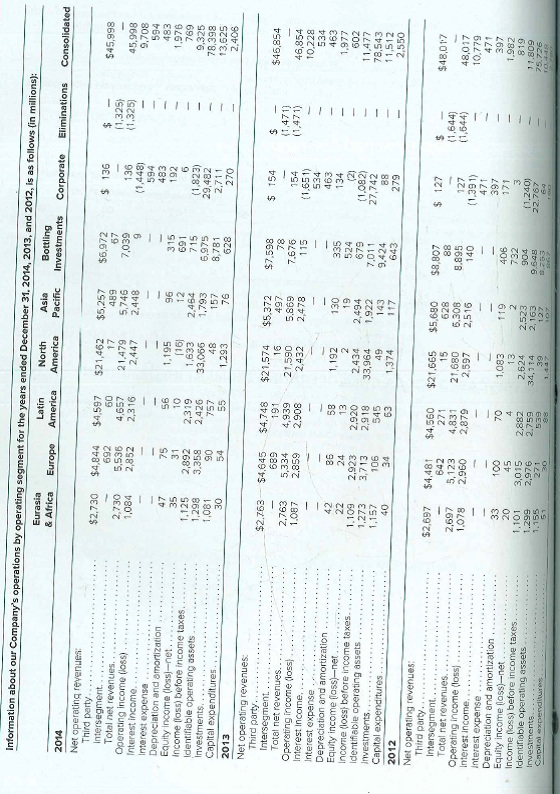

Information about our Company's operations by operating segment for the years ended December 31, 2014, 2013, and 2012, is as follows (in millions): Eurasia & Africa Latin America North Europe Asia Pacific Bottling Investments America Corporate Eliminations Consolidated 2014 Net operating revenues: Third perty. $2,730 $4,844 L6S'V$ $21,462 09 4,657 $5,257 $6,972 $ 136 769 5,536 2$ (1,325) uaubasiatu 866'StS Total net revenues. Operating income (loss) Interest income.. Interest expense.. Depreciation and omortization Equity income (loss)-net.. Income floss) before income taxes. Identifieble operating assets Investments... Capital expenditures 2,730 1,084 21,479 5,746 2,448 7,039 136 (1,325) 866'st 80L'6 2,852 2,316 2,447 (1,448) 6. 483 47 315 691 715 6,975 8,781 192 1,976 .......... 561'1 96 35 1.125 31 2,892 2,319 2,426 757 12 2,464 1,793 (1,823) 29,482 2,711 270 69L 9,325 EE9'I 862'I 1,081 33,066 8GE'E 13,625 86E'8L 06 1,293 628 2013 Net operating revenues: Aued puy zuaubasueu $2,763 $44,645 $4,748 $21,574 $5,372 $7.598 $154 $46,854 689 5,334 191 16 (1,471) (1,471) Total net revenues. Operating income (loss) Interest Income, Interest expense Depreciation and amortization Equity income loss)-net Income (loss) before income taxes. identifiable operating assets Investments. Capital expenditures..... 2012 4,939 698's 2,478 7,676 115 154 46,854 10,228 534 1.087 06S'I7 2,859 2,432 (1,651) 8067 534 463 42 89 13 1,192 98 335 134 1,977 22 24 2,923 3,713 2. 2,434 61 2,494 1,922 143 117 524 2,920 2,918 545 602 11,477 78,543 11,512 2,550 (1,082) 27,742 60L'I 1,273 1,157 33,964 629 90L 34 7,011 9,424 643 ..... 1,374 88 E9 Net operating revenues: Aued pa Total net revenues. Operating income (loss) $4,481 L69'2S 642 $4,560 271 4,831 $21,665 089'S$ 879 80E'9 LOB'8S 88 $ 127 $48,017 15 21,680 2,597 (1,644) (1,644) ........ 269'Z 5,123 127 48,017 10,779 471 1,078 S68'8 2,516 (LEE1) 471 ....... Interest Income. 096'Z Interest expense Depreciation and amortization Equity income (loss)-net Income (loss) before income taxes. Identifioble operating assets 33 001 45 1,083 26E 26E 286'! 618 608'1 611 732 1,101 3,015 2,882 2.759 2,624 2,523 (1,240) PO6 2,976 75.726 66Z'1 tiL'PE 1,155 6ES Capital experditures

The Coca-Cola Company is organized geographically and defines reportable operating segments as regions of the world. The following information was extracted from Note 19 Operating Segments in the Coca-Cola Company 2014 Annual Report:

Required

1. Calculate the following measures for each of Coca-Cola's operating segments (excluding Bottling Investments and Corporate):

Percentage of total net revenues, 2013 and 2014.

Percentage change in total net revenues, 2012 to 2013 and 2013 to 2014.

Operating income as a percentage of total net revenues (profit margin), 2013 and 2014.

2. Determine whether you believe Coca.Cola should attempt to expand its operations in a particular region of the world to increase operating revenues and operating income.

3. List any additional information you would like to have to conduct your analysis.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images