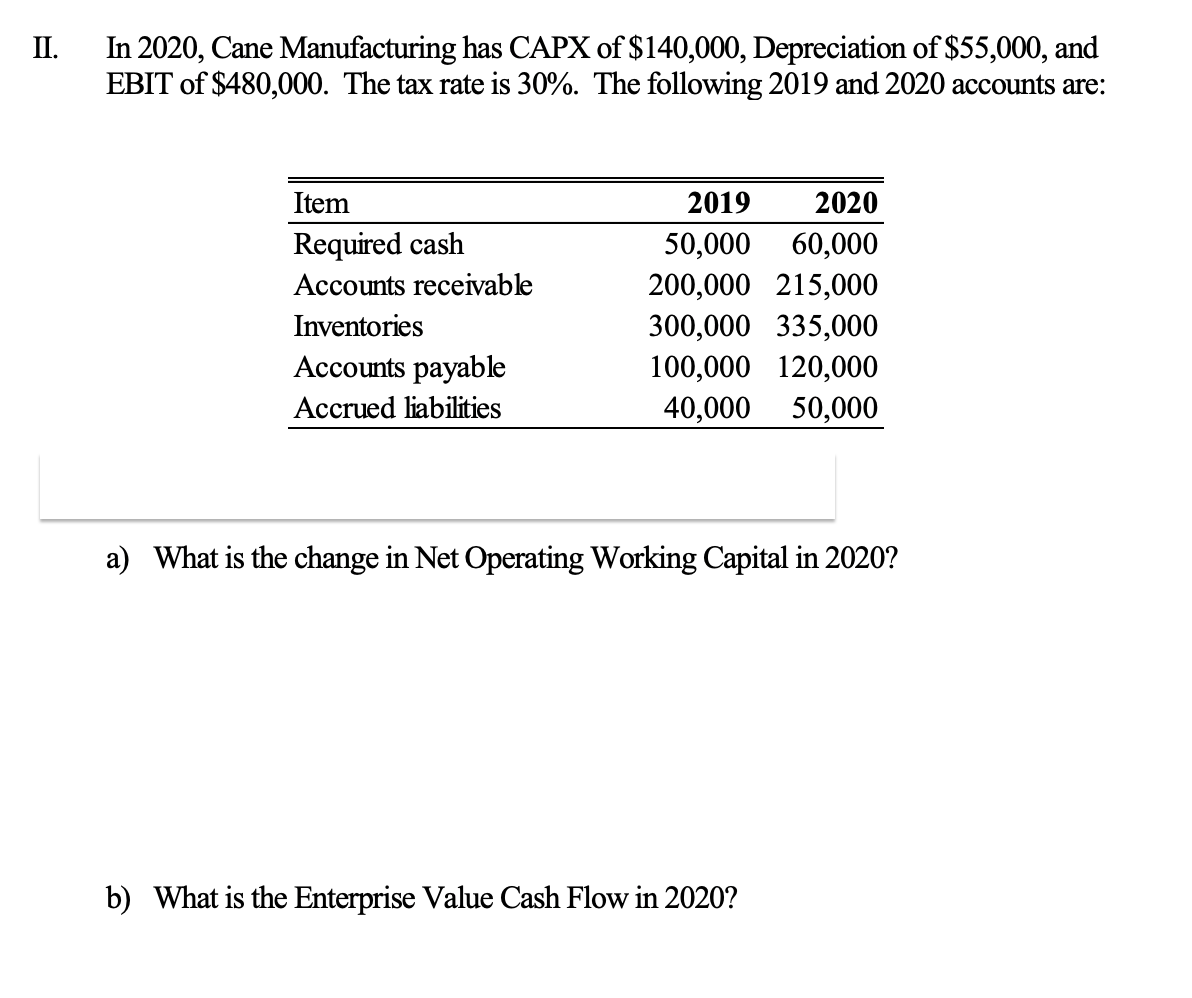

II. In 2020, Cane Manufacturing has CAPX of $140,000, Depreciation of $55,000, and EBIT of $480,000. The tax rate is 30%. The following 2019 and 2020 accounts are: Item Required cash Accounts receivable Inventories Accounts payable Accrued liabilities 2019 2020 50,000 60,000 200,000 215,000 300,000 335,000 100,000 120,000 40,000 50,000 a) What is the change in Net Operating Working Capital in 2020? b) What is the Enterprise Value Cash Flow in 2020?

II. In 2020, Cane Manufacturing has CAPX of $140,000, Depreciation of $55,000, and EBIT of $480,000. The tax rate is 30%. The following 2019 and 2020 accounts are: Item Required cash Accounts receivable Inventories Accounts payable Accrued liabilities 2019 2020 50,000 60,000 200,000 215,000 300,000 335,000 100,000 120,000 40,000 50,000 a) What is the change in Net Operating Working Capital in 2020? b) What is the Enterprise Value Cash Flow in 2020?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 16E

Related questions

Question

answer a and b pls

Transcribed Image Text:II.

In 2020, Cane Manufacturing has CAPX of $140,000, Depreciation of $55,000, and

EBIT of $480,000. The tax rate is 30%. The following 2019 and 2020 accounts are:

Item

Required cash

Accounts receivable

Inventories

Accounts payable

Accrued liabilities

2019

2020

50,000 60,000

200,000 215,000

300,000 335,000

100,000 120,000

40,000 50,000

a) What is the change in Net Operating Working Capital in 2020?

b) What is the Enterprise Value Cash Flow in 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning