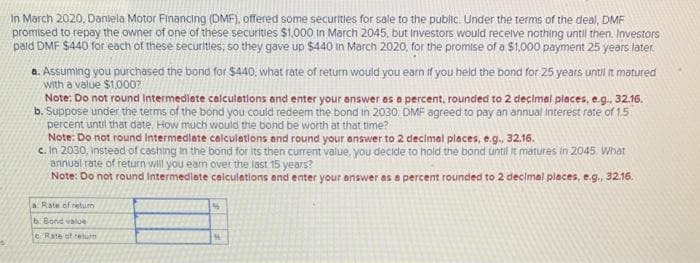

In March 2020, Daniela Motor Financing (DMF), offered some securities for sale to the public. Under the terms of the deal, DMF promised to repay the owner of one of these securities $1,000 in March 2045, but Investors would receive nothing until then. Investors pald DMF $440 for each of these securities; so they gave up $440 in March 2020, for the promise of a $1,000 payment 25 years later. a. Assuming you purchased the bond for $440, what rate of return would you earn if you held the bond for 25 years until it matured with a value $1,000? Note: Do not round Intermediate calculations and enter your answer as a percent, rounded to 2 decimal places, e.g., 32.16. b. Suppose under the terms of the bond you could redeem the bond in 2030. DMF agreed to pay an annual Interest rate of 1.5 percent until that date. How much would the bond be worth at that time? Note: Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. In 2030, instead of cashing in the bond for its then current value, you decide to hold the bond until it matures in 2045 What annual rate of return will you earn over the last 15 years? Note: Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Rate of retum b. Bond value c. Rate of return M

In March 2020, Daniela Motor Financing (DMF), offered some securities for sale to the public. Under the terms of the deal, DMF promised to repay the owner of one of these securities $1,000 in March 2045, but Investors would receive nothing until then. Investors pald DMF $440 for each of these securities; so they gave up $440 in March 2020, for the promise of a $1,000 payment 25 years later. a. Assuming you purchased the bond for $440, what rate of return would you earn if you held the bond for 25 years until it matured with a value $1,000? Note: Do not round Intermediate calculations and enter your answer as a percent, rounded to 2 decimal places, e.g., 32.16. b. Suppose under the terms of the bond you could redeem the bond in 2030. DMF agreed to pay an annual Interest rate of 1.5 percent until that date. How much would the bond be worth at that time? Note: Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. In 2030, instead of cashing in the bond for its then current value, you decide to hold the bond until it matures in 2045 What annual rate of return will you earn over the last 15 years? Note: Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Rate of retum b. Bond value c. Rate of return M

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 38P

Related questions

Question

Transcribed Image Text:In March 2020, Daniela Motor Financing (DMF), offered some securities for sale to the public. Under the terms of the deal, DMF

promised to repay the owner of one of these securities $1,000 in March 2045, but Investors would receive nothing until then. Investors

pald DMF $440 for each of these securities; so they gave up $440 in March 2020, for the promise of a $1,000 payment 25 years later.

a. Assuming you purchased the bond for $440, what rate of return would you earn if you held the bond for 25 years until it matured

with a value $1,000?

Note: Do not round Intermediate calculations and enter your answer as a percent, rounded to 2 decimal places, e.g., 32.16.

b. Suppose under the terms of the bond you could redeem the bond in 2030. DMF agreed to pay an annual Interest rate of 1.5

percent until that date. How much would the bond be worth at that time?

Note: Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

c. In 2030, instead of cashing in the bond for its then current value, you decide to hold the bond until it matures in 2045 What

annual rate of return will you earn over the last 15 years?

Note: Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

a. Rate of retum

b. Bond value

c. Rate of return

M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning