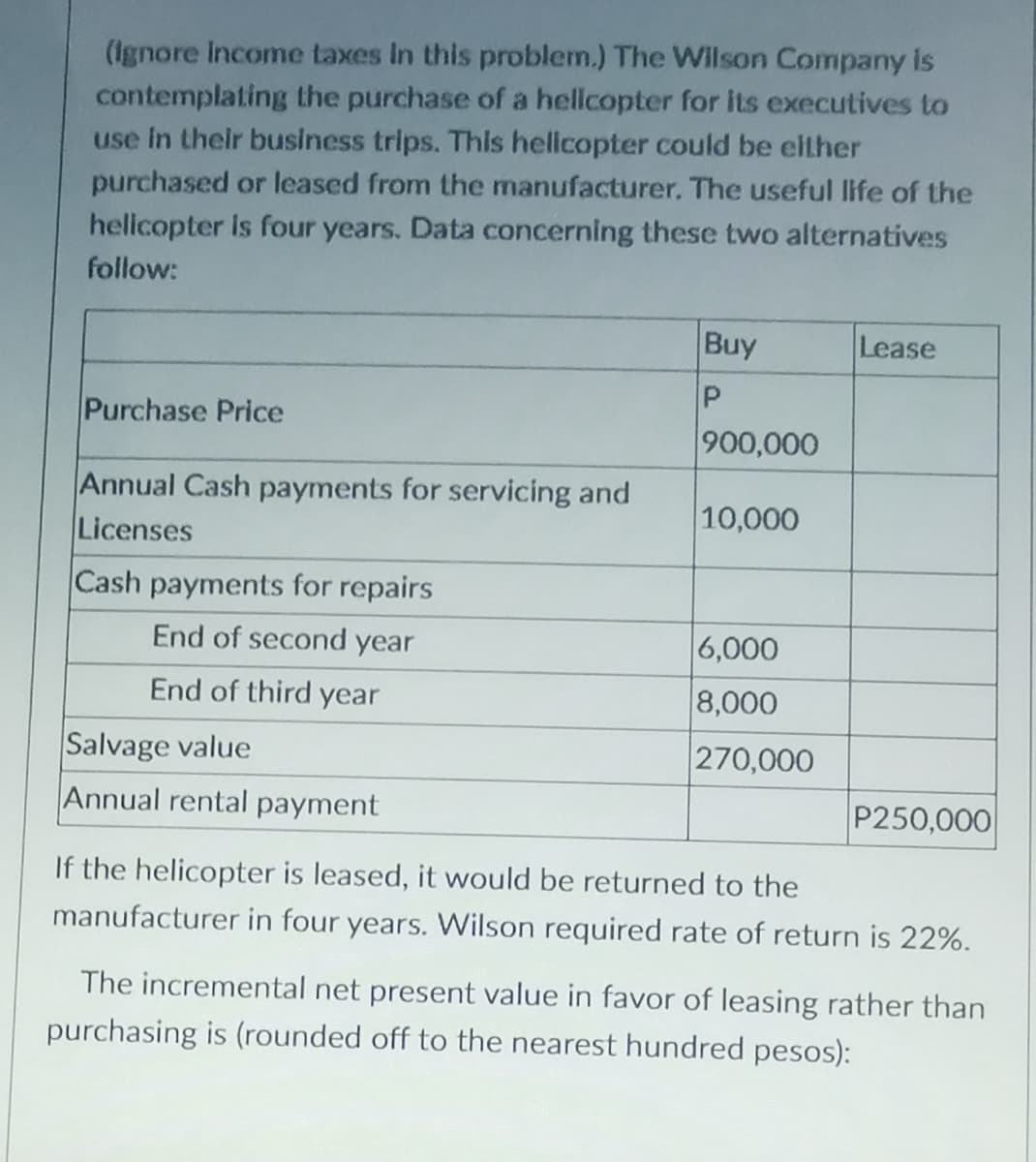

(Ignore Income taxes in this problem.) The Wilson Company is contemplating the purchase of a helicopter for its executives to use in their business trips. This helicopter could be either purchased or leased from the manufacturer. The useful life of the helicopter is four years. Data concerning these two alternatives follow: Buy Lease P Purchase Price 900,000 Annual Cash payments for servicing and 10,000 Licenses Cash payments for repairs End of second year 6,000 End of third year 8,000 Salvage value 270,000 Annual rental payment P250,000 If the helicopter is leased, it would be returned to the manufacturer in four years. Wilson required rate of return is 22%. The incremental net present value in favor of leasing rather than purchasing is (rounded off to the nearest hundred pesos):

(Ignore Income taxes in this problem.) The Wilson Company is contemplating the purchase of a helicopter for its executives to use in their business trips. This helicopter could be either purchased or leased from the manufacturer. The useful life of the helicopter is four years. Data concerning these two alternatives follow: Buy Lease P Purchase Price 900,000 Annual Cash payments for servicing and 10,000 Licenses Cash payments for repairs End of second year 6,000 End of third year 8,000 Salvage value 270,000 Annual rental payment P250,000 If the helicopter is leased, it would be returned to the manufacturer in four years. Wilson required rate of return is 22%. The incremental net present value in favor of leasing rather than purchasing is (rounded off to the nearest hundred pesos):

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 2P

Related questions

Question

Transcribed Image Text:(Ignore Income taxes in this problem.) The Wilson Company is

contemplating the purchase of a helicopter for its executives to

use in their business trips. This helicopter could be either

purchased or leased from the manufacturer. The useful life of the

helicopter is four years. Data concerning these two alternatives

follow:

Buy

Lease

P

Purchase Price

900,000

Annual Cash payments for servicing and

10,000

Licenses

Cash payments for repairs

End of second year

6,000

End of third year

8,000

Salvage value

270,000

Annual rental payment

P250,000

If the helicopter is leased, it would be returned to the

manufacturer in four years. Wilson required rate of return is 22%.

The incremental net present value in favor of leasing rather than

purchasing is (rounded off to the nearest hundred pesos):

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning