Problem 14-19 (IAA) At the beginning of current year, Ultra Company lease. equipment to alessee under a sales type lease. Rentals ar payable at the end of each year, beginning December 31 a the current year. The lease term is 6 years and the usefu

Problem 14-19 (IAA) At the beginning of current year, Ultra Company lease. equipment to alessee under a sales type lease. Rentals ar payable at the end of each year, beginning December 31 a the current year. The lease term is 6 years and the usefu

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 2E: Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement...

Related questions

Question

Please answer all the sub-parts 1-4. I badly need it. And please provide concrete solution as well as explanation. Thank you so much.

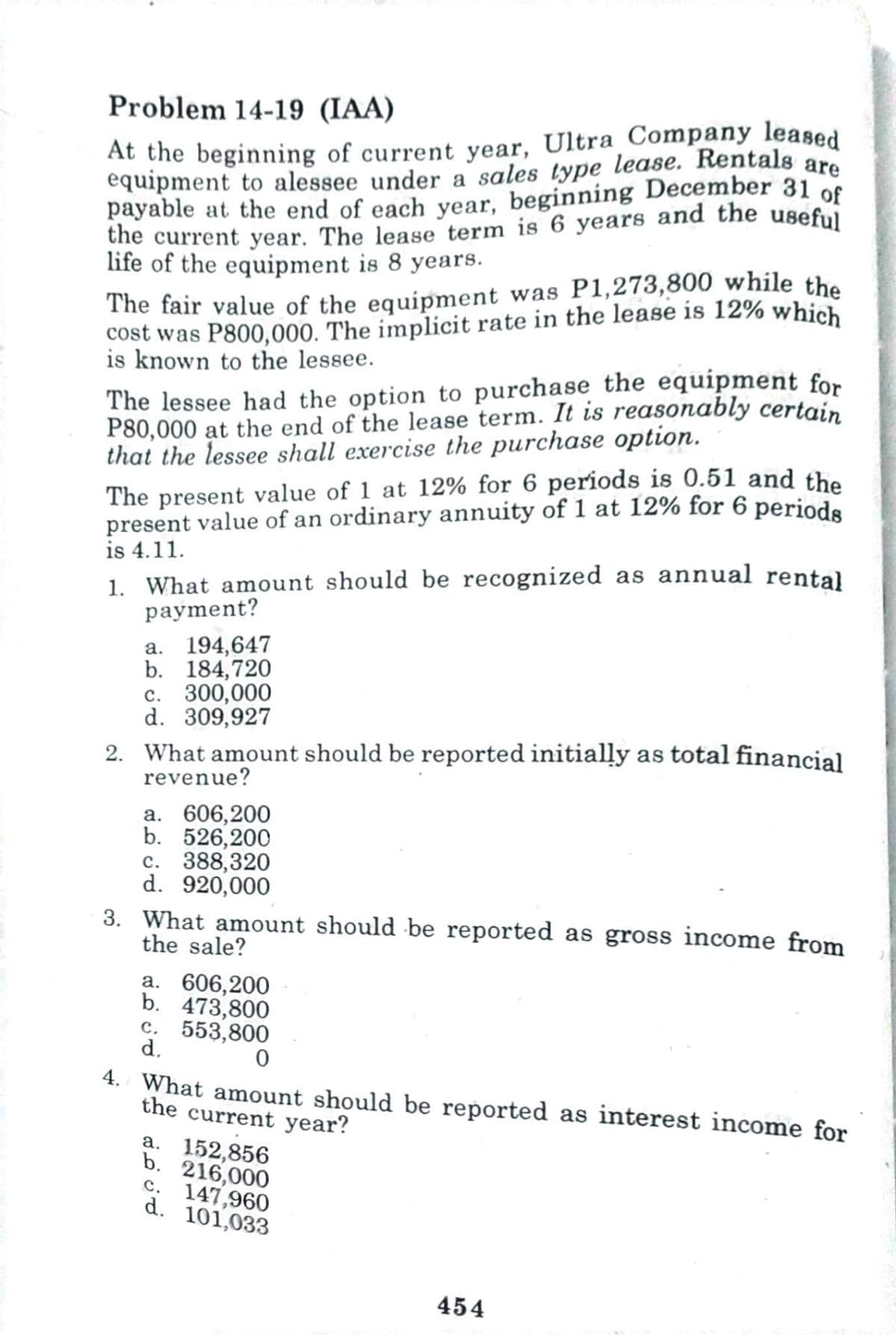

Transcribed Image Text:Problem 14-19 (IAA)

At the beginning of current year, Ultra Company leased

equipment to alessee under a sales type lease. Rentals are

payable at the end of each year, beginning December 31 of

the current year. The lease term is 6 years and the useful

life of the equipment is 8 years.

The fair value of the equipment was P1,273,800 while the

cost was P800,000. The implicit rate in the lease is 12% which

is known to the lessee.

The lessee had the option to purchase the equipment for

P80,000 at the end of the lease term. It is reasonably certain

that the lessee shall exercise the purchase option.

The present value of 1 at 12% for 6 periods is 0.51 and the

present value of an ordinary annuity of 1 at 12% for 6 periods

is 4.11.

1. What amount should be recognized as annual rental

payment?

a. 194,647

b. 184,720

c. 300,000

d. 309,927

2. What amount should be reported initially as total financial

revenue?

a. 606,200

b. 526,200

c. 388,320

d. 920,000

3. What amount should be reported as gross income from

the sale?

a. 606,200

b. 473,800

c. 553,800

d.

0

4. What amount should be reported as interest income for

the current year?

a. 152,856

b. 216,000

c.

147,960

d. 101,033

454

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Hi! I can't seem to get the answer on number 2. When I try to solve it using the formula given, it arrives on different answer.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning