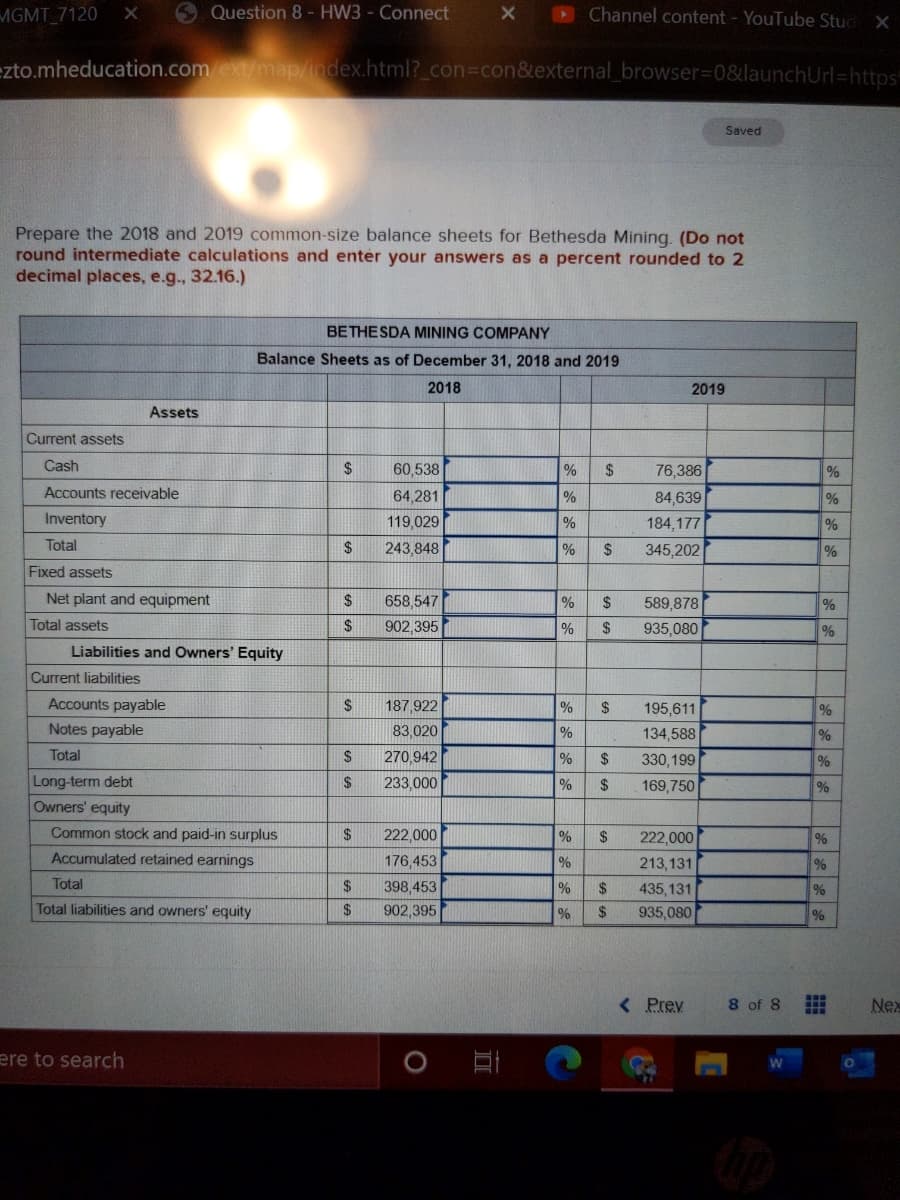

MGMT_7120 6 Question 8- HW3 - Connect Channel content - YouTube Stud zto.mheducation.com ext/map/index.html?_con%3Dcon&external_browser=0&launchUrl=http: Saved Prepare the 2018 and 2019 common-size balance sheets for Bethesda Mining. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) BETHESDA MINING COMPANY Balance Sheets as of December 31, 2018 and 2019 2018 2019 Assets Current assets Cash 2$ 60,538 76,386 Accounts receivable 64,281 % 84,639 Inventory 119,029 184,177 Total 243,848 345,202 % Fixed assets Net plant and equipment 2$ 658,547 589,878 Total assets 902,395 935,080 % Liabilities and Owners' Equity Current liabilities Accounts payable 187,922 195,611 Notes payable 83,020 % 134,588 Total $4 270,942 24 330,199 Long-term debt 2$ 233,000 % 2$ 169,750 Owners' equity Common stock and paid-in surplus 2$ 222,000 222,000 Accumulated retained earnings 176,453 213,131 Total 24 2$ 398,453 2$ 435,131 Total liabilities and owners' equity 902,395 2$ 935,080 %%%一% %24 %24 %24 %24 %24 %24 %24 %24

MGMT_7120 6 Question 8- HW3 - Connect Channel content - YouTube Stud zto.mheducation.com ext/map/index.html?_con%3Dcon&external_browser=0&launchUrl=http: Saved Prepare the 2018 and 2019 common-size balance sheets for Bethesda Mining. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) BETHESDA MINING COMPANY Balance Sheets as of December 31, 2018 and 2019 2018 2019 Assets Current assets Cash 2$ 60,538 76,386 Accounts receivable 64,281 % 84,639 Inventory 119,029 184,177 Total 243,848 345,202 % Fixed assets Net plant and equipment 2$ 658,547 589,878 Total assets 902,395 935,080 % Liabilities and Owners' Equity Current liabilities Accounts payable 187,922 195,611 Notes payable 83,020 % 134,588 Total $4 270,942 24 330,199 Long-term debt 2$ 233,000 % 2$ 169,750 Owners' equity Common stock and paid-in surplus 2$ 222,000 222,000 Accumulated retained earnings 176,453 213,131 Total 24 2$ 398,453 2$ 435,131 Total liabilities and owners' equity 902,395 2$ 935,080 %%%一% %24 %24 %24 %24 %24 %24 %24 %24

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 104.4C

Related questions

Topic Video

Question

8. Fill in all of the blanks

Transcribed Image Text:MGMT 7120

O Question 8 - HW3 - Connect

Channel content - YouTube Stud X

ezto.mheducation.comext/map/index.html?_con%3con&external_browser3D0&launchUrl=https"

Saved

Prepare the 2018 and 2019 common-size balance sheets for Bethesda Mining. (Do not

round intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

BETHESDA MINING COMPANY

Balance Sheets as of December 31, 2018 and 2019

2018

2019

Assets

Current assets

Cash

60,538

%

$4

76,386

Accounts receivable

64,281

84,639

Inventory

119,029

%

184,177

Total

2$

243,848

345,202

Fixed assets

Net plant and equipment

658,547

2$

589,878

%

Total assets

902,395

24

935,080

Liabilities and Owners' Equity

Current liabilities

Accounts payable

187,922

%

$

195,611

%

Notes payable

83,020

134,588

Total

270,942

2$

330,199

%

Long-term debt

Owners' equity

2$

233,000

2$

169,750

%

Common stock and paid-in surplus

$

222,000

%

2$

222,000

%

Accumulated retained earnings

176,453

213,131

%

Total

24

398,453

24

435, 131

Total liabilities and owners' equity

2$

902,395

%

2$

935,080

%

< Prev

8 of 8

Nex

ere to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning