Plant A Plant B Plant C Average Station Heat Rate (BTU/kwh) 16500 14500 13000 Total investment (boiler/turbine/electrical/ structures) $8.530 $9,498 $10,546 Annual operating cost: Fuel $1,128 $930 $828 Labor $616 $616 $616 O&M $150 $126 $114 Supplies $60 $60 $60 Insurance and property taxes $10 $12 $14 The service life of each plant is expected to be 20 years. The plant investment will be subject to a 20-year MACRS property classification. The expected salvage value of the plant at the end of its useful life is about 10% of its original investment. The firm's MARR is known to be 12%. The firm's marginal income tax rate is 25%. a. Determine the unit power cost ($/kWh) for each plant. b. Which plant would provide the most economical power?

Plant A Plant B Plant C Average Station Heat Rate (BTU/kwh) 16500 14500 13000 Total investment (boiler/turbine/electrical/ structures) $8.530 $9,498 $10,546 Annual operating cost: Fuel $1,128 $930 $828 Labor $616 $616 $616 O&M $150 $126 $114 Supplies $60 $60 $60 Insurance and property taxes $10 $12 $14 The service life of each plant is expected to be 20 years. The plant investment will be subject to a 20-year MACRS property classification. The expected salvage value of the plant at the end of its useful life is about 10% of its original investment. The firm's MARR is known to be 12%. The firm's marginal income tax rate is 25%. a. Determine the unit power cost ($/kWh) for each plant. b. Which plant would provide the most economical power?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 9E: Gelbart Company manufactures gas grills. Fixed costs amount to 16,335,000 per year. Variable costs...

Related questions

Question

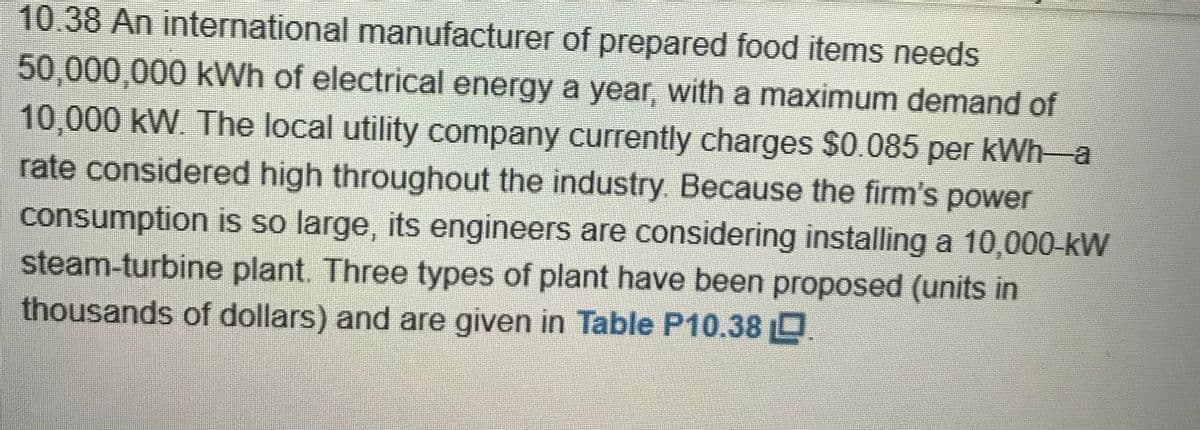

Transcribed Image Text:10.38An international manufacturer of prepared food items needs

50,000,000 kWh of electrical energy a year, with a maximum demand of

10,000kW. The local utility company currently charges $0.085 per kWh-a

rate considered high throughout the industry. Because the firm's power

consumption is so large, its engineers are considering installing a 10,000-kW

steam-turbine plant. Three types of plant have been proposed (units in

thousands of dollars) and are given in Table P10.38 D

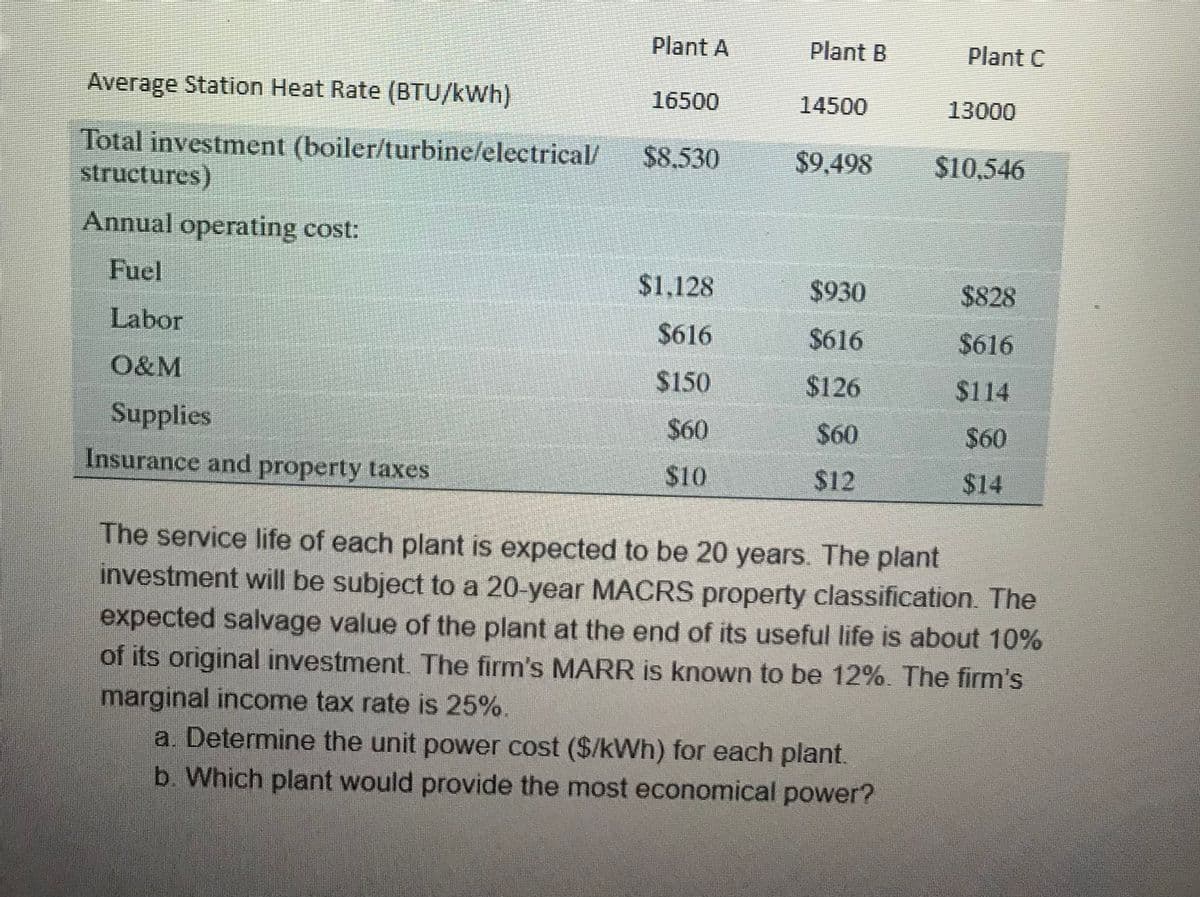

Transcribed Image Text:Plant A

Plant B

Plant C

Average Station Heat Rate (BTU/kWh)

16500

14500

13000

Total investment (boiler/turbine/electrical/

structures)

$8.530

$9,498

$10,546

Annual operating cost:

Fuel

$1,128

$930

$828

Labor

$616

$616

$616

O&M

$150

$126

$114

Supplies

$60

$60

$60

Insurance and property taxes

$10

$12

$14

The service life of each plant is expected to be 20 years. The plant

investment will be subject to a 20-year MACRS property classification. The

expected salvage value of the plant at the end of its useful life is about 10%

of its original investment. The firm's MARR is known to be 12%. The firm's

marginal income tax rate is 25%.

a. Determine the unit power cost ($/kWh) for each plant.

b. Which plant would provide the most economical power?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning