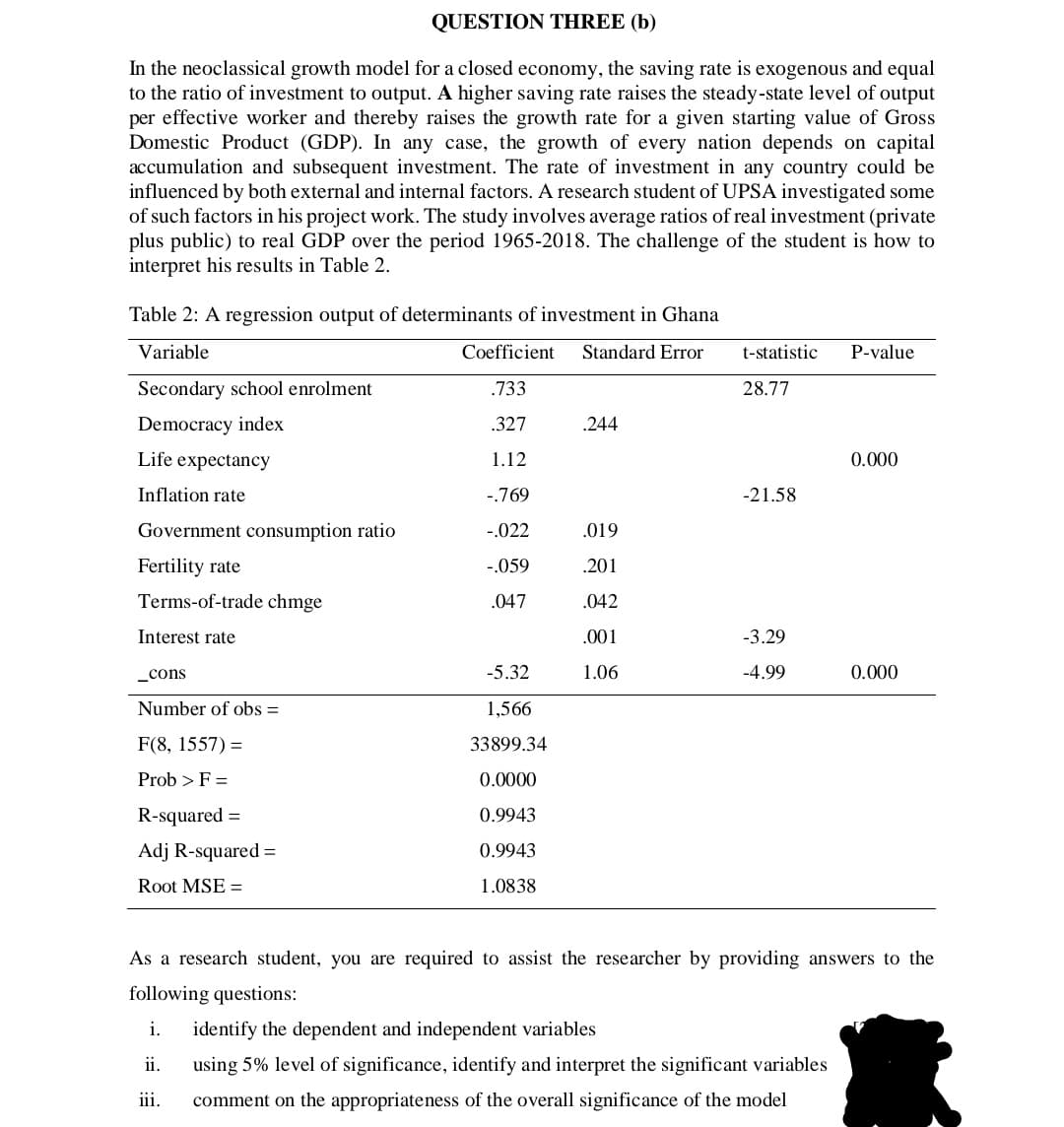

In the neoclassical growth model for a closed economy, the saving rate is exogenous and equal to the ratio of investment to output. A higher saving rate raises the steady-state level of output per effective worker and thereby raises the growth rate for a given starting value of Gross Domestic Product (GDP). In any case, the growth of every nation depends on capital accumulation and subsequent investment. The rate of investment in any country could be influenced by both external and internal factors. A research student of UPSA investigated some of such factors in his project work. The study involves average ratios of real investment (private plus public) to real GDP over the period 1965-2018. The challenge of the student is how to interpret his results in Table 2. Table 2: A regression output of determinants of investment in Ghana Variable Coefficient Standard Error t-statistic P-value Secondary school enrolment .733 28.77 Democracy index .327 .244 Life expectancy 1.12 0.000 Inflation rate -.769 -21.58 Government consumption ratio -.022 .019 Fertility rate -.059 .201 Terms-of-trade chmge .047 .042 Interest rate .001 -3.29 _cons -5.32 1.06 -4.99 0.000 Number of obs = 1,566 F(8, 1557) = 33899.34 Prob > F = 0.0000 R-squared = 0.9943 Adj R-squared = 0.9943 Root MSE = 1.0838 As a research student, you are required to assist the researcher by providing answers to the following questions: i. identify the dependent and independent variables ii. using 5% level of significance, identify and interpret the significant variables iii. comment on the appropriateness of the overall significance of the model

In the neoclassical growth model for a closed economy, the saving rate is exogenous and equal to the ratio of investment to output. A higher saving rate raises the steady-state level of output per effective worker and thereby raises the growth rate for a given starting value of Gross Domestic Product (GDP). In any case, the growth of every nation depends on capital accumulation and subsequent investment. The rate of investment in any country could be influenced by both external and internal factors. A research student of UPSA investigated some of such factors in his project work. The study involves average ratios of real investment (private plus public) to real GDP over the period 1965-2018. The challenge of the student is how to interpret his results in Table 2. Table 2: A regression output of determinants of investment in Ghana Variable Coefficient Standard Error t-statistic P-value Secondary school enrolment .733 28.77 Democracy index .327 .244 Life expectancy 1.12 0.000 Inflation rate -.769 -21.58 Government consumption ratio -.022 .019 Fertility rate -.059 .201 Terms-of-trade chmge .047 .042 Interest rate .001 -3.29 _cons -5.32 1.06 -4.99 0.000 Number of obs = 1,566 F(8, 1557) = 33899.34 Prob > F = 0.0000 R-squared = 0.9943 Adj R-squared = 0.9943 Root MSE = 1.0838 As a research student, you are required to assist the researcher by providing answers to the following questions: i. identify the dependent and independent variables ii. using 5% level of significance, identify and interpret the significant variables iii. comment on the appropriateness of the overall significance of the model

Algebra and Trigonometry (MindTap Course List)

4th Edition

ISBN:9781305071742

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter10: Systems Of Equations And Inequalities

Section10.FOM: Focus On Modeling: Linear Programming

Problem 14P

Related questions

Question

Transcribed Image Text:QUESTION THREE (b)

In the neoclassical growth model for a closed economy, the saving rate is exogenous and equal

to the ratio of investment to output. A higher saving rate raises the steady-state level of output

per effective worker and thereby raises the growth rate for a given starting value of Gross

Domestic Product (GDP). In any case, the growth of every nation depends on capital

accumulation and subsequent investment. The rate of investment in any country could be

influenced by both external and internal factors. A research student of UPSA investigated some

of such factors in his project work. The study involves average ratios of real investment (private

plus public) to real GDP over the period 1965-2018. The challenge of the student is how to

interpret his results in Table 2.

Table 2: A regression output of determinants of investment in Ghana

Variable

Coefficient

Standard Error

t-statistic

P-value

Secondary school enrolment

.733

28.77

Democracy index

.327

.244

Life expectancy

1.12

0.000

Inflation rate

-.769

-21.58

Government consumption ratio

-.022

.019

Fertility rate

-.059

.201

Terms-of-trade chmge

.047

.042

Interest rate

.001

-3.29

_cons

-5.32

1.06

-4.99

0.000

Number of obs =

1,566

F(8, 1557) =

33899.34

Prob >F =

0.0000

R-squared =

0.9943

Adj R-squared =

0.9943

Root MSE =

1.0838

As a research student, you are required to assist the researcher by providing answers to the

following questions:

i.

identify the dependent and independent variables

ii.

using 5% level of significance, identify and interpret the significant variables

iii.

comment on the appropriateness of the overall significance of the model

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning