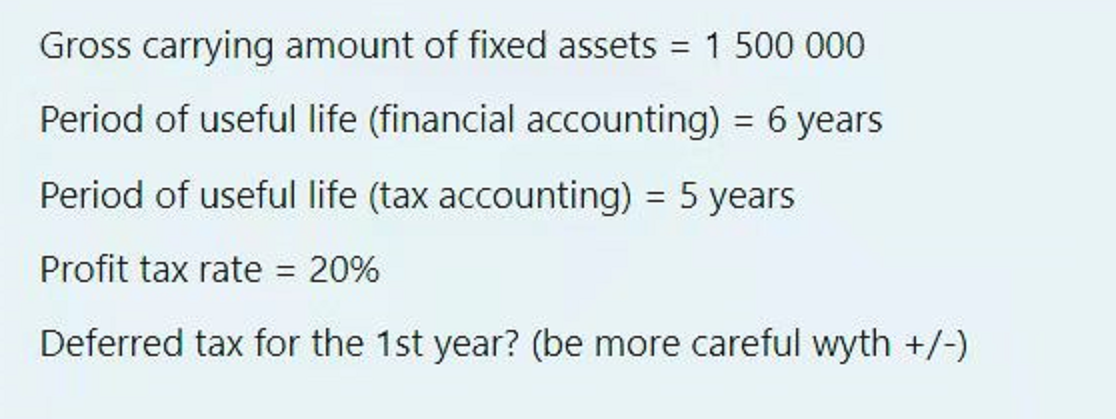

Gross carrying amount of fixed assets = 1 500 000 Period of useful life (financial accounting) = 6 years %3D Period of useful life (tax accounting) = 5 years Profit tax rate = 20% Deferred tax for the 1st year? (be more careful wyth +/-)

Q: prid are accountants.

A: Forensic Accountants are Authorized individuals or bodies who investigates financial fraud or…

Q: 28. Kokong Company provided the following information for the current year: P 2,100,000 Accounts…

A: Inventory means the goods in which business deals. Inventory can be calculated by preparing the…

Q: 4. The most appropriate definition of depreciation is: A. A means of determining the decrease in the…

A: Introduction:- The following methods used to calculate depreciation as follows under:- Straight…

Q: Customers' current ac bank.

A: Liabilities are accumulated financial obligations that result from past events that are expected to…

Q: Required information [The following information applies to the questions displayed below.] A company…

A: Using Weighted Average cost method under perpetual inventory system, value of ending inventory is…

Q: 6. Your best friend has contacted you about her new bar-b-que restaurant. She has pieced together…

A: Break-even point in units=Total Fixed CostSelling Price-Variable Cost per unit Units to be sold for…

Q: Required information [The following information applies to the questions displayed below.] Trey…

A: Specific Identification method of inventory valuation: in this method Every units of inventory is…

Q: Chloe Mendez owns a clothing company, Chloe's Closet. She has a team of tailors who work for 8 hours…

A: Determination of problems in Chloe's closet business. To ascertain the problem the financial…

Q: What happens when a qualified exempt importer subsequently sells what was imported to a taxable…

A: when a qualified exempt importer subsequently sells to non exempt person, the purchaser shall be…

Q: Lee Gon Corporation has the following revenue and cost characteristics on their only product:…

A: If 5% increase in selling price P6.00 + P6.00 *5% = 6.3 Variable cost = P4.20 Contribution = selling…

Q: ameter capturing technology

A: Given as, Y= z.f (K, N, L)

Q: nount toward total overhead?

A: There are three department . Contribution to overhead is a amount of money that department has…

Q: Android Bank makes new consumer loans totalling £100m, crediting the amount to its customers'…

A: Net worth means all value of assets held by entity less all value of liability held by entity.

Q: quipment costing P600,000 to Ace Company for P800,000. The equipment has a remaining life of five…

A: Thus Ace company is an associate and not a subsidiary company as the shares held are only 25%. An…

Q: 9. Browny sells to retail appliance stores on credit terms of net 30. Annual credit sales is…

A: Introduction: Accounts receivable is a business term that refers to the account that a company uses…

Q: Alexander Corporation reports the following components of stockholders' equity at December 31, 2018.…

A: Out of the profit earned by the business organizations, some of the profit is distributed to the…

Q: Under the two-variance method for analyzing factory overhead, the difference between the actual…

A: The question is related to Standard Costing and is related to two Varaince method.

Q: 5. Given the following information, what is the amount of Equity. Buildings £30,000, Inventory…

A: IN THE GIVEN QUESTION WE HAVE TO CALCULATE AMOUNT OF EQUITY AMOUNT OF EQUITY = TOTAL ASSETS - (TRADE…

Q: The following data is given: December 31, 2021 2020 Cash $59,000 $49,500 Accounts receivable (net)…

A: I am answering the first 3 sub-parts of the question as per bartleby guidelines. Please re-submit…

Q: P1.990,000 he following information were taken from the books of Laxa Co. for the month of December,…

A: Prime costs = Direct materials used + Direct labor Conversion Costs = Direct labor + Factory…

Q: 16. Which of the following statements is true? A. Gross profit margin is always less than net profit…

A: Gross profit margin = Total sales revenue - cost of goods sold

Q: On January 1, 2020, a machine was purchased for $400,000 by Younger Leasing Co. The machine is…

A: The main difference between IFRS and ASPE using is that the lease is Capital Lease under IFRS while…

Q: For the 2022 Season, the LA Dodgers have a projected payroll of: $285,748,333.00| $230,000,000.00…

A: MLB Luxury Tax is the tax paid by the MLB teams over and above the threshold limit on the projected…

Q: A company makes pens. They sell each pen for $77. Their revenue is represented by R = 7 x. The cost…

A: Given :- R = 7 x. C = 3 x + 4500 X( in part a ) = 1000 pens…

Q: On December 31, 2019, Oriole Company leased machinery from Terminator Corporation for an agreed upon…

A: The lease liability is a total of the present value discounted at incremental borrowing rate, in…

Q: On January 2, 2017, Normal Inc. acquired 15% interest in Laco Co. by paying P1,500,000 for 7,500…

A: Investment Income For Recognize of investment income which has to be the fair value at the end of…

Q: The following data are for four independent process-costing departments. Inputs are added…

A: Equivalent units refer to the partially complete units expressed in the terms of completed units.

Q: Prince company had bought $5,400,000, and additional realtor's fee of $50,000 an office building and…

A: When the assets are acquired in lump sum amount, then the same is apportionment in the ratio of…

Q: Following are transactions of Danica Company. Dec. 13 Accepted a $19, 000, 45-day, 7% note in…

A: interest expense = principal * time * rate

Q: Oct. 02, 2022: Mr Alberto bought 10 units of computer at P30,000 each for the shop. The computers…

A: The journal keeps the record the transactions as debit one account and credit other. The…

Q: On February 3, Smart Company sold merchandise in the amount of $1,800 to Kennedy Company, with…

A: Under Gross Method, Sales are recorded at their Gross Value. If the buyer makes payment within…

Q: 47. Under this inventory system, a physical count is necessary before profit is determined a.…

A: Introduction:- There are different types of inventory systems used in the business Inventory systems…

Q: On January 2, Bering Company disposes of a machine costing $57,600 with accumulated depreciation of…

A: A journal entry is often recorded in the main ledger; however, it may also be entered in a…

Q: QUESTION 2 1. On 1 January 2015, Dinara Enterprise purchased a printing machine for RM90,000 cash.…

A: Fixed assets are assets of a non-current nature that are essential for the performance of a…

Q: On April 1, Kang Corporation purchased back 250 shares of $1 par value common stock for $20 per…

A: Working: Note: Additional Paid in capital from Treasury Stock = Value of shares reissued - Cost of…

Q: Listed below is the inventory, purchases and sales for the month of July 2021: Units RM per unit…

A: Under perpetual inventory system cost of goods sold is recorded simultaneously whereas under…

Q: Rico Company produces custom-made machine parts. Rico recently has implemented an activity-based…

A: Standard price per hour = Fixed setup cost/Capacity in hours =$860200/39100 hours = $22 per hour

Q: Sandpiper Company has 20,000 shares of cumulative preferred 3% stock, $50 par and 50,000 shares of…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: Vibrant Inc. manufactures two models of speakers, Rumble and Thunder. Based on the following…

A: Total units to be produced = Expected units to be sold + desired ending inventory - estimated…

Q: During the current taxation year, Mike made the following donations to registered charities: Cash of…

A: Here explain the details of the taxable deduction which are incurred in the form of donation which…

Q: Find the maturity value if P25,000 is invested from October 15, 2016 to December 15, 2017 at a…

A: Under Simple Interest Method, Interest is paid only on the invested amount and calculated by…

Q: NYC Enterprise Fund?

A: NYC has three type of activities which are operated transportation-$10,000, NYC operated…

Q: PT DIDI acquired 30% of PT DODO's ordinary shares on January 1, 2019, by providing a land with the…

A: An investment journal is the journal ledger prepared to record the journal entries in the books of…

Q: hannon Company began operations on January 1, 2020. The financial statement contained the following…

A: Prior Period Errors are the errors done while recording the transactions of the prior financial…

Q: For the credit card account below, compute the average daily balance, the finance charge, and the…

A: Solution: Average Daily Balance Date Balance…

Q: The planned activity level for the assembly department of the Shields Company during the month of…

A: Variances represent the comparison of actual performance and the standard set by the company. If the…

Q: Accounting rate of return Payback period Net present value 8.60 4.35 years Net present val

A: Net Present Value It is difference of present value of cash inflows and cash outflow. When the NPV…

Q: Beacon Corporation issued a 3 percent stock dividend on 37,000 shares of its $7 par common stock. At…

A: A stock dividend is the unrestricted distribution of a company's common stock to its shareholders. A…

Q: Account Title Bonds payable Common stock Year 2 $ 690,000 217,000 35, 000 87,300 Year 1 Treasury…

A: Cash flow statement includes: Cash flows from Operating activities Cash flows from investing…

Q: Make the journal entry (debit and credits) for recording the payroll.

A: Payroll accounting is known as the recording of all the payroll transactions in the books of the…

Step by step

Solved in 2 steps

- The annual revenue, expenses, and depreciation for a company are $130,000; 32,000; and $11,000, respectively. What is the after-tax cashflow if the effective income tax rate is 23%? a.77990 b.66990 c. 75460 d. 64460 e. 20010Net profit before tax will be: a. OMR 12,740,000 b. OMR 14,540,000 c. OMR 13,440,000 d. OMR 12,540,000 Operating profit for the year will be: a. OMR 15,540,000 b. OMR 10,360,000 c. OMR 15,340,000 d. OMR 13,540,0002011 During 2011, its first yearof operations, Eli-Wallace Distributors reported pretax accounting income of $200 million which included thefollowing amounts: 1. Income (net) from installment sales of warehouses ni 2011 of$9 milion to be reported for tax purposes ni 2012 ($5 million) and 2013 ($4 milion). .2 Depreciation si reported by the straight-line method on na asset with afour-year useful life. On the tax return, deductions for depreciation will be more than straightline depreciation the first two years but less than straight-line depreciation the next two years (S in millions): 2011 2012 2013 2014 Income Statement $ 50 50 50 50 $ 2 0 0 T a x R e t u r n •66 88 30 16 $200 Difference $(16) (38) 20 34 0 3. Estimated warranty expense that wil be deductible on the taxreturn when actually paid during the next two years. Estimated deductionsare as follows $( ni millions): 2011 2012 2013 57 : $4 (4) (3) $0 income Statement Tax Return Difference 2012 During 2012, pretax accounting income…

- Stone Company reported pre-tax book income of $700,000 in 20X1, the first year of operation. The tax depreciation exceeded the book depreciation by $90,000. The tax rate for 20X1 and all future years was 21%. What amount of deferred tax liability should Stone report in its December 31, 20X1, balance sheet? Select one: a. $6,300 b. $14,000 c. $18,900 d. $3,500In Geri Co, the 5 year weighted average historical pre-tax economic earnings are $1,250,000. The tax rate is 28%. The hurdle and debt rate are 12.25%. The adjusted net assets from prior year-end is $2,050,000. The cap rate applicable to this kind of company is 25% pretax. Determine the value of this business using reasonable rate return on assets. a. $3,995,500 b. $2,050,000 c. $6,045,500 d. Cannot be determined from the information provided.EFG & Co. started its business at the beginning of the current year. By end of first year operations, EFG reported P6,000,000 financial income before income tax and P5,100,000 taxable income. Breakdown of the P900,000 difference revealed that P500,000 is a permanent difference and P400,000 is a future taxable amount. Enacted tax rate is 30%. How much is the total income tax expense? a. 1,800,000 b. 1,950,000 c. 1,530,00 d. 1,650,000

- 2. Sohar Company had a 40 percent tax rate. Given the following pre-tax amounts, what would be the income tax expense reported on the face of the income statement ?............................................................................ Sales $ 100,000 Depreciation expense11,000 Cost of goods sold60,000 Dividend revenue9,000 Salary expense8,000 Utilities expense1,000 Extraordinary loss10,000 Interest expense2,000Estimate the gross income for Bling Enterprises, which reports a CFAT of $2.5 million, $900,000 in expenses, $900,000 in depreciation charges, and has an effective tax rate of 26.4%.A company reported in the income statement for the current year P900,000 income before provision for income tax. Please consider the following information: Rent income received in advance 150,000Interest income on time deposit 200,000Depreciation deducted for income tax purposes in excess of financial depreciation 100,000Income tax rate 30% Required: 1. How much is the taxable income?2. How much is the accounting income subject to tax?3. How much is the permanent difference?4. How much is the net temporary differences?

- A company reported in the income statement for the current year P900,000 income before provision for income tax. Please consider the following information: Rent income received in advance P150,000Interest income on time deposit 200,000Depreciation deducted for income tax purposes in excess of financial depreciation P100,000Income tax rate 30% 1. How much is the taxable income?A. 950,000B. 750,000C. 850,000D. 700,0002. How much is the accounting income subject to tax?A. 900,000B. 750,000C. 700,000D. 225,000Thank you.1. Pine Corporation’s books showed pretax income of P600,000 for the year ended December 31, 20x1. In the computation of federal income taxes, the following data were considered: Gain on involuntary conversion (expropriation) P350,000 Depreciation deducted for tax purposes in excess of depreciation deducted for book purposes 50,000 Estimated tax payments during 20x1 70,000 Income tax rate 30% What amount should Pine report as its current income tax liability on its December 31, 20x1, balance sheet?Refer to the following financial information of Scholz Company: NOPAT 8.250.000.00 EBITDA 17,725.000.00 Net Income 5,050,000.00 Capital Expenditures 6,820,000.00 After tax capital costs 6,280.000.00 Tax rate 40% 1. Calculate the Company's depreciation and amortization expense 2. calculate its interest expense. Use 2 decimal places for your final answer. 3. calculate its EVA. Use 2 decimal places for your final answer.