is the estimated annual profit for a mine producing 21,000 tons per year (which is at 100% capacity) when zinc sells for $1.00 per pound? There are variable costs of $19.74 million at 100% capacity and fixed costs of $16 million per year. duction is only 17,000 tons per year, will the mine be profitable? stimated annual profit is $ 6260000 (Round to the nearest dollar.) e mine be profitable at 17,000 tons per year? Choose the correct answer below. s C

is the estimated annual profit for a mine producing 21,000 tons per year (which is at 100% capacity) when zinc sells for $1.00 per pound? There are variable costs of $19.74 million at 100% capacity and fixed costs of $16 million per year. duction is only 17,000 tons per year, will the mine be profitable? stimated annual profit is $ 6260000 (Round to the nearest dollar.) e mine be profitable at 17,000 tons per year? Choose the correct answer below. s C

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter8: Cost Analysis

Section: Chapter Questions

Problem 5E

Related questions

Question

Please explain each process and show your work

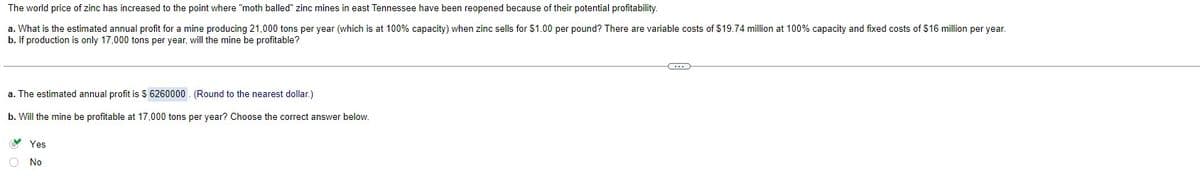

Transcribed Image Text:The world price of zinc has increased to the point where "moth balled" zinc mines in east Tennessee have been reopened because of their potential profitability.

a. What is the estimated annual profit for a mine producing 21,000 tons per year (which is at 100% capacity) when zinc sells for $1.00 per pound? There are variable costs of $19.74 million at 100% capacity and fixed costs of $16 million per year.

b. If production is only 17,000 tons per year, will the mine be profitable?

a. The estimated annual profit is $ 6260000. (Round to the nearest dollar.)

b. Will the mine be profitable at 17,000 tons per year? Choose the correct answer below.

O

Yes

No

G

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning