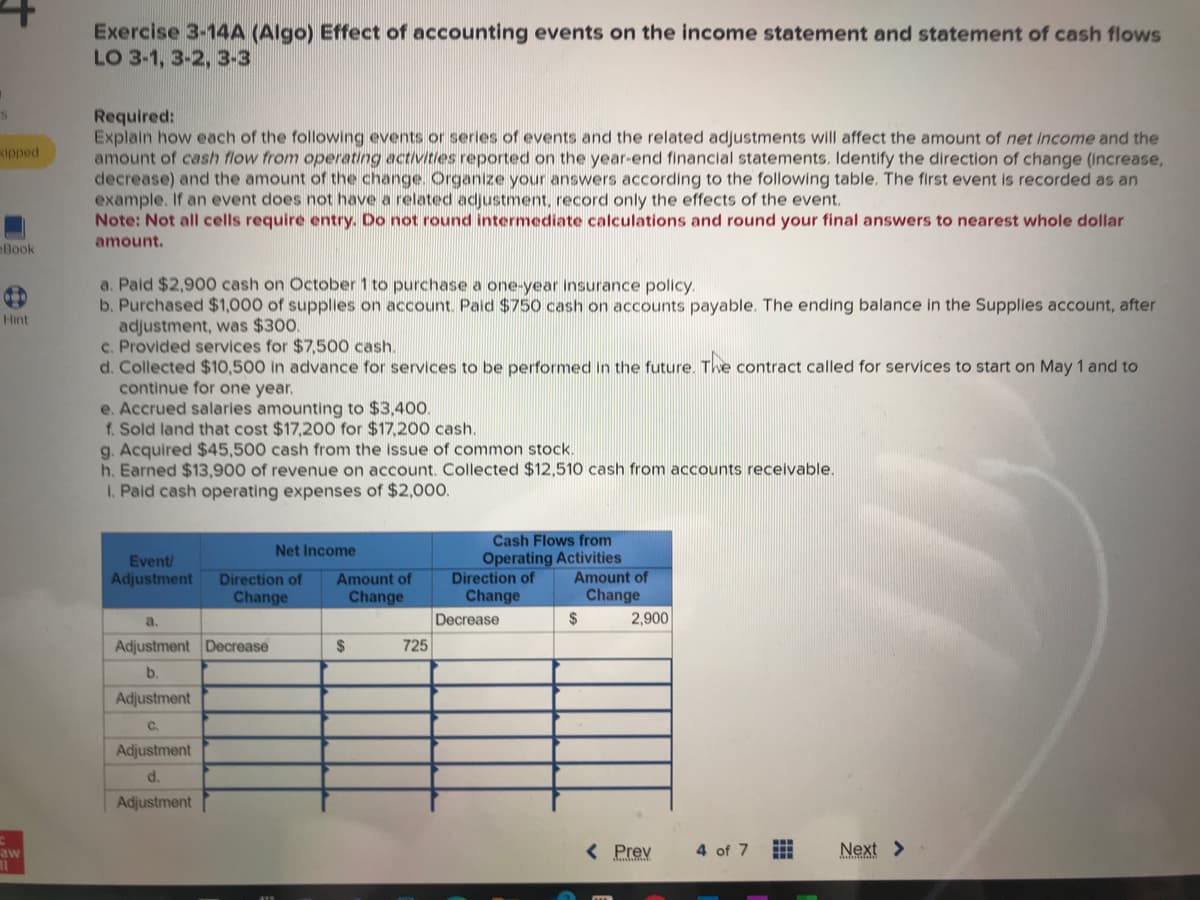

ipped Book Hint w Exercise 3-14A (Algo) Effect of accounting events on the income statement and statement of cash flows LO 3-1, 3-2, 3-3 Required: Explain how each of the following events or series of events and the related adjustments will affect the amount of net income and the amount of cash flow from operating activities reported on the year-end financial statements. Identify the direction of change (increase, decrease) and the amount of the change. Organize your answers according to the following table. The first event is recorded as an example. If an event does not have a related adjustment, record only the effects of the event. Note: Not all cells require entry. Do not round intermediate calculations and round your final answers to nearest whole dollar amount. a. Paid $2,900 cash on October 1 to purchase a one-year insurance policy. b. Purchased $1,000 of supplies on account. Paid $750 cash on accounts payable. The ending balance in the Supplies account, after adjustment, was $300. c. Provided services for $7,500 cash. d. Collected $10,500 in advance for services to be performed in the future. The contract called for services to start on May 1 and to continue for one year. e. Accrued salaries amounting to $3,400. f. Sold land that cost $17,200 for $17,200 cash. g. Acquired $45,500 cash from the issue of common stock. h. Earned $13,900 of revenue on account. Collected $12,510 cash from accounts receivable. 1. Paid cash operating expenses of $2,000. Event/ Adjustment Net Income Direction of Change a. Adjustment Decrease b. Adjustment C. Adjustment d. Adjustment Amount of Change $ 725 Cash Flows from Operating Activities Direction of Change Decrease Amount of Change $ 2,900 < Prev 4 of 7 Next >

ipped Book Hint w Exercise 3-14A (Algo) Effect of accounting events on the income statement and statement of cash flows LO 3-1, 3-2, 3-3 Required: Explain how each of the following events or series of events and the related adjustments will affect the amount of net income and the amount of cash flow from operating activities reported on the year-end financial statements. Identify the direction of change (increase, decrease) and the amount of the change. Organize your answers according to the following table. The first event is recorded as an example. If an event does not have a related adjustment, record only the effects of the event. Note: Not all cells require entry. Do not round intermediate calculations and round your final answers to nearest whole dollar amount. a. Paid $2,900 cash on October 1 to purchase a one-year insurance policy. b. Purchased $1,000 of supplies on account. Paid $750 cash on accounts payable. The ending balance in the Supplies account, after adjustment, was $300. c. Provided services for $7,500 cash. d. Collected $10,500 in advance for services to be performed in the future. The contract called for services to start on May 1 and to continue for one year. e. Accrued salaries amounting to $3,400. f. Sold land that cost $17,200 for $17,200 cash. g. Acquired $45,500 cash from the issue of common stock. h. Earned $13,900 of revenue on account. Collected $12,510 cash from accounts receivable. 1. Paid cash operating expenses of $2,000. Event/ Adjustment Net Income Direction of Change a. Adjustment Decrease b. Adjustment C. Adjustment d. Adjustment Amount of Change $ 725 Cash Flows from Operating Activities Direction of Change Decrease Amount of Change $ 2,900 < Prev 4 of 7 Next >

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 4E

Related questions

Question

Transcribed Image Text:S

sipped

Book

Hint

aw

11

Exercise 3-14A (Algo) Effect of accounting events on the income statement and statement of cash flows

LO 3-1, 3-2, 3-3

Required:

Explain how each of the following events or series of events and the related adjustments will affect the amount of net income and the

amount of cash flow from operating activities reported on the year-end financial statements. Identify the direction of change (increase,

decrease) and the amount of the change. Organize your answers according to the following table. The first event is recorded as an

example. If an event does not have a related adjustment, record only the effects of the event.

Note: Not all cells require entry. Do not round intermediate calculations and round your final answers to nearest whole dollar

amount.

a. Paid $2,900 cash on October 1 to purchase a one-year insurance policy.

b. Purchased $1,000 of supplies on account. Paid $750 cash on accounts payable. The ending balance in the Supplies account, after

adjustment, was $300.

c. Provided services for $7,500 cash.

d. Collected $10,500 in advance for services to be performed in the future. The contract called for services to start on May 1 and to

continue for one year.

e. Accrued salaries amounting to $3,400.

f. Sold land that cost $17,200 for $17,200 cash.

g. Acquired $45,500 cash from the issue of common stock.

h. Earned $13,900 of revenue on account. Collected $12,510 cash from accounts receivable.

1. Paid cash operating expenses of $2,000.

Event/

Adjustment

Net Income

Direction of

Change

a.

Adjustment Decrease

b.

Adjustment

C.

Adjustment

d.

Adjustment

Amount of

Change

$

725

Cash Flows from

Operating Activities

Direction of Amount of

Change

Change

Decrease

$

2,900

< Prev

4 of 7

Next >

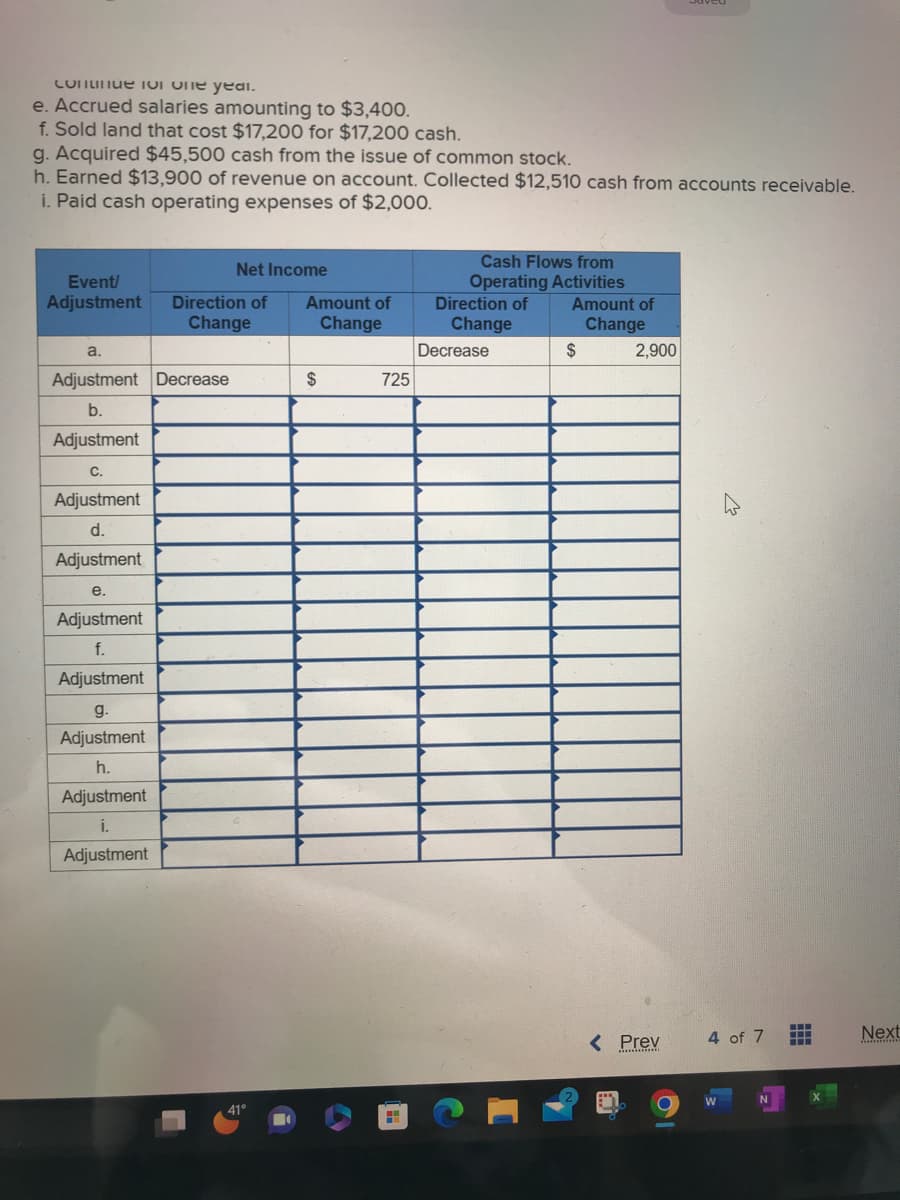

Transcribed Image Text:Continue to one year.

e. Accrued salaries amounting to $3,400.

f. Sold land that cost $17,200 for $17,200 cash.

g. Acquired $45,500 cash from the issue of common stock.

h. Earned $13,900 of revenue on account. Collected $12,510 cash from accounts receivable.

i. Paid cash operating expenses of $2,000.

Event/

Adjustment

a.

Adjustment Decrease

b.

Adjustment

C.

Adjustment

d.

Adjustment

e.

Adjustment

f.

Adjustment

g.

Adjustment

h.

Net Income

Direction of Amount of

Change

Change

Adjustment

i.

Adjustment

41°

$

725

Hi

Cash Flows from

Operating Activities

Amount of

Change

Direction of

Change

Decrease

$

2,900

< Prev

O

4 of 7

‒‒‒

www

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning