HINT: STEP-BY-STEP WALKTHROUGH 1. Horizontal analysis: Create a new sheet within your Excel workbook that you will use to perform the horizontal analysis, comparing each year's income stateme item to its corresponding item in year 1.

HINT: STEP-BY-STEP WALKTHROUGH 1. Horizontal analysis: Create a new sheet within your Excel workbook that you will use to perform the horizontal analysis, comparing each year's income stateme item to its corresponding item in year 1.

Chapter9: Responsibility Accounting And Decentralization

Section: Chapter Questions

Problem 5PB: Financial information for Lighthizer Trading Company for the fiscal year-ended September 30, 20xx,...

Related questions

Question

30

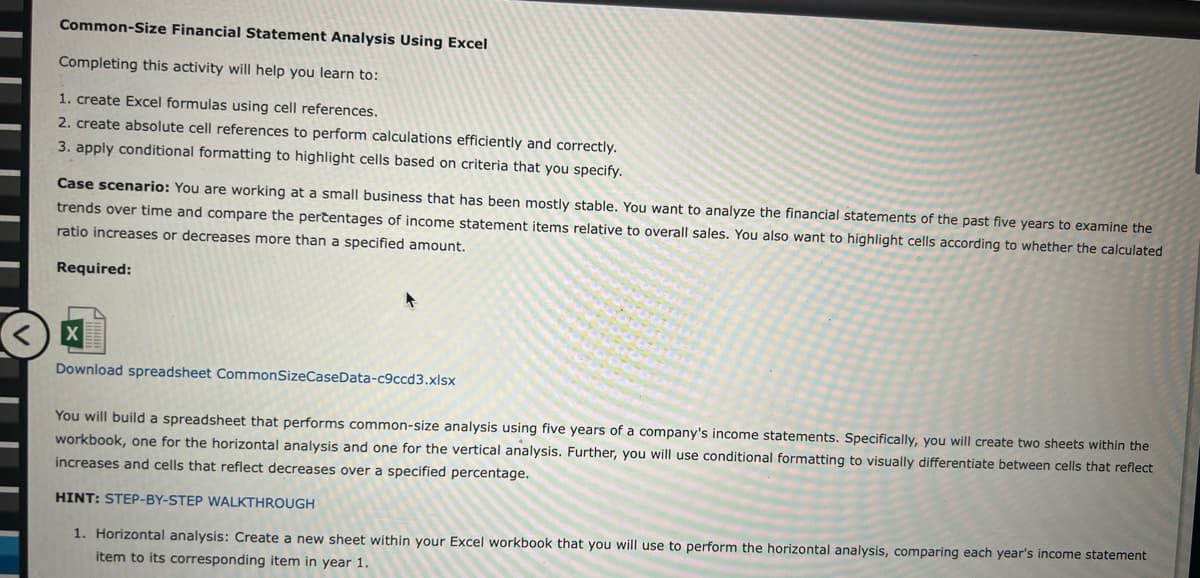

Transcribed Image Text:Common-Size Financial Statement Analysis Using Excel

Completing this activity will help you learn to:

1. create Excel formulas using cell references.

2. create absolute cell references to perform calculations efficiently and correctly.

3. apply conditional formatting to highlight cells based on criteria that you specify.

Case scenario: You are working at a small business that has been mostly stable. You want to analyze the financial statements of the past five years to examine the

trends over time and compare the pertentages of income statement items relative to overall sales. You also want to highlight cells according to whether the calculated

ratio increases or decreases more than a specified amount.

Required:

Download spreadsheet CommonSizeCaseData-c9ccd3.xlsx

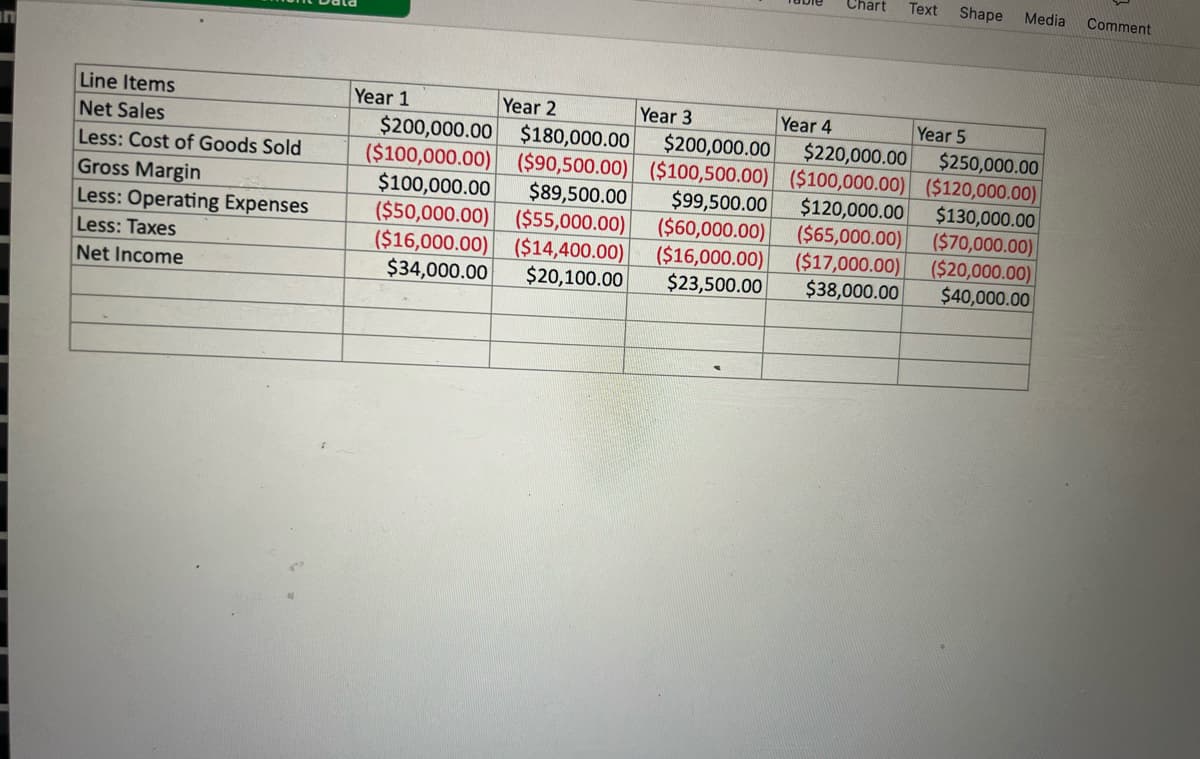

You will build a spreadsheet that performs common-size analysis using five years of a company's income statements. Specifically, you will create two sheets within the

workbook, one for the horizontal analysis and one for the vertical analysis. Further, you will use conditional formatting to visually differentiate between cells that reflect

increases and cells that reflect decreases over a specified percentage.

HINT: STEP-BY-STEP WALKTHROUGH

1. Horizontal analysis: Create a new sheet within your Excel workbook that you will use to perform the horizontal analysis, comparing each year's income statement

item to its corresponding item in year 1.

Transcribed Image Text:Chart

Text

Shape

Media

Comment

an

Line Items

Net Sales

Less: Cost of Goods Sold

Gross Margin

Less: Operating Expenses

Less: Taxes

Year 1

Year 2

Year 4

$220,000.00

Year 3

$200,000.00

Year 5

$250,000.00

$180,000.00

$200,000.00

($100,000.00) ($90,500.00) ($100,500.00) ($100,000.00) ($120,000.00)

$99,500.00

($60,000.00)

($16,000.00)

$23,500.00

$100,000.00

($50,000.00) ($55,000.00)

($16,000.00) ($14,400.00)

$34,000.00

$130,000.00

($70,000.00)

($20,000.00)

$40,000.00

$89,500.00

$120,000.00

($65,000.00)

($17,000.00)

$38,000.00

Net Income

$20,100.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning