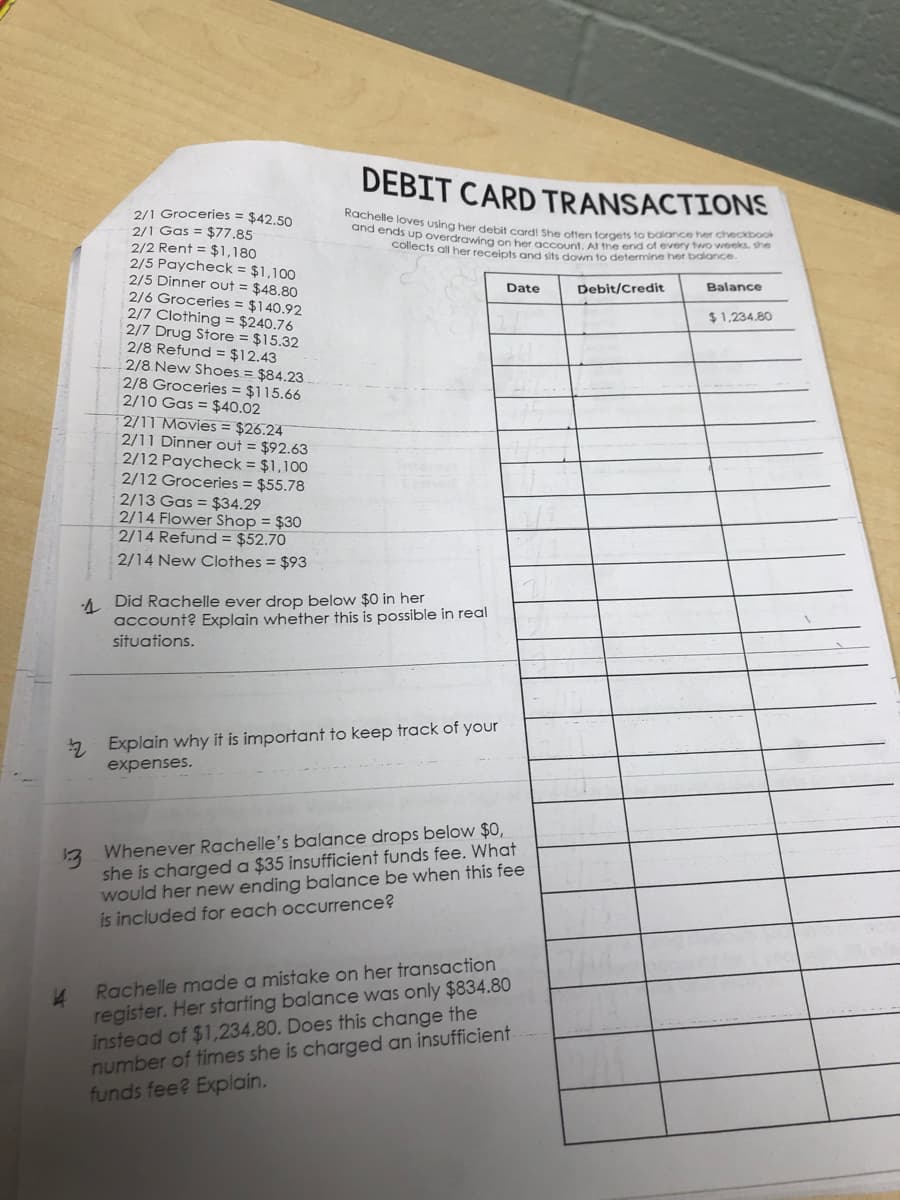

-h Did Rachelle ever drop below $0 in her account? Explain whether this is possible in real situations. 2 Explain why it is important to keep track of your expenses. 13 Whenever Rachelle's balance drops below $0, she is charged a $35 insufficient funds fee. What would her new ending balance be when this fee is included for each occurrence? E Rachelle made a mistake on her transaction register. Her starting balance was only $834.80 instead of $1,234.80. Does this change the number of times she is charged an insufficient funds fee? Explain.

-h Did Rachelle ever drop below $0 in her account? Explain whether this is possible in real situations. 2 Explain why it is important to keep track of your expenses. 13 Whenever Rachelle's balance drops below $0, she is charged a $35 insufficient funds fee. What would her new ending balance be when this fee is included for each occurrence? E Rachelle made a mistake on her transaction register. Her starting balance was only $834.80 instead of $1,234.80. Does this change the number of times she is charged an insufficient funds fee? Explain.

Chapter6: Building And Maintaining Good Credit

Section: Chapter Questions

Problem 1FPC

Related questions

Question

Transcribed Image Text:and ends UD overdrawing on her account, AI the end of every two weeks. she

Rachelle loves using her debit card! She often forgets to balance her checkboo

DEBIT CARD TRANSACTIONS

2/1 Groceries = $42.50

2/1 Gas = $77.85

2/2 Rent = $1,180

2/5 Paycheck = $1,100

2/5 Dinner out = $48.80

Collects all her receipts and sits down to determine her balance.

Date

Debit/Credit

Balance

2/6 Groceries = $140.92

2/7 Clothing = $240.76

2/7 Drug Store = $15.32

2/8 Refund = $12.43

2/8 New Shoes = $84.23

2/8 Groceries = $115.66

2/10 Gas = $40.02

2/11 Movies = $26.24

2/11 Dinner out = $92.63

2/12 Paycheck = $1,100

2/12 Groceries = $55.78

2/13 Gas = $34.29

2/14 Flower Shop = $30

2/14 Refund = $52.70

$1,234.,80

2/14 New Clothes = $93

-h Did Rachelle ever drop below $0 in her

account? Explain whether this is possible in real

situations.

2 Explain why it is important to keep track of your

expenses.

3 Whenever Rachelle's balance drops below $0,

she is charged a $35 insufficient funds fee. What

would her new ending balance be when this fee

is included for each occurrence?

14

register. Her starting balance was only $834.80

instead of $1,234.80. Does this change the

number of times she is charged an insufficient

funds fee? Explain.

Rachelle made a mistake on her transaction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning