in Purchase, New York. PepsiCo has interests in the manufacturing, marketing, and distribution of grain-based snack foods, beverages, and other products. PepsiCo was formed in 1965 with the merger of the Pepsi-Cola Company and Frito-Lay, Inc. PepsiCo has since expanded from its namesake product Pepsi to a broader range of food and beverage brands, the largest of which included an acquisition of Tropicana Products in 1998 and the Quaker Oats Company in 2001, which added the Gatorade brand to its portfolio. As of January 26, 2012, 22 of PepsiCo's brands generated retail sales of more than $1 billion apiece, and the company's products were distributed across more than 200 countries, resulting in annual net revenues of $43.3 billion. Based on net revenue, PepsiCo is the second largest food and beverage business in the world. Your consulting firm has been hired to forecast the total revenues for PepsiCo, Inc. for each quarter of 2021. The company's past seasonal revenues are located below. Total Revenues ($millions) Quarter 2 $15,710 $16,090 $16,449 $15,945 Fiscal Year (FY) Quarter 1 $12,049 $12,562 $12,884 $13,881 Quarter 3 $16,240 $16,485 $17,188 $18,091 Quarter 4 $19,526 $19,524 $20,640 $22,455 2017 2018 2019 2020 Before continuing to the problems below, construct a time series plot (line chart) of PepsiCo revenue data. Use the data and this chart to answer the questions below. Because the data are categorized by quarter, the forecast may need to account for seasonal impacts. Use the multiple regression model defined below to forecast PepsiCo's revenues. 1. A colleague has suggested the presence of a trend in PepsiCo’s revenues, disregarding seasonal impacts. Use the regression equations identified below to forecast using only trend. (a) Using a second-order model, develop a nonlinear estimated regression equation [T = bo + bit + bzť²] to forecast PepsiCo's revenues. Use the nonlinear equation to forecast revenues for each quarter of 2021. Using a= 0.05, discuss the significance (R-square, F-test and t-tests) of the equation in part (d). (b) Do you prefer the estimated regression equation developed in part (b) or part (d)? Explain. (c)

in Purchase, New York. PepsiCo has interests in the manufacturing, marketing, and distribution of grain-based snack foods, beverages, and other products. PepsiCo was formed in 1965 with the merger of the Pepsi-Cola Company and Frito-Lay, Inc. PepsiCo has since expanded from its namesake product Pepsi to a broader range of food and beverage brands, the largest of which included an acquisition of Tropicana Products in 1998 and the Quaker Oats Company in 2001, which added the Gatorade brand to its portfolio. As of January 26, 2012, 22 of PepsiCo's brands generated retail sales of more than $1 billion apiece, and the company's products were distributed across more than 200 countries, resulting in annual net revenues of $43.3 billion. Based on net revenue, PepsiCo is the second largest food and beverage business in the world. Your consulting firm has been hired to forecast the total revenues for PepsiCo, Inc. for each quarter of 2021. The company's past seasonal revenues are located below. Total Revenues ($millions) Quarter 2 $15,710 $16,090 $16,449 $15,945 Fiscal Year (FY) Quarter 1 $12,049 $12,562 $12,884 $13,881 Quarter 3 $16,240 $16,485 $17,188 $18,091 Quarter 4 $19,526 $19,524 $20,640 $22,455 2017 2018 2019 2020 Before continuing to the problems below, construct a time series plot (line chart) of PepsiCo revenue data. Use the data and this chart to answer the questions below. Because the data are categorized by quarter, the forecast may need to account for seasonal impacts. Use the multiple regression model defined below to forecast PepsiCo's revenues. 1. A colleague has suggested the presence of a trend in PepsiCo’s revenues, disregarding seasonal impacts. Use the regression equations identified below to forecast using only trend. (a) Using a second-order model, develop a nonlinear estimated regression equation [T = bo + bit + bzť²] to forecast PepsiCo's revenues. Use the nonlinear equation to forecast revenues for each quarter of 2021. Using a= 0.05, discuss the significance (R-square, F-test and t-tests) of the equation in part (d). (b) Do you prefer the estimated regression equation developed in part (b) or part (d)? Explain. (c)

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter2: Systems Of Linear Equations

Section2.4: Applications

Problem 28EQ

Related questions

Question

Solve on excel

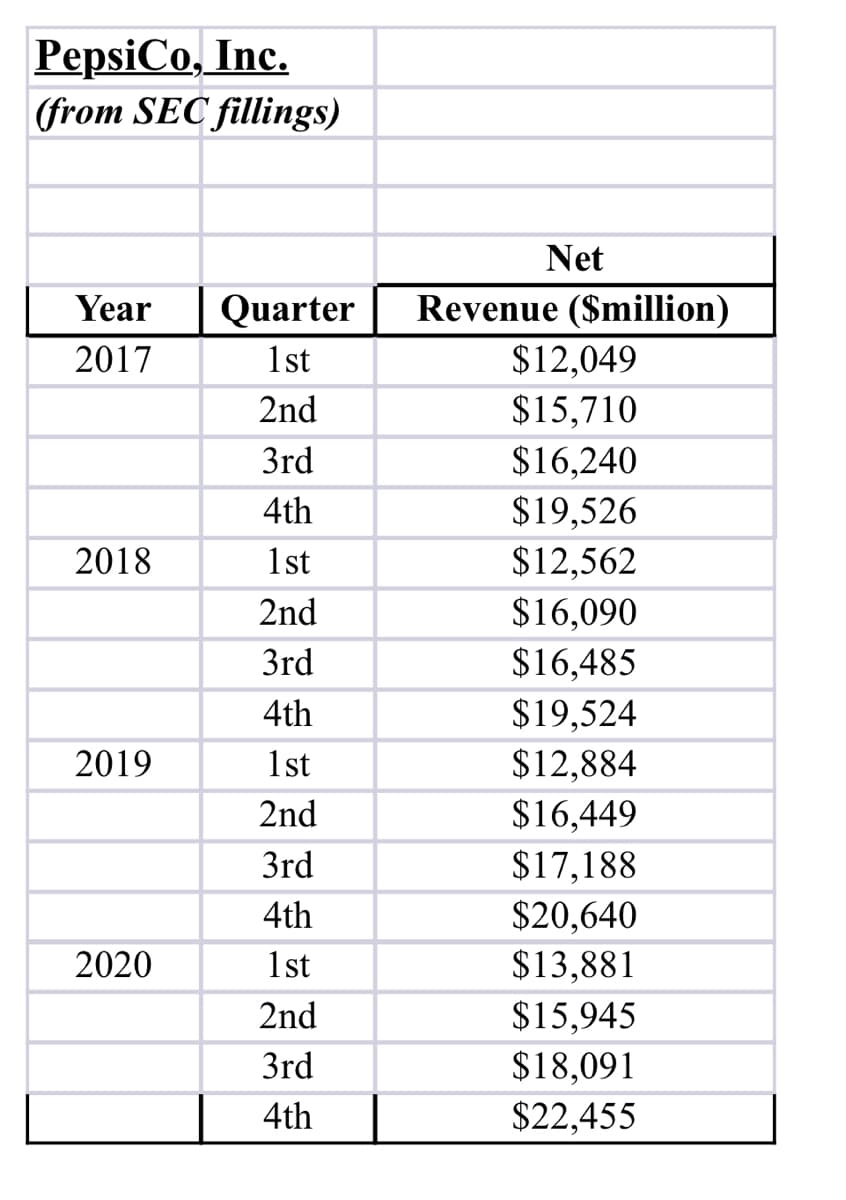

Transcribed Image Text:PepsiCo, Inc.

(from SEC fillings)

Net

Revenue ($million)

Quarter

1st

Year

2017

$12,049

2nd

$15,710

3rd

$16,240

4th

$19,526

2018

1st

$12,562

2nd

$16,090

3rd

$16,485

$19,524

$12,884

4th

2019

1st

2nd

$16,449

$17,188

$20,640

$13,881

3rd

4th

2020

1st

$15,945

$18,091

$22,455

2nd

3rd

4th

![PepsiCo, Inc. is an American multinational food, snack, and beverage corporation headquartered

in Purchase, New York. PepsiCo has interests in the manufacturing, marketing, and distribution

of grain-based snack foods, beverages, and other products. PepsiCo was formed in 1965 with the

merger of the Pepsi-Cola Company and Frito-Lay, Inc. PepsiCo has since expanded from its

namesake product Pepsi to a broader range of food and beverage brands, the largest of which

included an acquisition of Tropicana Products in 1998 and the Quaker Oats Company in 2001,

which added the Gatorade brand to its portfolio.

As of January 26, 2012, 22 of PepsiCo's brands generated retail sales of more than $1 billion

apiece, and the company's products were distributed across more than 200 countries, resulting in

annual net revenues of $43.3 billion. Based on net revenue, PepsiCo is the second largest food

and beverage business in the world.

Your consulting firm has been hired to forecast the total revenues for PepsiCo, Inc. for each

quarter of 2021. The company's past seasonal revenues are located below.

Total Revenues ($millions).

Quarter 2

$15,710

$16,090

$16,449

$15,945

Fiscal Year (FY)

Quarter 1

$12,049

$12,562

$12,884

$13,881

Quarter 3

$16,240

$16,485

$17,188

$18,091

Quarter 4

$19,526

$19,524

$20,640

$22,455

2017

2018

2019

2020

Before continuing to the problems below, construct a time series plot (line chart) of

PepsiCo revenue data. Use the data and this chart to answer the questions below.

Because the data are categorized by quarter, the forecast may need to account for seasonal

impacts. Use the multiple regression model defined below to forecast PepsiCo's revenues.

1. A colleague has suggested the presence of a trend in PepsiCo’s revenues, disregarding

seasonal impacts. Use the regression equations identified below

ABC

forecast using only

trend.

Using a second-order model, develop a nonlinear estimated regression equation

[T = bo + bit + bzť²] to forecast PepsiCo's revenues. Use the nonlinear equation

to forecast revenues for each quarter of 2021.

(a)

(b)

Using a = 0.05, discuss the significance (R-square, F-test and t-tests) of the

equation in part (d).

Do you prefer the estimated regression equation developed in part (b) or part (d)?

Explain.

(c)](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fb4fd4aa7-ffaa-45f5-a4ad-104dc0e7ed8a%2Fa2353674-4854-44fb-a439-72f1aaea47c4%2F15rpo4n_processed.jpeg&w=3840&q=75)

Transcribed Image Text:PepsiCo, Inc. is an American multinational food, snack, and beverage corporation headquartered

in Purchase, New York. PepsiCo has interests in the manufacturing, marketing, and distribution

of grain-based snack foods, beverages, and other products. PepsiCo was formed in 1965 with the

merger of the Pepsi-Cola Company and Frito-Lay, Inc. PepsiCo has since expanded from its

namesake product Pepsi to a broader range of food and beverage brands, the largest of which

included an acquisition of Tropicana Products in 1998 and the Quaker Oats Company in 2001,

which added the Gatorade brand to its portfolio.

As of January 26, 2012, 22 of PepsiCo's brands generated retail sales of more than $1 billion

apiece, and the company's products were distributed across more than 200 countries, resulting in

annual net revenues of $43.3 billion. Based on net revenue, PepsiCo is the second largest food

and beverage business in the world.

Your consulting firm has been hired to forecast the total revenues for PepsiCo, Inc. for each

quarter of 2021. The company's past seasonal revenues are located below.

Total Revenues ($millions).

Quarter 2

$15,710

$16,090

$16,449

$15,945

Fiscal Year (FY)

Quarter 1

$12,049

$12,562

$12,884

$13,881

Quarter 3

$16,240

$16,485

$17,188

$18,091

Quarter 4

$19,526

$19,524

$20,640

$22,455

2017

2018

2019

2020

Before continuing to the problems below, construct a time series plot (line chart) of

PepsiCo revenue data. Use the data and this chart to answer the questions below.

Because the data are categorized by quarter, the forecast may need to account for seasonal

impacts. Use the multiple regression model defined below to forecast PepsiCo's revenues.

1. A colleague has suggested the presence of a trend in PepsiCo’s revenues, disregarding

seasonal impacts. Use the regression equations identified below

ABC

forecast using only

trend.

Using a second-order model, develop a nonlinear estimated regression equation

[T = bo + bit + bzť²] to forecast PepsiCo's revenues. Use the nonlinear equation

to forecast revenues for each quarter of 2021.

(a)

(b)

Using a = 0.05, discuss the significance (R-square, F-test and t-tests) of the

equation in part (d).

Do you prefer the estimated regression equation developed in part (b) or part (d)?

Explain.

(c)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning