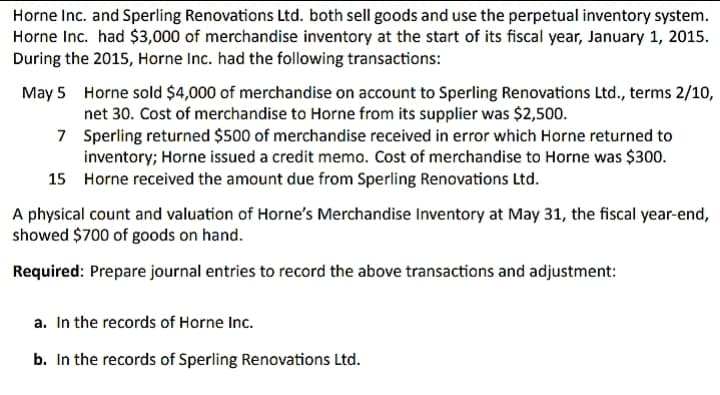

Horne Inc. and Sperling Renovations Ltd. both sell goods and use the perpetual inventory system. Horne Inc. had $3,000 of merchandise inventory at the start of its fiscal year, January 1, 2015. During the 2015, Horne Inc. had the following transactions: May 5 Horne sold $4,000 of merchandise on account to Sperling Renovations Ltd., terms 2/10, net 30. Cost of merchandise to Horne from its supplier was $2,500. 7 Sperling returned $500 of merchandise received in error which Horne returned to inventory; Horne issued a credit memo. Cost of merchandise to Horne was $300. 15 Horne received the amount due from Sperling Renovations Ltd. A physical count and valuation of Horne's Merchandise Inventory at May 31, the fiscal year-end, showed $700 of goods on hand. Required: Prepare journal entries to record the above transactions and adjustment: a. In the records of Horne Inc. b. In the records of Sperling Renovations Ltd.

Horne Inc. and Sperling Renovations Ltd. both sell goods and use the perpetual inventory system. Horne Inc. had $3,000 of merchandise inventory at the start of its fiscal year, January 1, 2015. During the 2015, Horne Inc. had the following transactions: May 5 Horne sold $4,000 of merchandise on account to Sperling Renovations Ltd., terms 2/10, net 30. Cost of merchandise to Horne from its supplier was $2,500. 7 Sperling returned $500 of merchandise received in error which Horne returned to inventory; Horne issued a credit memo. Cost of merchandise to Horne was $300. 15 Horne received the amount due from Sperling Renovations Ltd. A physical count and valuation of Horne's Merchandise Inventory at May 31, the fiscal year-end, showed $700 of goods on hand. Required: Prepare journal entries to record the above transactions and adjustment: a. In the records of Horne Inc. b. In the records of Sperling Renovations Ltd.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 7PB: Selected data on merchandise inventory, purchases, and sales for Jaffe Co. and Coronado Co. are as...

Related questions

Topic Video

Question

Transcribed Image Text:Horne Inc. and Sperling Renovations Ltd. both sell goods and use the perpetual inventory system.

Horne Inc. had $3,000 of merchandise inventory at the start of its fiscal year, January 1, 2015.

During the 2015, Horne Inc. had the following transactions:

May 5 Horne sold $4,000 of merchandise on account to Sperling Renovations Ltd., terms 2/10,

net 30. Cost of merchandise to Horne from its supplier was $2,500.

7 Sperling returned $500 of merchandise received in error which Horne returned to

inventory; Horne issued a credit memo. Cost of merchandise to Horne was $300.

15 Horne received the amount due from Sperling Renovations Ltd.

A physical count and valuation of Horne's Merchandise Inventory at May 31, the fiscal year-end,

showed $700 of goods on hand.

Required: Prepare journal entries to record the above transactions and adjustment:

a. In the records of Horne Inc.

b. In the records of Sperling Renovations Ltd.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning