Hought Office Machines, Inc.'s accountants assembled the following selected data for the year ended December 31, 2018: E (Click the icon to view the current accounts.) E (Click the icon to view the transaction data.) Requirement 1. Prepare Hought Office Machines, Inc.'s statement of cash flows using the indirect method to report operating activities. List noncash investing and financing activities on an accompanying schedule. Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use parentheses or a minus sign for numbers to be subtracted.) Hought Office Machines, Inc. Data Table Statement of Cash Flows Year Ended December 31, 2018 Cash flows from operating activities: Transaction Data for 2018: Net income Net income. ..... $ 60,000 Adjustments to reconcile net income to net cash Purchase of treasury stock. 14.300 provided by (used for) operating activities: Issuance of common stock for cash. 36,600 Loss on sale of equipment. 6.000 Payment of cash dividends 18,500 Depreciation expense. 21,100 Issuance of long-term note payable in exchange for cash 39,000 Purchase of building for cash....... 123,000 Retirement of bonds payable by issuing common stock 63,000 Net cash provided by (used for) operating activities Sale of equipment for cash. ............................. 51,000 Cash flows from investing activities: Print Done Net cash provided by (used for) investing activities Cash flows from financing activities: Data Table Net cash provided by (used for) financing activities Hought Office Machines, Inc. Net increase (decrease) in cash: December 31 2018 2017 Current assets: Cash balance, December 31, 2017 Cash and cash equivalents . .... S 86,200 S 29,000 Cash balance, December 31, 2018 Accounts receivable 69,300 64,200 Inventory 79,100 83,600 Noncash investing and financing activities: Current liabilities: Accounts payable 58,400 $ 56,000 Income tax payable . . . . ..... 14,300 16,800 Print Done

Hought Office Machines, Inc.'s accountants assembled the following selected data for the year ended December 31, 2018: E (Click the icon to view the current accounts.) E (Click the icon to view the transaction data.) Requirement 1. Prepare Hought Office Machines, Inc.'s statement of cash flows using the indirect method to report operating activities. List noncash investing and financing activities on an accompanying schedule. Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use parentheses or a minus sign for numbers to be subtracted.) Hought Office Machines, Inc. Data Table Statement of Cash Flows Year Ended December 31, 2018 Cash flows from operating activities: Transaction Data for 2018: Net income Net income. ..... $ 60,000 Adjustments to reconcile net income to net cash Purchase of treasury stock. 14.300 provided by (used for) operating activities: Issuance of common stock for cash. 36,600 Loss on sale of equipment. 6.000 Payment of cash dividends 18,500 Depreciation expense. 21,100 Issuance of long-term note payable in exchange for cash 39,000 Purchase of building for cash....... 123,000 Retirement of bonds payable by issuing common stock 63,000 Net cash provided by (used for) operating activities Sale of equipment for cash. ............................. 51,000 Cash flows from investing activities: Print Done Net cash provided by (used for) investing activities Cash flows from financing activities: Data Table Net cash provided by (used for) financing activities Hought Office Machines, Inc. Net increase (decrease) in cash: December 31 2018 2017 Current assets: Cash balance, December 31, 2017 Cash and cash equivalents . .... S 86,200 S 29,000 Cash balance, December 31, 2018 Accounts receivable 69,300 64,200 Inventory 79,100 83,600 Noncash investing and financing activities: Current liabilities: Accounts payable 58,400 $ 56,000 Income tax payable . . . . ..... 14,300 16,800 Print Done

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

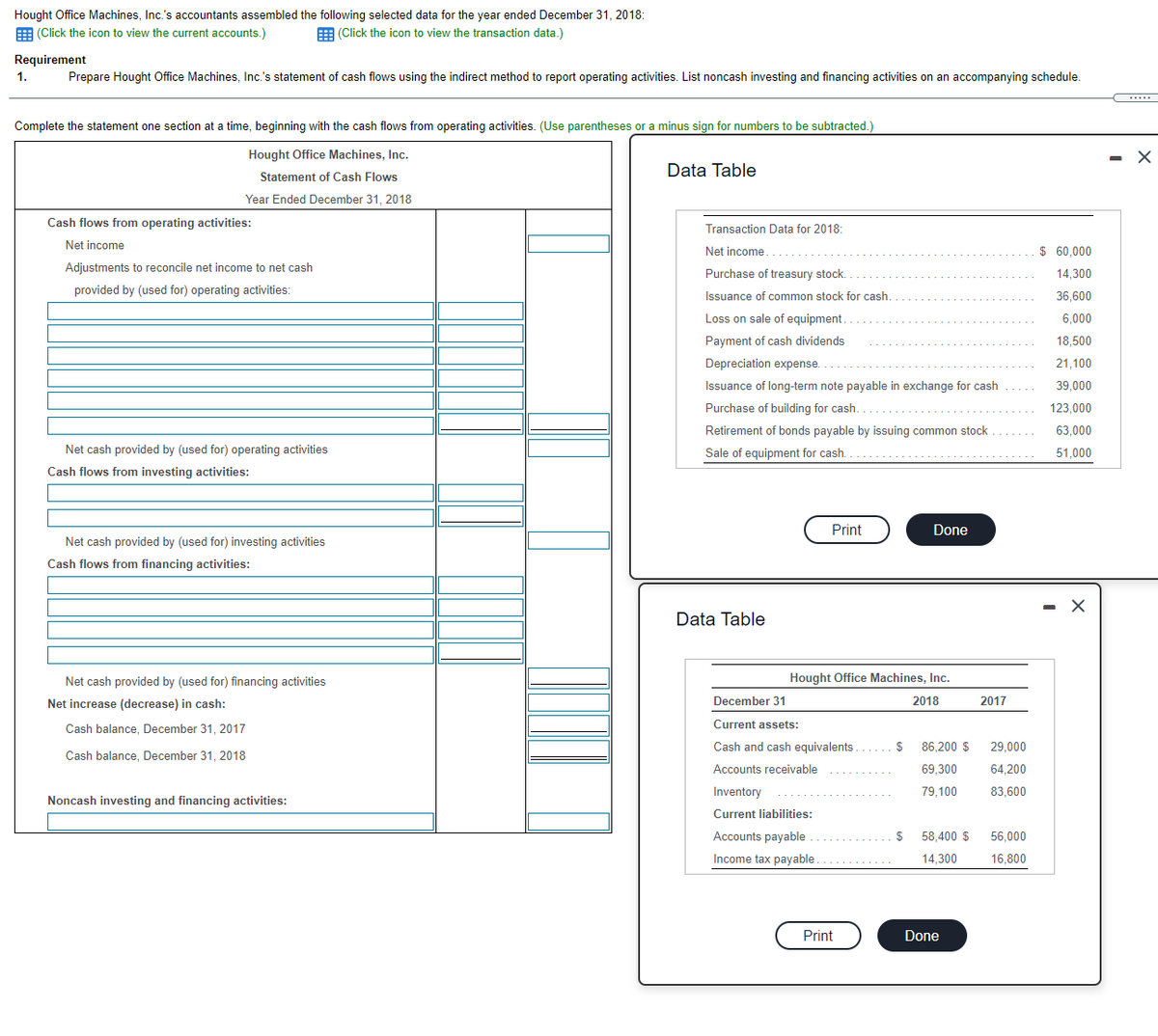

Transcribed Image Text:Hought Office Machines, Inc.'s accountants assembled the following selected data for the year ended December 31, 2018:

E (Click the icon to view the current accounts.)

E (Click the icon to view the transaction data.)

Requirement

1.

Prepare Hought Office Machines, Inc.'s statement of cash flows using the indirect method to report operating activities. List noncash investing and financing activities on an accompanying schedule.

Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use parentheses or a minus sign for numbers to be subtracted.)

Hought Office Machines, Inc.

Data Table

Statement of Cash Flows

Year Ended December 31, 2018

Cash flows from operating activities:

Transaction Data for 2018:

Net income

Net income.....

$ 60,000

Adjustments to reconcile net income to net cash

Purchase of treasury stock.

14,300

provided by (used for) operating activities:

Issuance of common stock for cash.

36,600

Loss on sale of equipment.

6,000

Payment of cash dividends

18,500

Depreciation expense.

21,100

Issuance of long-term note payable in exchange for cash

39,000

Purchase of building for cash.

123,000

Retirement of bonds payable by issuing common stock .

63,000

Net cash provided by (used for) operating activities

Sale of equipment for cash.

51.000

Cash flows from investing activities:

Print

Done

Net cash provided by (used for) investing activities

Cash flows from financing activities:

Data Table

Net cash provided by (used for) financing activities

Hought Office Machines, Inc.

Net increase (decrease) in cash:

December 31

2018

2017

Current assets:

Cash balance, December 31, 2017

Cash and cash equivalents...... $

86,200 $

29,000

Cash balance, December 31, 2018

Accounts receivable

69,300

64,200

Inventory

79,100

83,600

Noncash investing and financing activities:

Current liabilities:

Accounts payable

$

58.400 $

56,000

Income tax payable............

14,300

16,800

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education