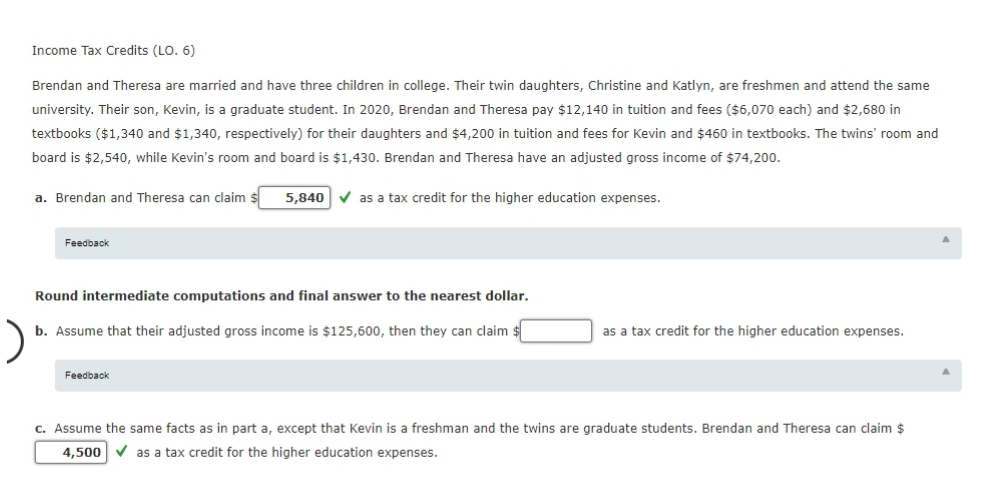

Income Tax Credits (LO. 6) Brendan and Theresa are married and have three children in college. Their twin daughters, Christine and Katlyn, are freshmen and attend the same university. Their son, Kevin, is a graduate student. In 2020, Brendan and Theresa pay $12,140 in tuition and fees ($6,070 each) and $2,680 in textbooks ($1,340 and $1,340, respectively) for their daughters and $4,200 in tuition and fees for Kevin and $460 in textbooks. The twins' room and board is $2,540, while Kevin's room and board is $1,430. Brendan and Theresa have an adjusted gross income of $74,200. a. Brendan and Theresa can claim 5,840 as a tax credit for the higher education expenses. Feedback Round intermediate computations and final answer to the nearest dollar. b. Assume that their adjusted gross income is $125,600, then they can claim : as a tax credit for the higher education expenses. Feedback c. Assume the same facts as in part a, except that Kevin is a freshman and the twins are graduate students. Brendan and Theresa can claim $ 4,500 v as a tax credit for the higher education expenses.

Income Tax Credits (LO. 6) Brendan and Theresa are married and have three children in college. Their twin daughters, Christine and Katlyn, are freshmen and attend the same university. Their son, Kevin, is a graduate student. In 2020, Brendan and Theresa pay $12,140 in tuition and fees ($6,070 each) and $2,680 in textbooks ($1,340 and $1,340, respectively) for their daughters and $4,200 in tuition and fees for Kevin and $460 in textbooks. The twins' room and board is $2,540, while Kevin's room and board is $1,430. Brendan and Theresa have an adjusted gross income of $74,200. a. Brendan and Theresa can claim 5,840 as a tax credit for the higher education expenses. Feedback Round intermediate computations and final answer to the nearest dollar. b. Assume that their adjusted gross income is $125,600, then they can claim : as a tax credit for the higher education expenses. Feedback c. Assume the same facts as in part a, except that Kevin is a freshman and the twins are graduate students. Brendan and Theresa can claim $ 4,500 v as a tax credit for the higher education expenses.

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter3: Preparing Your Taxes

Section: Chapter Questions

Problem 4FPE

Related questions

Question

I need help on part b. Thanks.

Transcribed Image Text:Income Tax Credits (LO. 6)

Brendan and Theresa are married and have three children in college. Their twin daughters, Christine and Katlyn, are freshmen and attend the same

university. Their son, Kevin, is a graduate student. In 2020, Brendan and Theresa pay $12,140 in tuition and fees ($6,070 each) and $2,680 in

textbooks ($1,340 and $1,340, respectively) for their daughters and $4,200 in tuition and fees for Kevin and $460 in textbooks. The twins' room and

board is $2,540, while Kevin's room and board is $1,430. Brendan and Theresa have an adjusted gross income of $74,200.

a. Brendan and Theresa can claim s

5,840 v as a tax credit for the higher education expenses.

Feedback

Round intermediate computations and final answer to the nearest dollar.

b. Assume that their adjusted gross income is $125,600, then they can claim $

as a tax credit for the higher education expenses.

Feedback

c. Assume the same facts as in part a, except that Kevin is a freshman and the twins are graduate students. Brendan and Theresa can claim $

4,500 V as a tax credit for the higher education expenses.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT