How much was this businesses inventory sold for in the year ended December 31, 2022? 2. On the december 31, 2022 balance sheet, this businesses beginning inventory balance was more than its ending inventory balance. True or false?

How much was this businesses inventory sold for in the year ended December 31, 2022? 2. On the december 31, 2022 balance sheet, this businesses beginning inventory balance was more than its ending inventory balance. True or false?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.12E

Related questions

Question

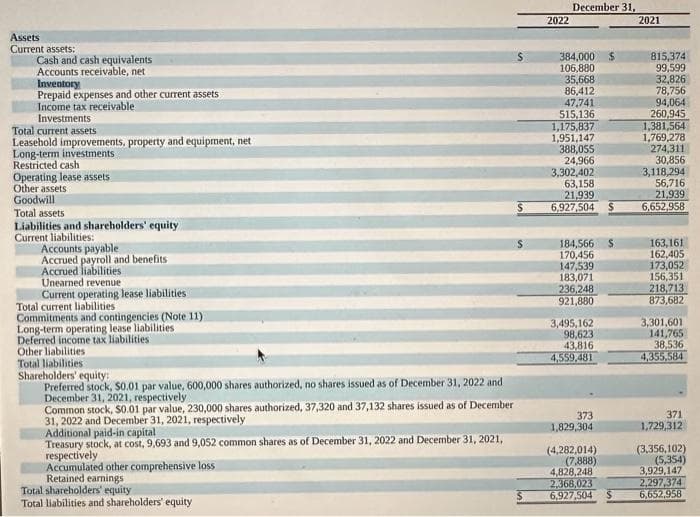

1. How much was this businesses inventory sold for in the year ended December 31, 2022?

2. On the december 31, 2022 balance sheet, this businesses beginning inventory balance was more than its ending inventory balance. True or false?

Transcribed Image Text:Assets

Current assets:

Cash and cash equivalents

Accounts receivable, net

Inventory

Prepaid expenses and other current assets

Income tax receivable

Investments

Total current assets

Leasehold improvements, property and equipment, net

Long-term investments

Restricted cash

Operating lease assets

Other assets

Goodwill

Total assets

Liabilities and shareholders' equity

Current liabilities:

Accounts payable

Accrued payroll and benefits

Accrued liabilities

Unearned revenue

Current operating lease liabilities

Total current liabilities

Commitments and contingencies (Note 11)

Long-term operating lease liabilities

Deferred income tax liabilities:

Other liabilities

Total liabilities

Shareholders' equity:

Preferred stock, $0.01 par value, 600,000 shares authorized, no shares issued as of December 31, 2022 and

December 31, 2021, respectively

Common stock, 50.01 par value, 230,000 shares authorized, 37,320 and 37,132 shares issued as of December

31, 2022 and December 31, 2021, respectively

Additional paid-in capital

Treasury stock, at cost, 9,693 and 9,052 common shares as of December 31, 2022 and December 31, 2021,

respectively

Accumulated other comprehensive loss

Retained earnings

Total shareholders' equity

Total liabilities and shareholders' equity

2022

December 31,

384,000 $

106,880

35,668

86,412

47,741

515,136

1,175,837

1,951,147

388,055

24,966

3,302,402

63,158

21,939

6,927,504

184,566

170,456

147,539

183,071

236,248

921,880

3,495,162

98,623

43,816

4,559,481

373

1,829,304

(4,282,014)

(7,888)

$

4,828,248

2,368,023

6,927,504 $

2021

815,374

99,599

32,826

78,756

94,064

260,945

1,381,564

1,769,278

274,311

30,856

3,118,2941

56,716

21,939

6,652,958

163,161

162,405

173,052

156,351

218,713

873,682

3,301,601

141,765

38,536

4,355,584

371

1,729,312

(3,356,102)

(5,354)

3,929,147

2,297,374

6,652,958

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub