In 1938, major powers met in Munich to discuss Germany’s demands to annex part of Czechoslovakia. Let us think of the issue as the proportion of Czechoslovak territory given to Germany. Possible outcomes can be plotted on a single dimension, where 0 implies that Germany obtains no territory and 1 implies that Germany obtains all of Czechoslovakia: Most countries at Munich (“Allies” for short) wish to give nothing to Germany: their ideal point is 0, which gives them utility of 1. Their worst possible outcome is for Germany to take all of Czechoslovakia; hence an outcome of 1 gives them utility of 0. In between these extremes, the Allies could propose a compromise, X, which gives them utility of 1 – X. The question for the Allies is whether to propose a compromise or fight a war with Germany, which they are sure will ensue if they offer nothing. If they propose a compromise and Germany accepts, they get a payoff of 1 – X. If they fight, they win with probability p and lose with probability 1 – p. If they win, they get their ideal outcome (0) but pay a cost of .2

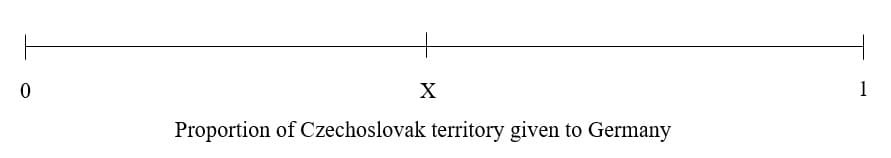

In 1938, major powers met in Munich to discuss Germany’s demands to annex part of Czechoslovakia. Let us think of the issue as the proportion of Czechoslovak territory given to Germany. Possible outcomes can be plotted on a single dimension, where 0 implies that Germany obtains no territory and 1 implies that Germany obtains all of Czechoslovakia:

Most countries at Munich (“Allies” for short) wish to give nothing to Germany: their ideal point is 0, which gives them utility of 1. Their worst possible outcome is for Germany to take all of Czechoslovakia; hence an outcome of 1 gives them utility of 0. In between these extremes, the Allies could propose a compromise, X, which gives them utility of 1 – X.

The question for the Allies is whether to propose a compromise or fight a war with Germany, which they are sure will ensue if they offer nothing. If they propose a compromise and Germany accepts, they get a payoff of 1 – X. If they fight, they win with probability p and lose with probability 1 – p. If they win, they get their ideal outcome (0) but pay a cost of .2; the payoff for winning is thus .8. If they lose, they get their worst outcome (1) and still pay a cost of .2; the payoff for losing is thus -.2.

Germany faces a symmetric situation. Germany’s utility from a compromise is simply X, since Germany’s utility rises with the proportion of territory it receives. If Germany fights, it wins with probability (1 – p) and loses with probability p. If Germany wins, it gets its ideal outcome (1) but pays a cost of .2, so its payoff for winning is .8. If it loses, it gets its worst outcome (0) and still pays a cost of .2, so its payoff for losing is -.2.

Questions:

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images