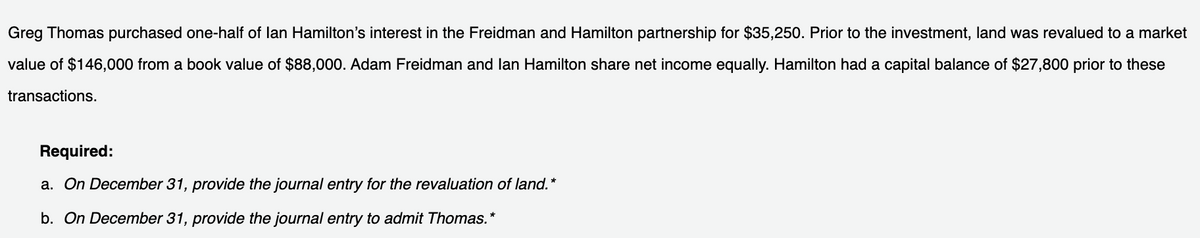

Greg Thomas purchased one-half of lan Hamilton's interest in the Freidman and Hamilton partnership for $35,250. Prior to the investment, land was revalued to a market value of $146,000 from a book value of $88,000. Adam Freidman and lan Hamilton share net income equally. Hamilton had a capital balance of $27,800 prior to these transactions. Required: a. On December 31, provide the journal entry for the revaluation of land.* b. On December 31, provide the journal entry to admit Thomas.*

Greg Thomas purchased one-half of lan Hamilton's interest in the Freidman and Hamilton partnership for $35,250. Prior to the investment, land was revalued to a market value of $146,000 from a book value of $88,000. Adam Freidman and lan Hamilton share net income equally. Hamilton had a capital balance of $27,800 prior to these transactions. Required: a. On December 31, provide the journal entry for the revaluation of land.* b. On December 31, provide the journal entry to admit Thomas.*

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 59IIP

Related questions

Question

Transcribed Image Text:Greg Thomas purchased one-half of lan Hamilton's interest in the Freidman and Hamilton partnership for $35,250. Prior to the investment, land was revalued to a market

value of $146,000 from a book value of $88,000. Adam Freidman and lan Hamilton share net income equally. Hamilton had a capital balance of $27,800 prior to these

transactions.

Required:

a. On December 31, provide the journal entry for the revaluation of land.*

b. On December 31, provide the journal entry to admit Thomas.*

Transcribed Image Text:Journal

PAGE 11

JOURNAL

ACCOUNTING EQUATION

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

1

2

3

4

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,