In a joint processing operation, Nolen Company manufactures three grades of sugar from a common input, sugar cane. Joint processing costs up to the split-off point total $42.700 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split off point. These sales values are as follows: raw sugar. $20,700: brown sugar $20700; and white sugar, $22,300. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The additional processing costs and the sales value after further processing for each product (on an annual basis) are shown below. Product Raw sugar Brown sugar Additional Processing Costs $ 22,500 Incremental profit (loss) $ 14,900 $ 5,200 Sales Value $42,600 $37,400 $44,400 Required: a. Compute the incremental profit (loss) for each product. (Loss amounts should be indicated by a minus sign.) Raw Sugar Brown Sugar White Sugar b. Which product or products should be sold at the split-off point? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.)

In a joint processing operation, Nolen Company manufactures three grades of sugar from a common input, sugar cane. Joint processing costs up to the split-off point total $42.700 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split off point. These sales values are as follows: raw sugar. $20,700: brown sugar $20700; and white sugar, $22,300. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The additional processing costs and the sales value after further processing for each product (on an annual basis) are shown below. Product Raw sugar Brown sugar Additional Processing Costs $ 22,500 Incremental profit (loss) $ 14,900 $ 5,200 Sales Value $42,600 $37,400 $44,400 Required: a. Compute the incremental profit (loss) for each product. (Loss amounts should be indicated by a minus sign.) Raw Sugar Brown Sugar White Sugar b. Which product or products should be sold at the split-off point? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.)

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter6: Process Cost Accounting—additional Procedures; Accounting For Joint Products And By-products

Section: Chapter Questions

Problem 12E: Adirondack Bat Co. processes rough timber to obtain three grades of lumber, A, B, and C that are...

Related questions

Question

DO not give answer in image

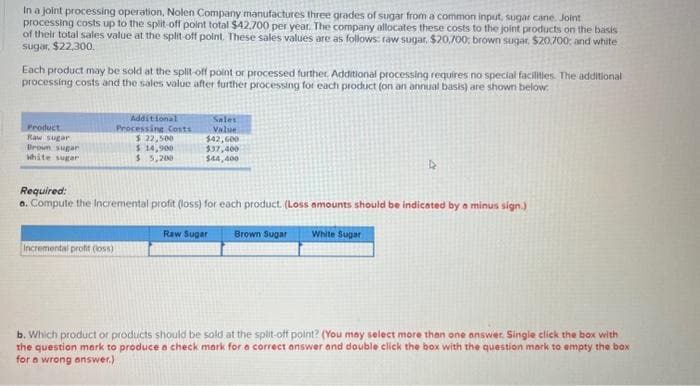

Transcribed Image Text:In a joint processing operation, Nolen Company manufactures three grades of sugar from a common input, sugar cane. Joint

processing costs up to the split-off point total $42,700 per year. The company allocates these costs to the joint products on the basis

of their total sales value at the split-off point. These sales values are as follows: raw sugar, $20,700, brown sugar, $20,700; and white

sugar, $22,300.

Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The additional

processing costs and the sales value after further processing for each product (on an annual basis) are shown below.

Product

Raw sugar

Brown sugar

white sugar

Additional

Processing Costs

$ 22,500

$ 14,900

$ 5,200

Incremental profit (loss)

Sales

Value

$42,600

$37,400

$44,400

Required:

a. Compute the incremental profit (loss) for each product. (Loss amounts should be indicated by a minus sign.)

Raw Sugar Brown Sugar

White Sugar

b. Which product or products should be sold at the split-off point? (You may select more than one answer. Single click the box with

the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box

for a wrong answer.)

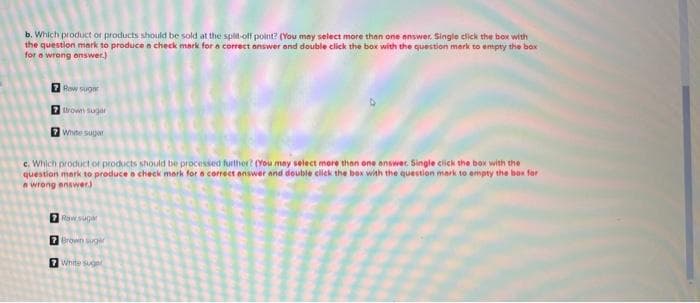

Transcribed Image Text:b. Which product or products should be sold at the split-off point? (You may select more than one answer. Single click the box with

the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box

for a wrong enswer.)

7 Rew sugar

7 thrown sugar

7 White sugar

c. Which product or products should be processed further? (You may select more than one answer. Single click the box with the

question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for

a wrong answer)

7 Raw suger

7 Brown suger

7 White suger

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College