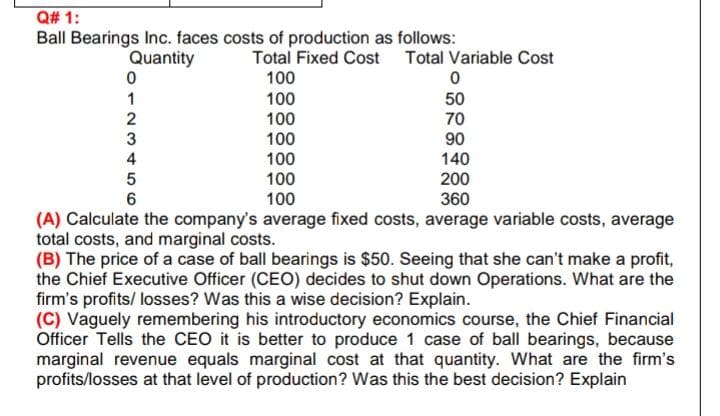

IIT Ball Bearings Inc. faces costs of production as follows: Quantity Total Fixed Cost Total Variable Cost 100 100 100 100 100 100 100 1 50 70 90 140 200 360 3 4 5 (A) Calculate the company's average fixed costs, average variable costs, average total costs, and marginal costs. (B) The price of a case of ball bearings is $50. Seeing that she can't make a profit, the Chief Executive Officer (CEO) decides to shut down Operations. What are the firm's profits/ losses? Was this a wise decision? Explain. (C) Vaguely remembering his introductory economics course, the Chief Financial Officer Tells the CEO it is better to produce 1 case of ball bearings, because marginal revenue equals marginal cost at that quantity. What are the firm's profits/losses at that level of production? Was this the best decision? Explain

IIT Ball Bearings Inc. faces costs of production as follows: Quantity Total Fixed Cost Total Variable Cost 100 100 100 100 100 100 100 1 50 70 90 140 200 360 3 4 5 (A) Calculate the company's average fixed costs, average variable costs, average total costs, and marginal costs. (B) The price of a case of ball bearings is $50. Seeing that she can't make a profit, the Chief Executive Officer (CEO) decides to shut down Operations. What are the firm's profits/ losses? Was this a wise decision? Explain. (C) Vaguely remembering his introductory economics course, the Chief Financial Officer Tells the CEO it is better to produce 1 case of ball bearings, because marginal revenue equals marginal cost at that quantity. What are the firm's profits/losses at that level of production? Was this the best decision? Explain

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter4: Extent (how Much) Decisions

Section: Chapter Questions

Problem 3MC

Related questions

Question

Transcribed Image Text:IIT

Ball Bearings Inc. faces costs of production as follows:

Quantity

Total Fixed Cost Total Variable Cost

100

100

100

100

100

100

100

1

50

70

90

140

200

360

3

4

5

(A) Calculate the company's average fixed costs, average variable costs, average

total costs, and marginal costs.

(B) The price of a case of ball bearings is $50. Seeing that she can't make a profit,

the Chief Executive Officer (CEO) decides to shut down Operations. What are the

firm's profits/ losses? Was this a wise decision? Explain.

(C) Vaguely remembering his introductory economics course, the Chief Financial

Officer Tells the CEO it is better to produce 1 case of ball bearings, because

marginal revenue equals marginal cost at that quantity. What are the firm's

profits/losses at that level of production? Was this the best decision? Explain

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax