In January 2019, United Airlines (UAL) had a market capitalization of $22.73 billion, debt of $13.63 billion, and cash of $3.81 billion. United Airlines had revenues of $40.87 billion. Southwest Airlines (LUV) had a market capitalization of $27.48 billion, debt of $3.48 billion, cash of $3.65 billion, and revenues of $21.72 billion. a. Compare the market capitalization-to-revenue ratio (also called the price-to-sales ratio) for United Airlines and Southwest Airlines. b. Compare the enterprise value-to-revenue ratio for United Airlines and Southwest Airlines. c. Which of these comparisons is more meaningful? Explain. a. Compare the market capitalization-to-revenue ratio (also called the price-to-sales ratio) for United Airlines and Southwest Airlines. The market capitalization-to-revenue ratio for United Airlines is ______. (Round to three decimal places.)

In January 2019, United Airlines (UAL) had a market capitalization of $22.73 billion, debt of $13.63 billion, and cash of $3.81 billion. United Airlines had revenues of $40.87 billion. Southwest Airlines (LUV) had a market capitalization of $27.48 billion, debt of $3.48 billion, cash of $3.65 billion, and revenues of $21.72 billion. a. Compare the market capitalization-to-revenue ratio (also called the price-to-sales ratio) for United Airlines and Southwest Airlines. b. Compare the enterprise value-to-revenue ratio for United Airlines and Southwest Airlines. c. Which of these comparisons is more meaningful? Explain. a. Compare the market capitalization-to-revenue ratio (also called the price-to-sales ratio) for United Airlines and Southwest Airlines. The market capitalization-to-revenue ratio for United Airlines is ______. (Round to three decimal places.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 88PSA: Ratio Analysis Consider the following information taken from the stockholders equity section: How do...

Related questions

Question

100%

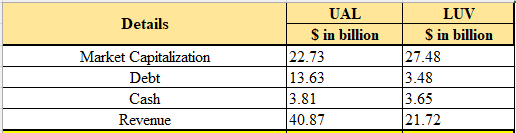

In January 2019, United Airlines (UAL) had a market capitalization of $22.73 billion, debt of $13.63 billion, and cash of $3.81 billion. United Airlines had revenues of $40.87 billion. Southwest Airlines (LUV) had a market capitalization of $27.48 billion, debt of $3.48 billion, cash of $3.65 billion, and revenues of $21.72 billion.

a. Compare the market capitalization-to-revenue ratio (also called the price-to-sales ratio) for United Airlines and Southwest Airlines.

b. Compare the enterprise value-to-revenue ratio for United Airlines and Southwest Airlines.

c. Which of these comparisons is more meaningful? Explain.

a. Compare the market capitalization-to-revenue ratio (also called the price-to-sales ratio) for United Airlines and Southwest Airlines.

The market capitalization-to-revenue ratio for United Airlines is ______. (Round to three decimal places.)

Transcribed Image Text:In January 2019, United Airlines (UAL) had a market capitalization of $22.73 billion, debt of $13.63 billion, and cash of $3.81 billion. United Airlines had revenues of

$40.87 billion. Southwest Airlines (LUV) had a market capitalization of $27.48 billion, debt of $3.48 billion, cash of $3.65 billion, and revenues of $21.72 billion.

a. Compare the market capitalization-to-revenue ratio (also called the price-to-sales ratio) for United Airlines and Southwest Airlines.

b. Compare the enterprise value-to-revenue ratio for United Airlines and Southwest Airlines.

c. Which of these comparisons is more meaningful? Explain.

a. Compare the market capitalization-to-revenue ratio (also called the price-to-sales ratio) for United Airlines and Southwest Airlines.

The market capitalization-to-revenue ratio for United Airlines is (Round to three decimal places.)

Expert Solution

Given:

Here,

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning