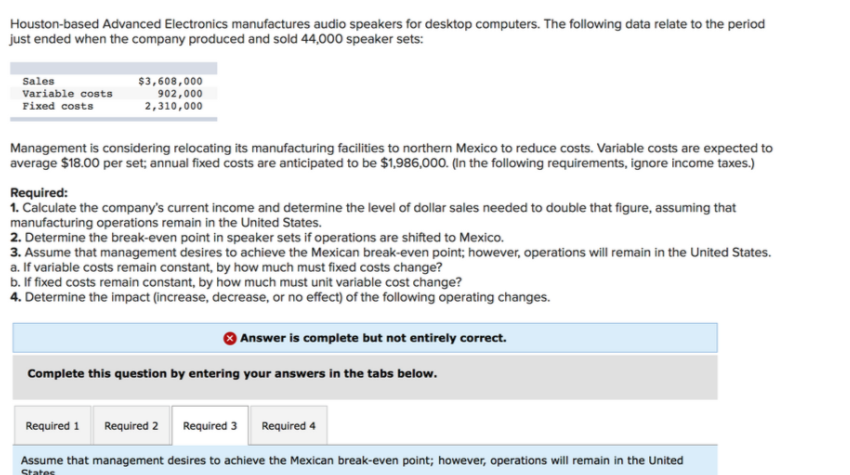

Houston-based Advanced Electronics manufactures audio speakers for desktop computers. The following data relate to the period just ended when the company produced and sold 44,000 speaker sets: Sales Variable costs $3,608,000 902,000 2,310,000 Fixed costs Management is considering relocating its manufacturing facilities to northern Mexico to reduce costs. Variable costs are expected to average $18.00 per set; annual fixed costs are anticipated to be $1,986,000. (In the following requirements, ignore income taxes.) Required: 1. Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that manufacturing operations remain in the United States. 2. Determine the break-even point in speaker sets if operations are shifted to Mexico. 3. Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States. a. If variable costs remain constant, by how much must fixed costs change? b. If fixed costs remain constant, by how much must unit variable cost change? 4. Determine the impact (increase, decrease, or no effect) of the following operating changes. O Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States

Houston-based Advanced Electronics manufactures audio speakers for desktop computers. The following data relate to the period just ended when the company produced and sold 44,000 speaker sets: Sales Variable costs $3,608,000 902,000 2,310,000 Fixed costs Management is considering relocating its manufacturing facilities to northern Mexico to reduce costs. Variable costs are expected to average $18.00 per set; annual fixed costs are anticipated to be $1,986,000. (In the following requirements, ignore income taxes.) Required: 1. Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that manufacturing operations remain in the United States. 2. Determine the break-even point in speaker sets if operations are shifted to Mexico. 3. Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States. a. If variable costs remain constant, by how much must fixed costs change? b. If fixed costs remain constant, by how much must unit variable cost change? 4. Determine the impact (increase, decrease, or no effect) of the following operating changes. O Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 13P: Deuce Sporting Goods manufactures a high-end model tennis racket. The company’s forecasted income...

Related questions

Question

Transcribed Image Text:Houston-based Advanced Electronics manufactures audio speakers for desktop computers. The following data relate to the period

just ended when the company produced and sold 44,000 speaker sets:

Sales

Variable costs

$3,608,000

902,000

2,310,000

Fixed costs

Management is considering relocating its manufacturing facilities to northern Mexico to reduce costs. Variable costs are expected to

average $18.00 per set; annual fixed costs are anticipated to be $1,986,000. (In the following requirements, ignore income taxes.)

Required:

1. Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that

manufacturing operations remain in the United States.

2. Determine the break-even point in speaker sets if operations are shifted to Mexico.

3. Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States.

a. If variable costs remain constant, by how much must fixed costs change?

b. If fixed costs remain constant, by how much must unit variable cost change?

4. Determine the impact (increase, decrease, or no effect) of the following operating changes.

O Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3 Required 4

Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United

States

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 8 images

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning