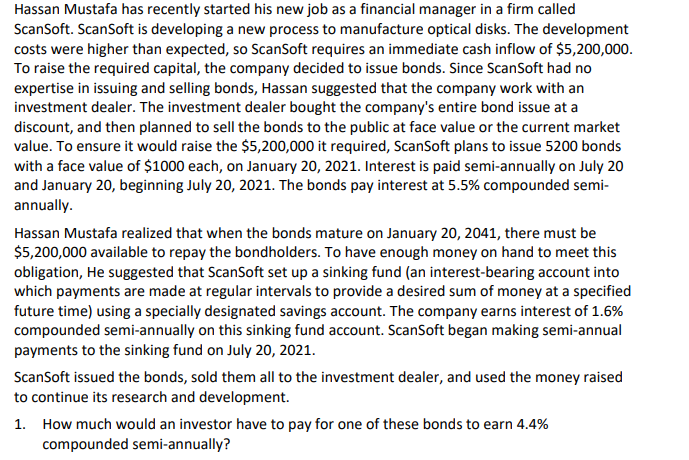

Hassan Mustafa has recently started his new job as a financial manager in a firm called ScanSoft. ScanSoft is developing a new process to manufacture optical disks. The development costs were higher than expected, so ScanSoft requires an immediate cash inflow of $5,200,000. To raise the required capital, the company decided to issue bonds. Since ScanSoft had no expertise in issuing and selling bonds, Hassan suggested that the company work with an investment dealer. The investment dealer bought the company's entire bond issue at a discount, and then planned to sell the bonds to the public at face value or the current market value. To ensure it would raise the $5,200,000 it required, ScanSoft plans to issue 5200 bonds with a face value of $1000 each, on January 20, 2021. Interest is paid semi-annually on July 20 and January 20, beginning July 20, 2021. The bonds pay interest at 5.5% compounded semi- annually. Hassan Mustafa realized that when the bonds mature on January 20, 2041, there must be $5,200,000 available to repay the bondholders. To have enough money on hand to meet this obligation, He suggested that ScanSoft set up a sinking fund (an interest-bearing account into which payments are made at regular intervals to provide a desired sum of money at a specified future time) using a specially designated savings account. The company earns interest of 1.6% compounded semi-annually on this sinking fund account. ScanSoft began making semi-annual payments to the sinking fund on July 20, 2021. ScanSoft issued the bonds, sold them all to the investment dealer, and used the money raised to continue its research and development. 1. How much would an investor have to pay for one of these bonds to earn 4.4% compounded semi-annually?

Hassan Mustafa has recently started his new job as a financial manager in a firm called ScanSoft. ScanSoft is developing a new process to manufacture optical disks. The development costs were higher than expected, so ScanSoft requires an immediate cash inflow of $5,200,000. To raise the required capital, the company decided to issue bonds. Since ScanSoft had no expertise in issuing and selling bonds, Hassan suggested that the company work with an investment dealer. The investment dealer bought the company's entire bond issue at a discount, and then planned to sell the bonds to the public at face value or the current market value. To ensure it would raise the $5,200,000 it required, ScanSoft plans to issue 5200 bonds with a face value of $1000 each, on January 20, 2021. Interest is paid semi-annually on July 20 and January 20, beginning July 20, 2021. The bonds pay interest at 5.5% compounded semi- annually. Hassan Mustafa realized that when the bonds mature on January 20, 2041, there must be $5,200,000 available to repay the bondholders. To have enough money on hand to meet this obligation, He suggested that ScanSoft set up a sinking fund (an interest-bearing account into which payments are made at regular intervals to provide a desired sum of money at a specified future time) using a specially designated savings account. The company earns interest of 1.6% compounded semi-annually on this sinking fund account. ScanSoft began making semi-annual payments to the sinking fund on July 20, 2021. ScanSoft issued the bonds, sold them all to the investment dealer, and used the money raised to continue its research and development. 1. How much would an investor have to pay for one of these bonds to earn 4.4% compounded semi-annually?

Chapter7: Valuation Of Stocks And Corporations

Section: Chapter Questions

Problem 1lM

Related questions

Question

Transcribed Image Text:Hassan Mustafa has recently started his new job as a financial manager in a firm called

ScanSoft. ScanSoft is developing a new process to manufacture optical disks. The development

costs were higher than expected, so ScanSoft requires an immediate cash inflow of $5,200,000.

To raise the required capital, the company decided to issue bonds. Since ScanSoft had no

expertise in issuing and selling bonds, Hassan suggested that the company work with an

investment dealer. The investment dealer bought the company's entire bond issue at a

discount, and then planned to sell the bonds to the public at face value or the current market

value. To ensure it would raise the $5,200,000 it required, ScanSoft plans to issue 5200 bonds

with a face value of $1000 each, on January 20, 2021. Interest is paid semi-annually on July 20

and January 20, beginning July 20, 2021. The bonds pay interest at 5.5% compounded semi-

annually.

Hassan Mustafa realized that when the bonds mature on January 20, 2041, there must be

$5,200,000 available to repay the bondholders. To have enough money on hand to meet this

obligation, He suggested that ScanSoft set up a sinking fund (an interest-bearing account into

which payments are made at regular intervals to provide a desired sum of money at a specified

future time) using a specially designated savings account. The company earns interest of 1.6%

compounded semi-annually on this sinking fund account. ScanSoft began making semi-annual

payments to the sinking fund on July 20, 2021.

ScanSoft issued the bonds, sold them all to the investment dealer, and used the money raised

to continue its research and development.

1. How much would an investor have to pay for one of these bonds to earn 4.4%

compounded semi-annually?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT