Is par Calculate the return on investment, residual income, and economic value added for each of the three projects. (Enter negative amounts using either a negative sign preceding the number, e.g. -45 or parentheses, e.g. (45). Round Return on Investment answer to 2 decimal places, eg. 15.25 & all other answers to 0 decimal places, e.g. 15 or 15%.) Playground Pool Gym Return on 13 18 17 % Investment Residual 24 -380 24 960 24 460 Income Economic Value 2$ -475 1120 2$ 632.5 Added %24

Is par Calculate the return on investment, residual income, and economic value added for each of the three projects. (Enter negative amounts using either a negative sign preceding the number, e.g. -45 or parentheses, e.g. (45). Round Return on Investment answer to 2 decimal places, eg. 15.25 & all other answers to 0 decimal places, e.g. 15 or 15%.) Playground Pool Gym Return on 13 18 17 % Investment Residual 24 -380 24 960 24 460 Income Economic Value 2$ -475 1120 2$ 632.5 Added %24

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1P: Talbot Industries is considering launching a new product. The new manufacturing equipment will cost...

Related questions

Question

100%

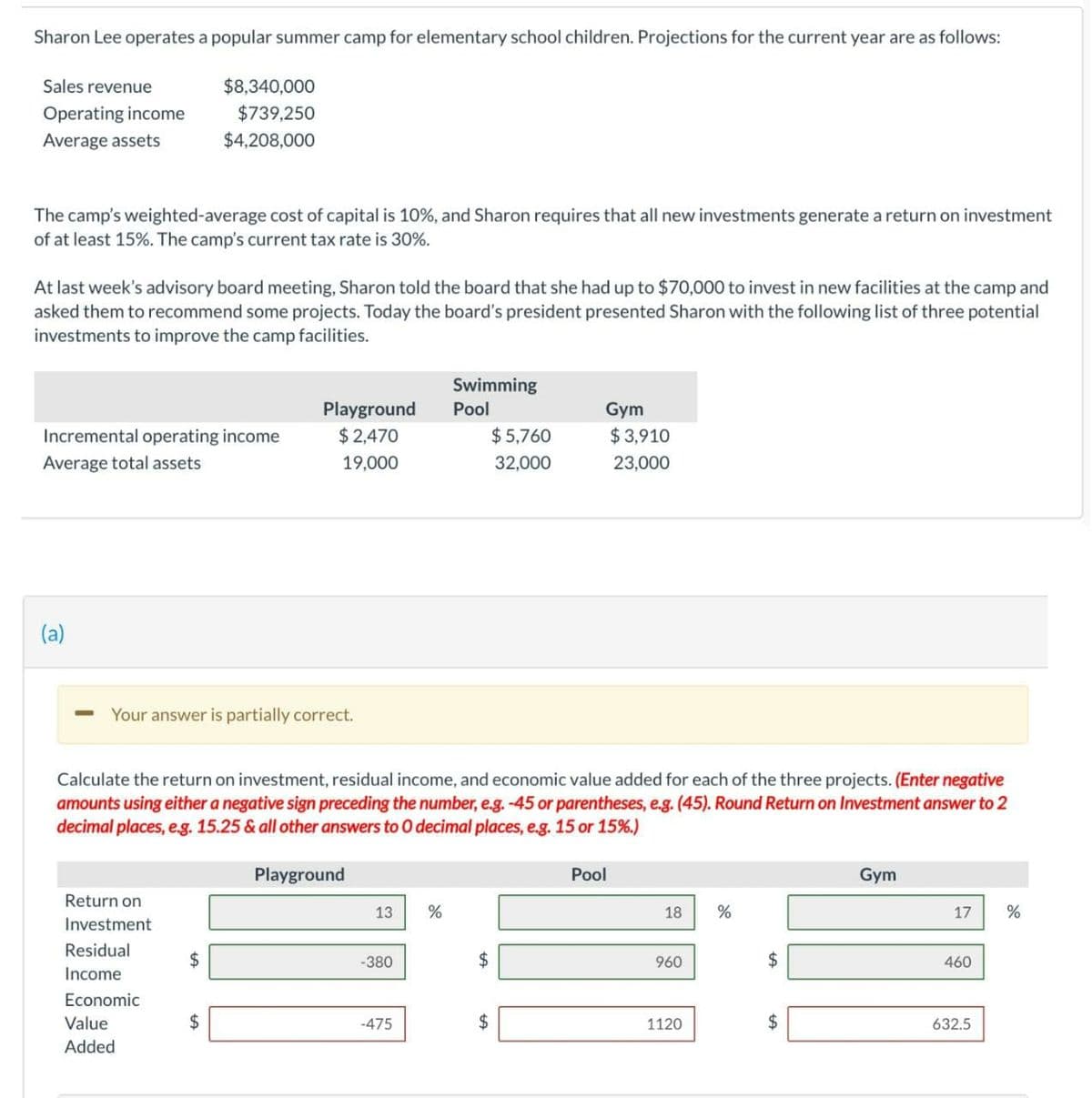

Transcribed Image Text:Sharon Lee operates a popular summer camp for elementary school children. Projections for the current year are as follows:

Sales revenue

$8,340,000

Operating income

Average assets

$739,250

$4,208,000

The camp's weighted-average cost of capital is 10%, and Sharon requires that all new investments generate a return on investment

of at least 15%. The camp's current tax rate is 30%.

At last week's advisory board meeting, Sharon told the board that she had up to $70,000 to invest in new facilities at the camp and

asked them to recommend some projects. Today the board's president presented Sharon with the following list of three potential

investments to improve the camp facilities.

Swimming

Playground

$ 2,470

Pool

Gym

$3,910

Incremental operating income

$5,760

Average total assets

19,000

32,000

23,000

(a)

Your answer is partially correct.

Calculate the return on investment, residual income, and economic value added for each of the three projects. (Enter negative

amounts using either a negative sign preceding the number, e.g. -45 or parentheses, e.g. (45). Round Return on Investment answer to 2

decimal places, e.g. 15.25 & all other answers to 0 decimal places, e.g. 15 or 15%.)

Playground

Pool

Gym

Return on

13

18

17

Investment

Residual

-380

960

2$

460

Income

Economic

Value

2$

-475

2$

1120

$

632.5

Added

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning