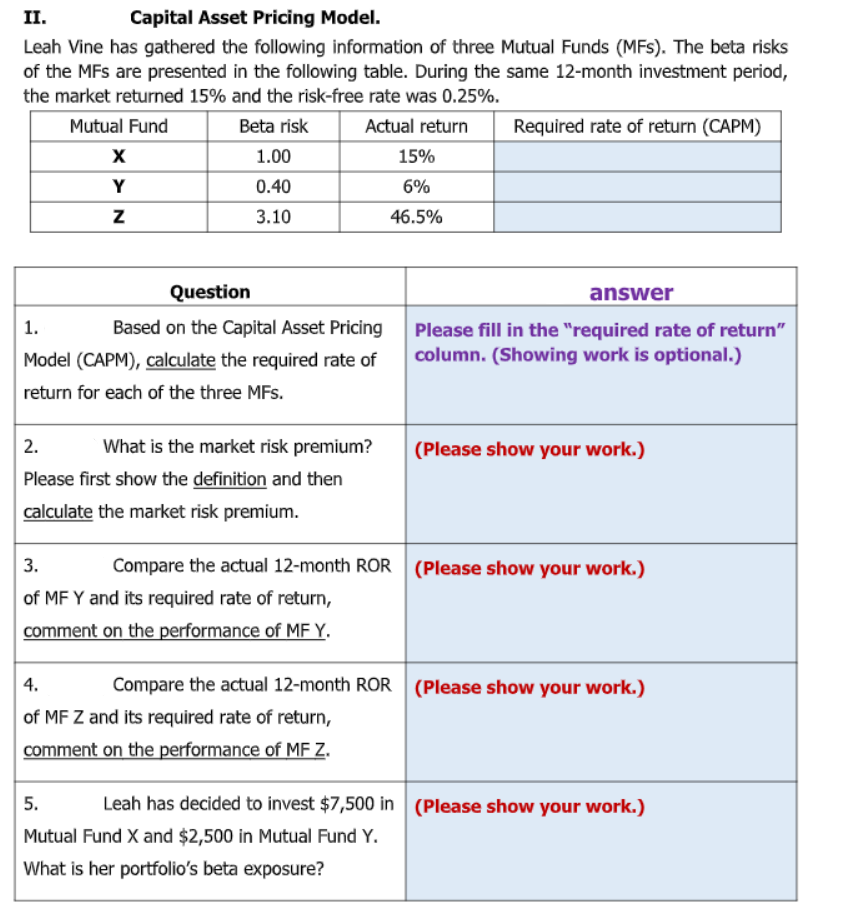

II. Capital Asset Pricing Model. Leah Vine has gathered the following information of three Mutual Funds (MFs). The beta risks of the MFs are presented in the following table. During the same 12-month investment period, the market returned 15% and the risk-free rate was 0.25%. Mutual Fund Beta risk Actual return Required rate of return (CAPM) X 1.00 15% Y 0.40 6% 3.10 46.5% Question answer 1. Based on the Capital Asset Pricing Please fill in the "required rate of return" column. (Showing work is optional.) Model (CAPM), calculate the required rate of return for each of the three MFs. 2. What is the market risk premium? (Please show your work.) Please first show the definition and then calculate the market risk premium. 3. Compare the actual 12-month ROR (Please show your work.) of MF Y and its required rate of return, comment on the performance of MF Y. 4. Compare the actual 12-month ROR (Please show your work.) of MF Z and its required rate of return, comment on the performance of MF Z. 5. Leah has decided to invest $7,500 in (Please show your work.) Mutual Fund X and $2,500 in Mutual Fund Y. What is her portfolio's beta exposure?

II. Capital Asset Pricing Model. Leah Vine has gathered the following information of three Mutual Funds (MFs). The beta risks of the MFs are presented in the following table. During the same 12-month investment period, the market returned 15% and the risk-free rate was 0.25%. Mutual Fund Beta risk Actual return Required rate of return (CAPM) X 1.00 15% Y 0.40 6% 3.10 46.5% Question answer 1. Based on the Capital Asset Pricing Please fill in the "required rate of return" column. (Showing work is optional.) Model (CAPM), calculate the required rate of return for each of the three MFs. 2. What is the market risk premium? (Please show your work.) Please first show the definition and then calculate the market risk premium. 3. Compare the actual 12-month ROR (Please show your work.) of MF Y and its required rate of return, comment on the performance of MF Y. 4. Compare the actual 12-month ROR (Please show your work.) of MF Z and its required rate of return, comment on the performance of MF Z. 5. Leah has decided to invest $7,500 in (Please show your work.) Mutual Fund X and $2,500 in Mutual Fund Y. What is her portfolio's beta exposure?

Chapter7: Types And Costs Of Financial Capital

Section: Chapter Questions

Problem 5EP

Related questions

Question

Please show work, don't use EXCEL

Transcribed Image Text:II.

Capital Asset Pricing Model.

Leah Vine has gathered the following information of three Mutual Funds (MFs). The beta risks

of the MFs are presented in the following table. During the same 12-month investment period,

the market returned 15% and the risk-free rate was 0.25%.

Mutual Fund

Beta risk

Actual return

Required rate of return (CAPM)

X

1.00

15%

Y

0.40

6%

3.10

46.5%

Question

answer

1.

Based on the Capital Asset Pricing

Please fill in the "required rate of return"

column. (Showing work is optional.)

Model (CAPM), calculate the required rate of

return for each of the three MFs.

2.

What is the market risk premium?

(Please show your work.)

Please first show the definition and then

calculate the market risk premium.

3.

Compare the actual 12-month ROR (Please show your work.)

of MF Y and its required rate of return,

comment on the performance of MF Y.

4.

Compare the actual 12-month ROR (Please show your work.)

of MF Z and its required rate of return,

comment on the performance of MF z.

5.

Leah has decided to invest $7,500 in (Please show your work.)

Mutual Fund X and $2,500 in Mutual Fund Y.

What is her portfolio's beta exposure?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning