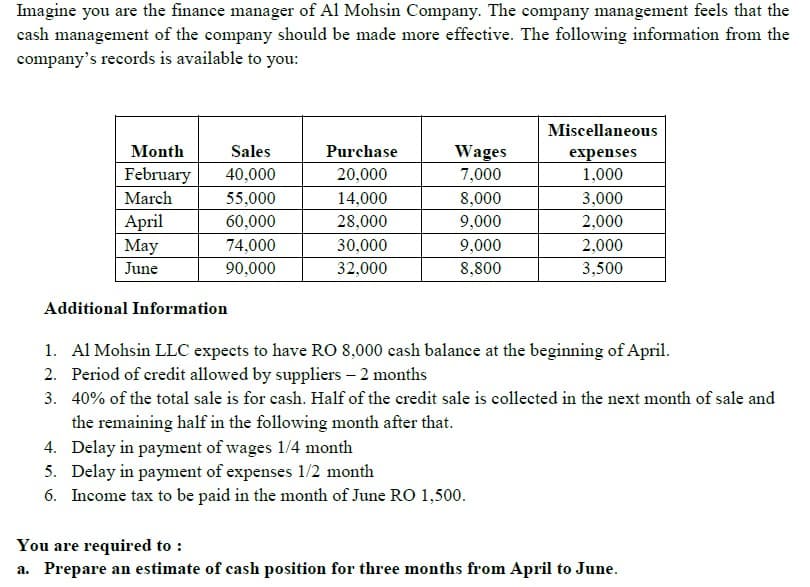

Imagine you are the finance manager of Al Mohsin Company. The company management feels that the cash management of the company should be made more effective. The following information from the company's records is available to you: Miscellaneous Wages 7,000 Month Sales Purchase еxpenses 1,000 February 40,000 20,000 March 55,000 14,000 8,000 3,000 Аpril 60,000 28,000 9,000 2,000 Мay 74,000 30,000 9,000 2,000 June 90,000 32,000 8,800 3,500 Additional Information 1. Al Mohsin LLC expects to have RO 8,000 cash balance at the beginning of April. 2. Period of credit allowed by suppliers - 2 months 3. 40% of the total sale is for cash. Half of the credit sale is collected in the next month of sale and the remaining half in the following month after that. 4. Delay in payment of wages 1/4 month 5. Delay in payment of expenses 1/2 month 6. Income tax to be paid in the month of June RO 1,500. You are required to : a. Prepare an estimate of cash position for three months from April to June.

Imagine you are the finance manager of Al Mohsin Company. The company management feels that the cash management of the company should be made more effective. The following information from the company's records is available to you: Miscellaneous Wages 7,000 Month Sales Purchase еxpenses 1,000 February 40,000 20,000 March 55,000 14,000 8,000 3,000 Аpril 60,000 28,000 9,000 2,000 Мay 74,000 30,000 9,000 2,000 June 90,000 32,000 8,800 3,500 Additional Information 1. Al Mohsin LLC expects to have RO 8,000 cash balance at the beginning of April. 2. Period of credit allowed by suppliers - 2 months 3. 40% of the total sale is for cash. Half of the credit sale is collected in the next month of sale and the remaining half in the following month after that. 4. Delay in payment of wages 1/4 month 5. Delay in payment of expenses 1/2 month 6. Income tax to be paid in the month of June RO 1,500. You are required to : a. Prepare an estimate of cash position for three months from April to June.

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 3TP: Consider the dilemma you might someday face if you are the chief financial officer of a company that...

Related questions

Question

Transcribed Image Text:Imagine you are the finance manager of Al Mohsin Company. The company management feels that the

cash management of the company should be made more effective. The following information from the

company's records is available to you:

Miscellaneous

Month

Sales

Purchase

Wages

еxpenses

1,000

February

40,000

20,000

7,000

March

55,000

14,000

8,000

3,000

Аpril

60,000

28,000

9,000

2,000

May

74,000

30,000

9,000

2,000

June

90,000

32,000

8,800

3,500

Additional Information

1. Al Mohsin LLC expects to have RO 8,000 cash balance at the beginning of April.

2. Period of credit allowed by suppliers - 2 months

3. 40% of the total sale is for cash. Half of the credit sale is collected in the next month of sale and

the remaining half in the following month after that.

4. Delay in payment of wages 1/4 month

5. Delay in payment of expenses 1/2 month

6. Income tax to be paid in the month of June RO 1,500.

You are required to :

a. Prepare an estimate of cash position for three months from April to June.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub