ining mounts Operating Lease Kulver's Inc. leases equipment from Equip Inc. on January 1, 2020, under a 3-year operating ease. Kulver's agrees to pay Equip Inc. $27,000 annually with the first payment due on Janua 1, 2020. As an incentive for Kulver's to sign the lease by January 1, Equip Inc. paid Kulver's Inc $1,260. Kulver's also incurred legal fees for the review of the lease agreement ($360) and salaries for employees involved in negotiating the lease ($2,340). Assuming an incremental borrowing rate of 7% for Kulver's Inc., determine the value of the lease liability and the right-

ining mounts Operating Lease Kulver's Inc. leases equipment from Equip Inc. on January 1, 2020, under a 3-year operating ease. Kulver's agrees to pay Equip Inc. $27,000 annually with the first payment due on Janua 1, 2020. As an incentive for Kulver's to sign the lease by January 1, Equip Inc. paid Kulver's Inc $1,260. Kulver's also incurred legal fees for the review of the lease agreement ($360) and salaries for employees involved in negotiating the lease ($2,340). Assuming an incremental borrowing rate of 7% for Kulver's Inc., determine the value of the lease liability and the right-

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 3E: Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides...

Related questions

Question

Subject - account

Please help me.

Thankyou.

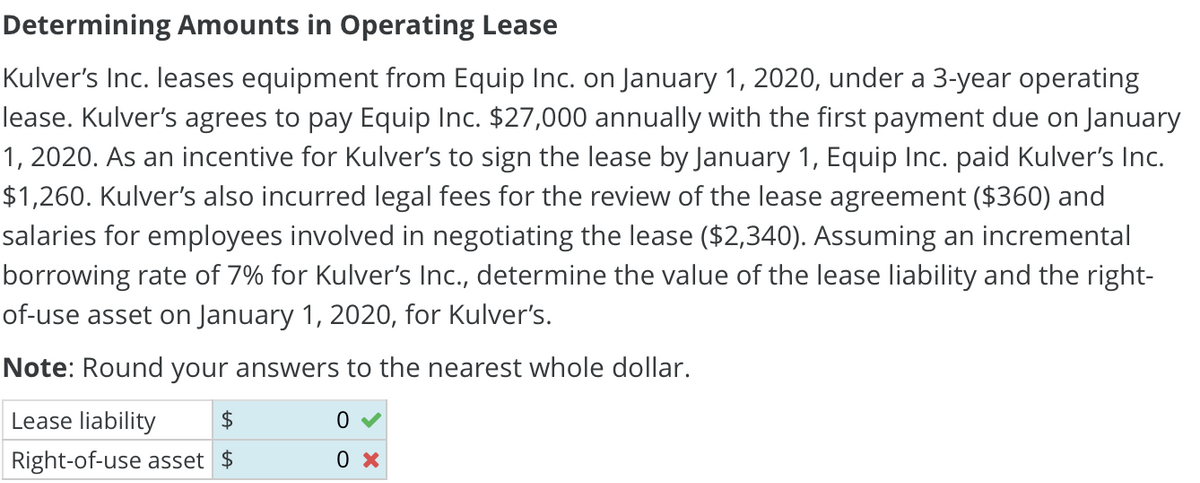

Transcribed Image Text:Determining Amounts in Operating Lease

Kulver's Inc. leases equipment from Equip Inc. on January 1, 2020, under a 3-year operating

lease. Kulver's agrees to pay Equip Inc. $27,000 annually with the first payment due on January

1, 2020. As an incentive for Kulver's to sign the lease by January 1, Equip Inc. paid Kulver's Inc.

$1,260. Kulver's also incurred legal fees for the review of the lease agreement ($360) and

salaries for employees involved in negotiating the lease ($2,340). Assuming an incremental

borrowing rate of 7% for Kulver's Inc., determine the value of the lease liability and the right-

of-use asset on January 1, 2020, for Kulver's.

Note: Round your answers to the nearest whole dollar.

Lease liability

$

Right-of-use asset $

0

0 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning