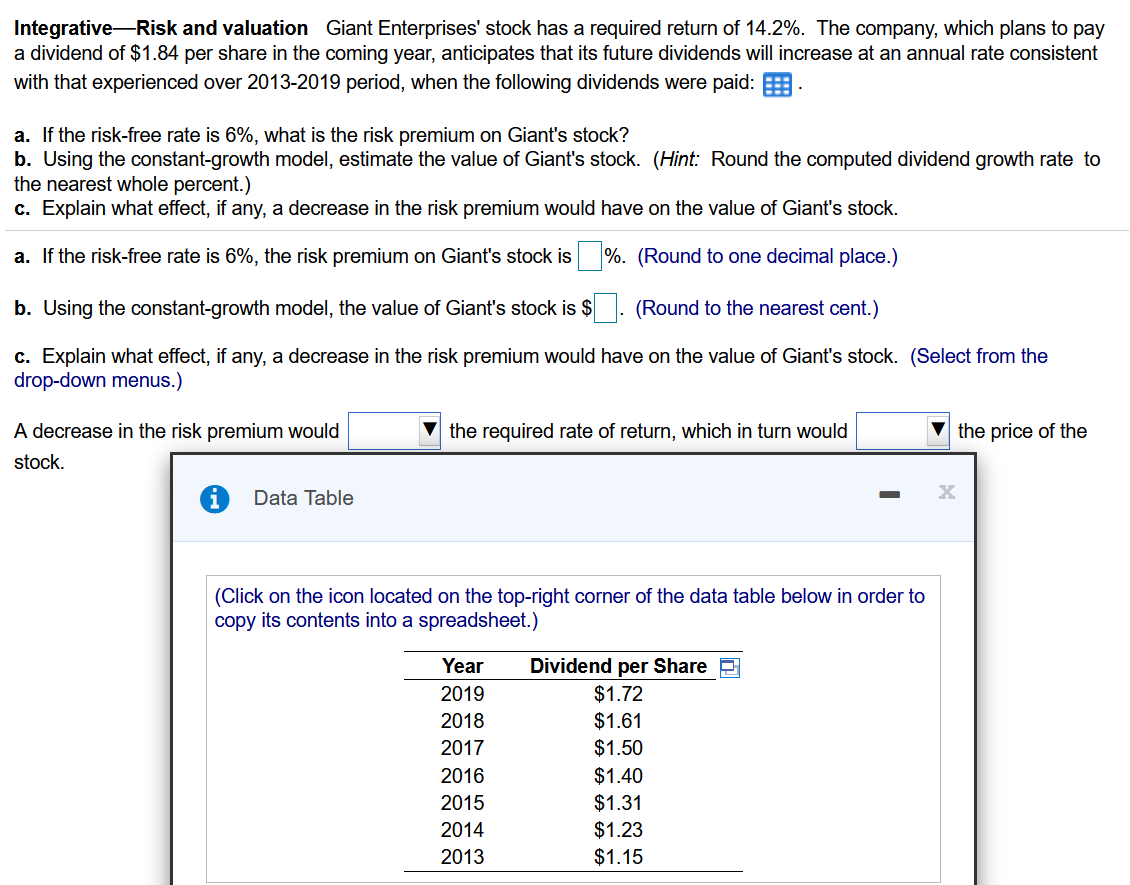

Integrative-Risk and valuation Giant Enterprises' stock has a required return of 14.2%. The company, which plans to pay a dividend of $1.84 per share in the coming year, anticipates that its future dividends will increase at an annual rate consistent with that experienced over 2013-2019 period, when the following dividends were paid: E. a. If the risk-free rate is 6%, what is the risk premium on Giant's stock? b. Using the constant-growth model, estimate the value of Giant's stock. (Hint: Round the computed dividend growth rate to the nearest whole percent.) c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock. a. If the risk-free rate is 6%, the risk premium on Giant's stock is %. (Round to one decimal place.) b. Using the constant-growth model, the value of Giant's stock is $. (Round to the nearest cent.) c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock. (Select from the drop-down menus.) A decrease in the risk premium would the required rate of return, which in turn would the price of the stock. Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Year Dividend per Share P 2019 $1.72 $1.61 $1.50 2018 2017 $1.40 $1.31 $1.23 $1.15 2016 2015 2014 2013

Integrative-Risk and valuation Giant Enterprises' stock has a required return of 14.2%. The company, which plans to pay a dividend of $1.84 per share in the coming year, anticipates that its future dividends will increase at an annual rate consistent with that experienced over 2013-2019 period, when the following dividends were paid: E. a. If the risk-free rate is 6%, what is the risk premium on Giant's stock? b. Using the constant-growth model, estimate the value of Giant's stock. (Hint: Round the computed dividend growth rate to the nearest whole percent.) c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock. a. If the risk-free rate is 6%, the risk premium on Giant's stock is %. (Round to one decimal place.) b. Using the constant-growth model, the value of Giant's stock is $. (Round to the nearest cent.) c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock. (Select from the drop-down menus.) A decrease in the risk premium would the required rate of return, which in turn would the price of the stock. Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Year Dividend per Share P 2019 $1.72 $1.61 $1.50 2018 2017 $1.40 $1.31 $1.23 $1.15 2016 2015 2014 2013

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 23P

Related questions

Question

Transcribed Image Text:Integrative-Risk and valuation Giant Enterprises' stock has a required return of 14.2%. The company, which plans to pay

a dividend of $1.84 per share in the coming year, anticipates that its future dividends will increase at an annual rate consistent

with that experienced over 2013-2019 period, when the following dividends were paid: E-

a. If the risk-free rate is 6%, what is the risk premium on Giant's stock?

b. Using the constant-growth model, estimate the value of Giant's stock. (Hint: Round the computed dividend growth rate to

the nearest whole percent.)

c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock.

a. If the risk-free rate is 6%, the risk premium on Giant's stock is

%. (Round to one decimal place.)

b. Using the constant-growth model, the value of Giant's stock is $

(Round to the nearest cent.)

c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock. (Select from the

drop-down menus.)

A decrease in the risk premium would

V the required rate of return, which in turn would

the price of the

stock.

Data Table

(Click on the icon located on the top-right corner of the data table below in order to

copy its contents into a spreadsheet.)

Year

Dividend per Share E

2019

$1.72

2018

$1.61

$1.50

2017

$1.40

$1.31

$1.23

$1.15

2016

2015

2014

2013

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning