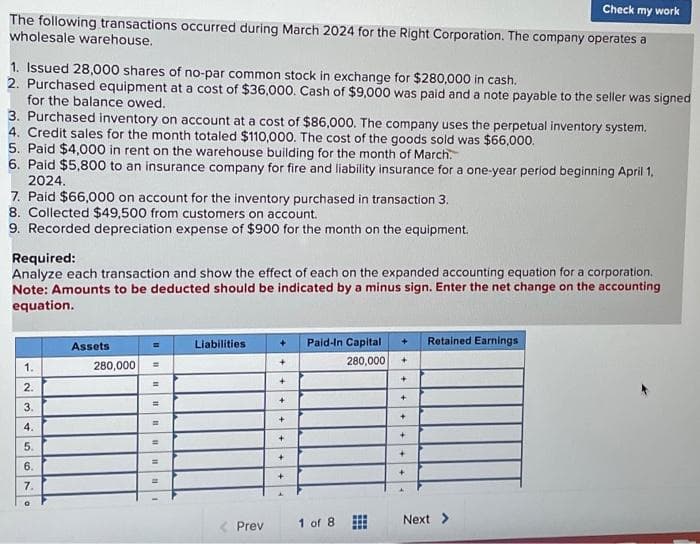

Check my work The following transactions occurred during March 2024 for the Right Corporation. The company operates a wholesale warehouse. 1. Issued 28,000 shares of no-par common stock in exchange for $280,000 in cash. 2. Purchased equipment at a cost of $36,000. Cash of $9,000 was paid and a note payable to the seller was signe for the balance owed. 3. Purchased inventory on account at a cost of $86,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $110,000. The cost of the goods sold was $66,000. 5. Paid $4,000 in rent on the warehouse building for the month of March. 6. Paid $5,800 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2024. 7. Paid $66,000 on account for the inventory purchased in transaction 3. 8. Collected $49,500 from customers on account. 9. Recorded depreciation expense of $900 for the month on the equipment. Required: Analyze each transaction and show the effect of each on the expanded accounting equation for a corporation. Note: Amounts to be deducted should be indicated by a minus sign. Enter the net change on the accounting equation.

Check my work The following transactions occurred during March 2024 for the Right Corporation. The company operates a wholesale warehouse. 1. Issued 28,000 shares of no-par common stock in exchange for $280,000 in cash. 2. Purchased equipment at a cost of $36,000. Cash of $9,000 was paid and a note payable to the seller was signe for the balance owed. 3. Purchased inventory on account at a cost of $86,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $110,000. The cost of the goods sold was $66,000. 5. Paid $4,000 in rent on the warehouse building for the month of March. 6. Paid $5,800 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2024. 7. Paid $66,000 on account for the inventory purchased in transaction 3. 8. Collected $49,500 from customers on account. 9. Recorded depreciation expense of $900 for the month on the equipment. Required: Analyze each transaction and show the effect of each on the expanded accounting equation for a corporation. Note: Amounts to be deducted should be indicated by a minus sign. Enter the net change on the accounting equation.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 16EA: Discuss how each of the following transactions for Watson, International, will affect assets,...

Related questions

Question

Please do not give image format

Transcribed Image Text:Check my work

The following transactions occurred during March 2024 for the Right Corporation. The company operates a

wholesale warehouse.

1. Issued 28,000 shares of no-par common stock in exchange for $280,000 in cash.

2. Purchased equipment at a cost of $36,000. Cash of $9,000 was paid and a note payable to the seller was signed

for the balance owed.

3. Purchased inventory on account at a cost of $86,000. The company uses the perpetual inventory system.

4. Credit sales for the month totaled $110,000. The cost of the goods sold was $66,000.

5. Paid $4,000 in rent on the warehouse building for the month of March.

6. Paid $5,800 to an insurance company for fire and liability insurance for a one-year period beginning April 1,

2024.

7. Paid $66,000 on account for the inventory purchased in transaction 3.

8. Collected $49,500 from customers on account.

9. Recorded depreciation expense of $900 for the month on the equipment.

Required:

Analyze each transaction and show the effect of each on the expanded accounting equation for a corporation.

Note: Amounts to be deducted should be indicated by a minus sign. Enter the net change on the accounting

equation.

1.

2.

3.

4.

5.

6.

7.

Assets

280,000

=

=

=

=

=

=

=

m

Liabilities

< Prev

+

+

+

+

+

+

+

+

Paid-In Capital

280,000

1 of 8

+

+

+

+

+

+

4

Retained Earnings

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning