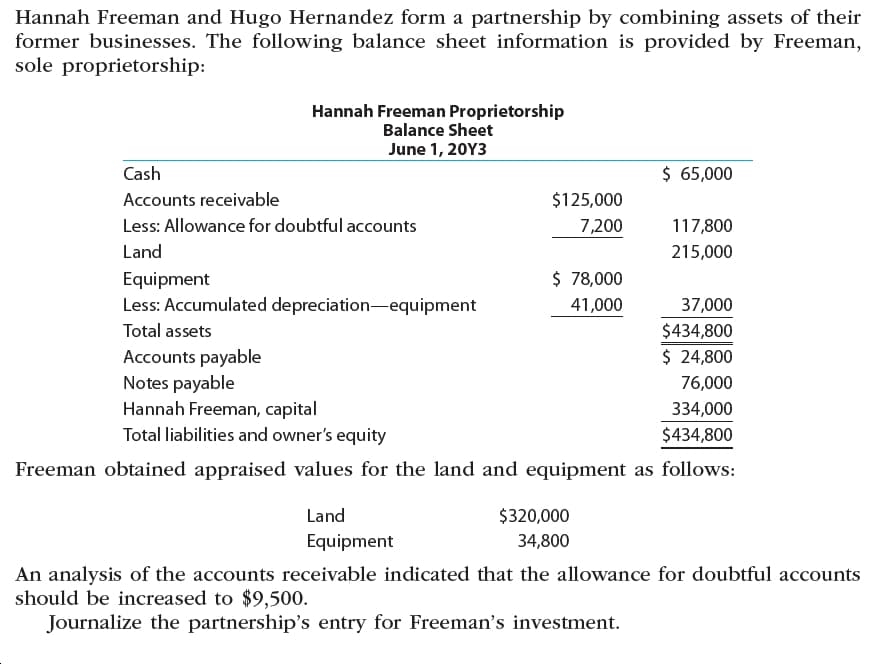

Hannah Freeman and Hugo Hernandez form a partnership by combining assets of their former businesses. The following balance sheet information is provided by Freeman, sole proprietorship: Hannah Freeman Proprietorship Balance Sheet June 1, 20Y3 $ 65,000 Cash Accounts receivable $125,000 Less: Allowance for doubtful accounts 7,200 117,800 Land 215,000 $ 78,000 Equipment Less: Accumulated depreciation-equipment 41,000 37,000 Total assets $434,800 $ 24,800 Accounts payable Notes payable Hannah Freeman, capital 76,000 334,000 Total liabilities and owner's equity $434,800 Freeman obtained appraised values for the land and equipment as follows: Land $320,000 Equipment 34,800 An analysis of the accounts receivable indicated that the allowance for doubtful accounts should be increased to $9,500. Journalize the partnership's entry for Freeman's investment.

Hannah Freeman and Hugo Hernandez form a partnership by combining assets of their former businesses. The following balance sheet information is provided by Freeman, sole proprietorship: Hannah Freeman Proprietorship Balance Sheet June 1, 20Y3 $ 65,000 Cash Accounts receivable $125,000 Less: Allowance for doubtful accounts 7,200 117,800 Land 215,000 $ 78,000 Equipment Less: Accumulated depreciation-equipment 41,000 37,000 Total assets $434,800 $ 24,800 Accounts payable Notes payable Hannah Freeman, capital 76,000 334,000 Total liabilities and owner's equity $434,800 Freeman obtained appraised values for the land and equipment as follows: Land $320,000 Equipment 34,800 An analysis of the accounts receivable indicated that the allowance for doubtful accounts should be increased to $9,500. Journalize the partnership's entry for Freeman's investment.

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 18CE

Related questions

Question

Transcribed Image Text:Hannah Freeman and Hugo Hernandez form a partnership by combining assets of their

former businesses. The following balance sheet information is provided by Freeman,

sole proprietorship:

Hannah Freeman Proprietorship

Balance Sheet

June 1, 20Y3

$ 65,000

Cash

Accounts receivable

$125,000

Less: Allowance for doubtful accounts

7,200

117,800

Land

215,000

$ 78,000

Equipment

Less: Accumulated depreciation-equipment

41,000

37,000

Total assets

$434,800

$ 24,800

Accounts payable

Notes payable

Hannah Freeman, capital

76,000

334,000

Total liabilities and owner's equity

$434,800

Freeman obtained appraised values for the land and equipment as follows:

Land

$320,000

Equipment

34,800

An analysis of the accounts receivable indicated that the allowance for doubtful accounts

should be increased to $9,500.

Journalize the partnership's entry for Freeman's investment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT