(i)Statement of Profit or Loss (classify expenses by function) for the year ended 31 December 2020.

(i)Statement of Profit or Loss (classify expenses by function) for the year ended 31 December 2020.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.4C

Related questions

Question

(i)Statement of Profit or Loss (classify expenses by function) for the year ended

31 December 2020.

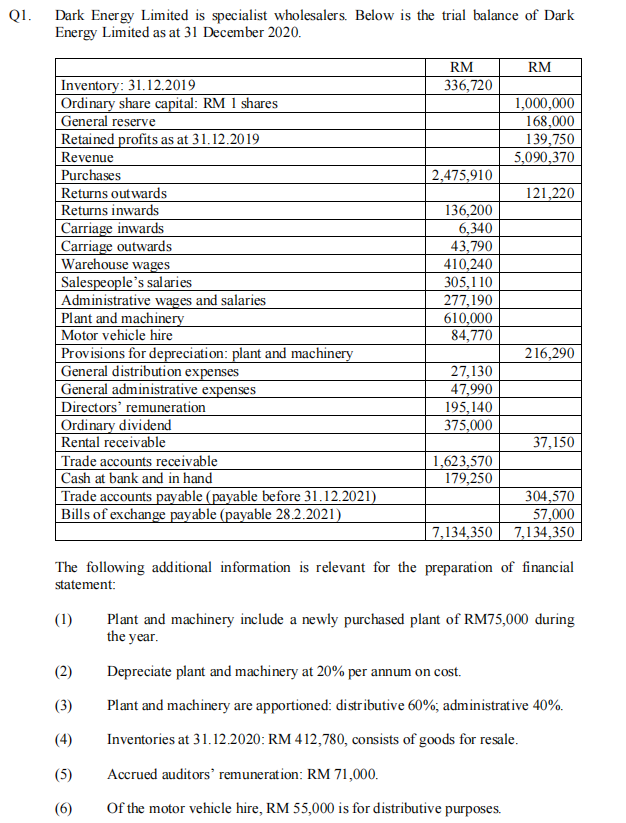

Transcribed Image Text:Dark Energy Limited is specialist wholesalers. Below is the trial balance of Dark

Energy Limited as at 31 December 2020.

QI.

RM

RM

Inventory: 31.12.2019

Ordinary share capital: RM 1 shares

General reserve

Retained profits as at 31.12.2019

Revenue

Purchases

Returns out wards

Returns inwards

Carriage inwards

|Carriage outwards

Warehouse wages

Salespeople's salaries

Administrative wages and salaries

Plant and machinery

Motor vehicle hire

Provisions for depreciation: plant and machinery

General distribution expenses

General administrative expenses

Directors' remuneration

Ordinary dividend

|Rental receivable

Trade accounts receivable

Cash at bank and in hand

Trade accounts payable (payable before 31.12.2021)

Bills of exchange payable (payable 28.2.2021)

336,720

1,000,000

168,000

139,750

5,090,370

2,475,910

121,220

136,200

6,340

43,790

410,240

305,1 10

277,190

610,000

84,770

216,290

27,130

47,990

195,140

375,000

37,150

1,623,570

179,250

304,570

57,000

7,134,350

7,134,350

The following additional information is relevant for the preparation of financial

statement:

Plant and machinery include a newly purchased plant of RM75,000 during

the year.

(1)

(2)

Depreciate plant and machinery at 20% per annum on cost.

(3)

Plant and machinery are apportioned: distributive 60%; administrative 40%.

(4)

Inventories at 31.12.2020: RM 412,780, consists of goods for resale.

(5)

Accrued auditors' remuneration: RM 71,000.

(6)

Of the motor vehicle hire, RM 55,000 is for distributive purposes.

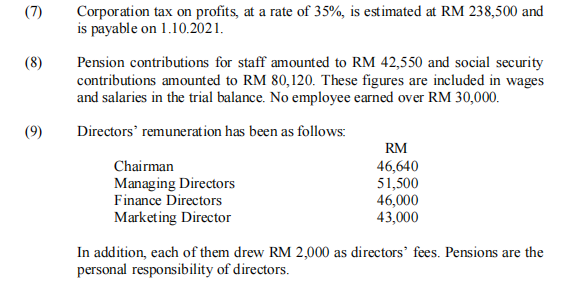

Transcribed Image Text:Corporation tax on profits, at a rate of 35%, is estimated at RM 238,500 and

is payable on 1.10.2021.

(7)

Pension contributions for staff amounted to RM 42,550 and social security

contributions amounted to RM 80,120. These figures are included in wages

and salaries in the trial balance. No employee earned over RM 30,000.

(8)

(9)

Directors' remuneration has been as follows:

RM

Chairman

Managing Directors

Finance Directors

Marketing Director

46,640

51,500

46,000

43,000

In addition, each of them drew RM 2,000 as directors' fees. Pensions are the

personal responsibility of directors.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning