FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Following is information on two alternative investments being considered by Tiger Co. The company requires a 8%

| Project X1 | Project X2 | |||||||||

| Initial investment | $ | (128,000 | ) | $ | (216,000 | ) | ||||

| Expected net |

||||||||||

| Year 1 | 49,000 | 96,000 | ||||||||

| Year 2 | 59,500 | 86,000 | ||||||||

| Year 3 | 84,500 | 76,000 | ||||||||

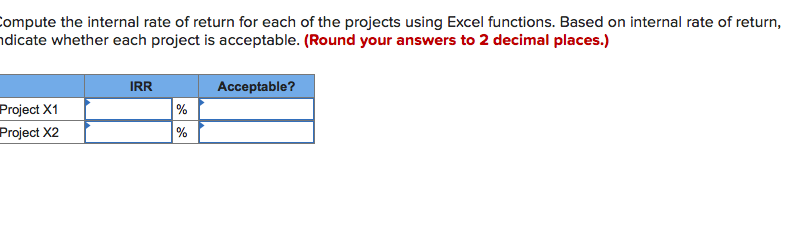

Transcribed Image Text:ompute the internal rate of return for each of the projects using Excel functions. Based on internal rate of return,

hdicate whether each project is acceptable. (Round your answers to 2 decimal places.)

Acceptable?

IRR

Project X1

Project X2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company is evaluating three possible investments. The following information is provided by the company: Project A Project B Project C Investment $238,000 $54,000 $238,000 Residual value 0 30,000 40,000 Net cash inflows: Year 1 70,000 30,000 100,000 Year 2 70,000 21,000 70,000 Year 3 70,000 17,000 80,000 Year 4 70,000 14,000 40,000 Year 5 70,000 0 0 What is the payback period for Project A? (Assume that the company uses the straight−line depreciation method.) (Round your answer to two decimal places.) A. 1.8 years B. 2.4 years C. 5.00 years D. 3.4 yearsarrow_forwardFirst United Bank Inc. is evaluating three capital investment projects using the net present value method. Relevant data related to the projects are summarized as follows: BranchOfficeExpansion ComputerSystemUpgrade ATMKioskExpansion Amount to be invested $686,053 $516,654 $295,458 Annual net cash flows: Year 1 411,000 288,000 177,000 Year 2 382,000 259,000 122,000 Year 3 349,000 230,000 89,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Required: 1. Assuming that the desired rate of return is 20%, prepare a net present value analysis for each project. Use the…arrow_forwardPls give me a correct answerarrow_forward

- Vishuarrow_forwardGarcia Company is considering a $380,000 investment with the following net cash flows. Garcia requires a 10% return on its investments. The net present value of this investment is: Annual Net Cash Present Value of $1 Flows at 10% Initial investment Year 1 Year 2 Year 3 Year 4 Year 5 Multiple Choice $190,413. $374,823. 3 $ 140,000 100, 000 160, 000 270,000 90,000 1.0000 0.9091 0.8264 0.7513 0.6830 0.6209arrow_forwardSubject :arrow_forward

- man.9arrow_forwardPlease Need Correct Answer with Explanation with calculationarrow_forward1 Park Company is considering an investment of $28,500 that provides net cash flows of $10,800 annually for four years. What is the investment's payback period? Answer is complete but not entirely correct. 1.04 points Numerator: Annual net cash flow Payback Period Denominator: Annual net cash flow Payback Period Payback period 25,000 $ 14,400x 1.74 years PYWY Next >> Swimmingarrow_forward

- Please give answer a & b And Don't give answer in image formatarrow_forwardQ1/ Ipswich Corporation is considering an investment opportunity with the expected net cash inflows of $300,000 for four years. The residual value of the investment , at the end of four years, would be $70,000. The company uses a discount rate of 14\% and the initial investment is $290,000. Calculate the NPV of the investment.arrow_forwardAnnual cash inflows from two competing investment opportunities are given below. Each investment opportunity will require the same initial investment, $50,000. The firm´s required rate of return on investments is 10%. YEAR INVESTMENT A INVESTMENT B 1 $10,000 $ 18,000 2 15,000 10,000 3 20,000 32,000 4 35,000 20,000 Total Cash Inflows $80,000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education