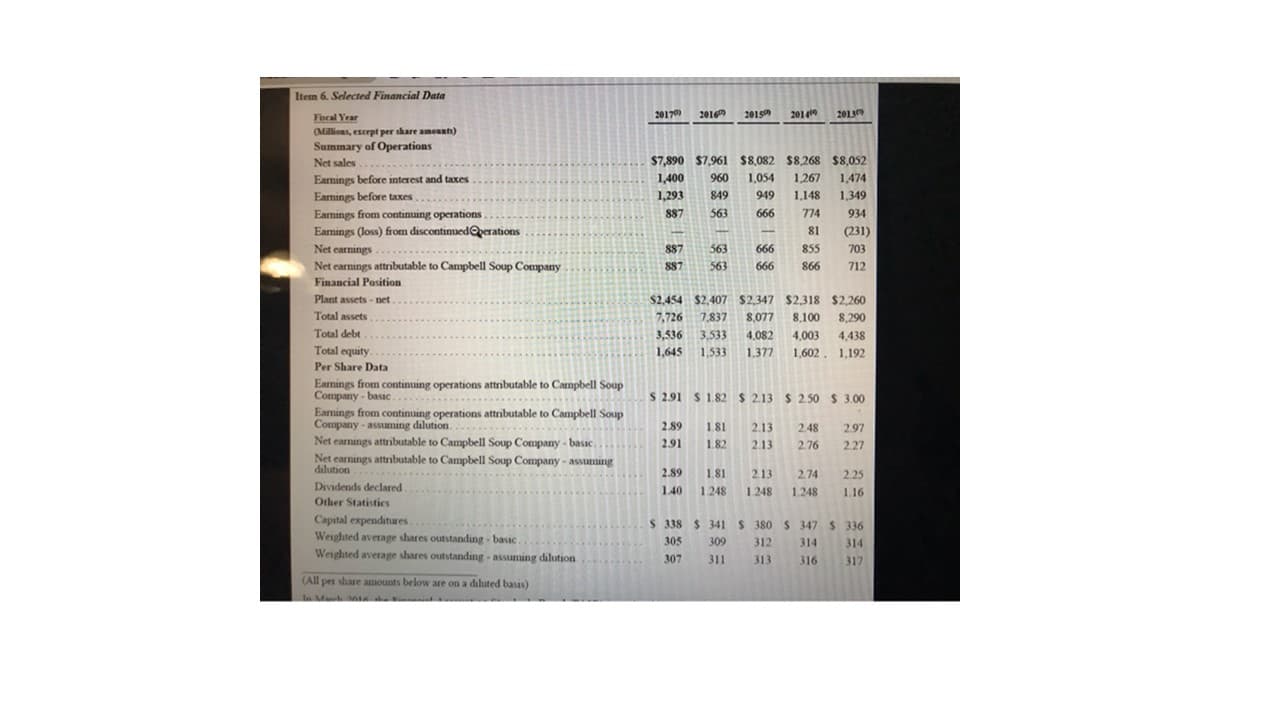

Item 6. Selected Financial Data 20170 2013 Foral Year (Millions, except per share amounts) Summary of Operations 2016 201S 20149 $7,890 $7,961 $8,082 $8.268 $8,052 1,054 Net sales Eamings before interest and taxes Eamings before taxes... 1,400 960 1,267 1,474 1,293 849 949 1,148 1,349 Earmings from continuing operations 887 563 666 774 934 Eamings (loss) from discontinuedQerations 81 (231) Net carnings.. . Net earnings attrnbutable to Campbell Soup Company 887 563 666 855 703 887 563 666 866 712 Financial Position Plant assets - net $2,454 $2,407 $2,347 $2,318 $2,260 Total assets 7,726 7,837 8,077 8,100 8,290 Total debt 3,536 3,533 4,082 4,003 4,438 Total equity. 1,645 1,533 1,377 1,602. 1,192 Per Share Data Eamings from continuing operations attnibutable to Campbell Soup Company - basic. Eamings from continuing operations attributable to Campbell Soup Company - assuming dilution. Net earnings attrbutable to Campbell Soup Company - basic c... . S 2.91 S 1.82 $ 2.13 $ 2.50 $ 3.00 2.89 1.81 2.13 2.48 2.97 2.91 1.82 2.13 2.76 2.27 decarnings attributable to Campbell Soup Company - assuming 2.89 1.81 2.13 2.74 2.25 Dividends declared 1.40 1248 1 248 1.248 1.16 Other Statistics Capital expenditures. Weighted average shares outstanding - basic, Weighted average shares outstanding - assuming dilution S 338 $ 341 $ 380 S 347 $ 336 305 309 312 314 314 307 311 313 316 317 (All per share amounts below are on a diluted basis) In Ma 0014t In Apnl 2015, the FASB Issued guidance that requires debt issuance costs to be presented in the balance sheet as a reduction from the carnying value of the associated debt liability, cosistent with the presentation of a debt discount We adopted the guidance in 2016 and retrospectively adjusted all prior periods. In November 2015, the FASB issued guidance that requires deferred tax liabilities and assets to be classified as noncurrent in the balance sheet We adopted the guidance in 2016 on a prospective basis and modified the presentation of deferred taxes in the Consolidated Balance Sheet as of July 31, 2016. The 2014 fiscal year consisted of 53 weeks All other periods had 52 weeks O The 2017 earmings from continuing operations attributable to Campbell Soup Company were impacted by the following a restructuring charge, related costs and administrative expenses of $37 million ($. 12 per share) associated with restructuring and cost savings initiatives; gains of S$116 million ($ 38 per share) associated with mark-to-market adjustments for defined benefit pension and postretirement plans; impairment charges of $180 million ($.59 per share) related to the intangable assets of the Bolthouse Farms carrot and carrot ingredients reporting unit and the Garden Fresh Gourmet reporting unit; and a tax benefit and reduction to interest expense of $56 million ($.18 per share) primanily associated with the sale of intercompany notes receivable to a financial institution. * The 2016 earnings from continuing operations attributable to Campbell Soup Company were impacted by the following a restructuring charge and administrative expenses of $49 million ($.16 per share) associated with restructuring and cost savings initiatives, losses of $200 million ($.64 per share) associated with mark-to-market adjustments for defined benefit pension and postretirement plans; a gain of $25 million ($.08 per share) associated with a settlement of a claim related to the Kelsen acquisition, and an impairment charge of$127 million (S.41 per share) related to the intangible assets of the Bolthouse Farms carrot and carrot ingredients reporting unit. The 2015 earnings from continuing operations attributable to Campbell Soup Company were impacted by the following a restructuring charge and administrative expenses of $78 million (S.25 per share) associated with restructuring and cost savings initiatives and losses of $87 million ($.28 per share) associated with mark-to-market adjustments for defined benefit pension and postretirement plans. * The 2014 eamings from continuing operations attributable to Canpbell Soup Company were impacted by the following a restructuring charge and related costs of $36 million (S.11 per share) associated with restructuring initiatives; losses of $19 million (S.06 per share) associated with mark-to-market adjustments for defined benefit pension and postretirement plans; a loss of $6 million ($.02 per share) on foreign exchange forward contracts used to hedge the proceeds from the sale of the European simple meals business, $7 million ($.02 per share) tax expense associated with the sale of the European simple meals business, and the estimated impact of the additional week of $25 million (S.08 per share). Eamings from discontinued operations included a gain of $72 million ($23 per share) on the sale of the European simple meals business. O The 2013 eamings from continuing operations attributable to Campbell Soup Conpany were impacted by the following a restructuring charge and related costs of $87 millhon (S.27 per share) associated with restructuring initiatives; gains of $183 million (S 58 per share) associated with mark-to-market adjustments for defined benefit pension and postretirement plans. and $7 million (S.02 per share) of transaction costs related to the acquisition of Bolthouse Farms. Eamings from discontunued operations were impacted by an impairment charge on the intangible assets of the simple meals business in Europe of $263 mullion ($ 83 per share) and tax expense of $18 million ($ 06 per share) representing taxes on the difference between the book

Item 6. Selected Financial Data 20170 2013 Foral Year (Millions, except per share amounts) Summary of Operations 2016 201S 20149 $7,890 $7,961 $8,082 $8.268 $8,052 1,054 Net sales Eamings before interest and taxes Eamings before taxes... 1,400 960 1,267 1,474 1,293 849 949 1,148 1,349 Earmings from continuing operations 887 563 666 774 934 Eamings (loss) from discontinuedQerations 81 (231) Net carnings.. . Net earnings attrnbutable to Campbell Soup Company 887 563 666 855 703 887 563 666 866 712 Financial Position Plant assets - net $2,454 $2,407 $2,347 $2,318 $2,260 Total assets 7,726 7,837 8,077 8,100 8,290 Total debt 3,536 3,533 4,082 4,003 4,438 Total equity. 1,645 1,533 1,377 1,602. 1,192 Per Share Data Eamings from continuing operations attnibutable to Campbell Soup Company - basic. Eamings from continuing operations attributable to Campbell Soup Company - assuming dilution. Net earnings attrbutable to Campbell Soup Company - basic c... . S 2.91 S 1.82 $ 2.13 $ 2.50 $ 3.00 2.89 1.81 2.13 2.48 2.97 2.91 1.82 2.13 2.76 2.27 decarnings attributable to Campbell Soup Company - assuming 2.89 1.81 2.13 2.74 2.25 Dividends declared 1.40 1248 1 248 1.248 1.16 Other Statistics Capital expenditures. Weighted average shares outstanding - basic, Weighted average shares outstanding - assuming dilution S 338 $ 341 $ 380 S 347 $ 336 305 309 312 314 314 307 311 313 316 317 (All per share amounts below are on a diluted basis) In Ma 0014t In Apnl 2015, the FASB Issued guidance that requires debt issuance costs to be presented in the balance sheet as a reduction from the carnying value of the associated debt liability, cosistent with the presentation of a debt discount We adopted the guidance in 2016 and retrospectively adjusted all prior periods. In November 2015, the FASB issued guidance that requires deferred tax liabilities and assets to be classified as noncurrent in the balance sheet We adopted the guidance in 2016 on a prospective basis and modified the presentation of deferred taxes in the Consolidated Balance Sheet as of July 31, 2016. The 2014 fiscal year consisted of 53 weeks All other periods had 52 weeks O The 2017 earmings from continuing operations attributable to Campbell Soup Company were impacted by the following a restructuring charge, related costs and administrative expenses of $37 million ($. 12 per share) associated with restructuring and cost savings initiatives; gains of S$116 million ($ 38 per share) associated with mark-to-market adjustments for defined benefit pension and postretirement plans; impairment charges of $180 million ($.59 per share) related to the intangable assets of the Bolthouse Farms carrot and carrot ingredients reporting unit and the Garden Fresh Gourmet reporting unit; and a tax benefit and reduction to interest expense of $56 million ($.18 per share) primanily associated with the sale of intercompany notes receivable to a financial institution. * The 2016 earnings from continuing operations attributable to Campbell Soup Company were impacted by the following a restructuring charge and administrative expenses of $49 million ($.16 per share) associated with restructuring and cost savings initiatives, losses of $200 million ($.64 per share) associated with mark-to-market adjustments for defined benefit pension and postretirement plans; a gain of $25 million ($.08 per share) associated with a settlement of a claim related to the Kelsen acquisition, and an impairment charge of$127 million (S.41 per share) related to the intangible assets of the Bolthouse Farms carrot and carrot ingredients reporting unit. The 2015 earnings from continuing operations attributable to Campbell Soup Company were impacted by the following a restructuring charge and administrative expenses of $78 million (S.25 per share) associated with restructuring and cost savings initiatives and losses of $87 million ($.28 per share) associated with mark-to-market adjustments for defined benefit pension and postretirement plans. * The 2014 eamings from continuing operations attributable to Canpbell Soup Company were impacted by the following a restructuring charge and related costs of $36 million (S.11 per share) associated with restructuring initiatives; losses of $19 million (S.06 per share) associated with mark-to-market adjustments for defined benefit pension and postretirement plans; a loss of $6 million ($.02 per share) on foreign exchange forward contracts used to hedge the proceeds from the sale of the European simple meals business, $7 million ($.02 per share) tax expense associated with the sale of the European simple meals business, and the estimated impact of the additional week of $25 million (S.08 per share). Eamings from discontinued operations included a gain of $72 million ($23 per share) on the sale of the European simple meals business. O The 2013 eamings from continuing operations attributable to Campbell Soup Conpany were impacted by the following a restructuring charge and related costs of $87 millhon (S.27 per share) associated with restructuring initiatives; gains of $183 million (S 58 per share) associated with mark-to-market adjustments for defined benefit pension and postretirement plans. and $7 million (S.02 per share) of transaction costs related to the acquisition of Bolthouse Farms. Eamings from discontunued operations were impacted by an impairment charge on the intangible assets of the simple meals business in Europe of $263 mullion ($ 83 per share) and tax expense of $18 million ($ 06 per share) representing taxes on the difference between the book

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.17P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

This problem is based on the 2017 annual report of Campbell Soup Company. Answer the following questions. Refer to the Selected Financial Data for parts (a) to (d).

Required:

- Find the net sales in 2014. (Enter your answer in millions.)

- Calculate the operating income (earnings before interest and taxes) in 2013. (Enter your answer in millions.)

- Calculate the difference between operating income (earnings before interest and taxes) and net income (net earnings) in 2015. (Enter your answer in millions.)

- Find the year(s) in which net income (net earnings) decreased compared to the previous year.

attatched are the charts needed for the following questions, I have tried to figure these out but I come up with incorrect answers. Thank You

Transcribed Image Text:Item 6. Selected Financial Data

20170

2013

Foral Year

(Millions, except per share amounts)

Summary of Operations

2016

201S

20149

$7,890 $7,961 $8,082 $8.268 $8,052

1,054

Net sales

Eamings before interest and taxes

Eamings before taxes...

1,400

960

1,267

1,474

1,293

849

949

1,148

1,349

Earmings from continuing operations

887

563

666

774

934

Eamings (loss) from discontinuedQerations

81

(231)

Net carnings.. .

Net earnings attrnbutable to Campbell Soup Company

887

563

666

855

703

887

563

666

866

712

Financial Position

Plant assets - net

$2,454 $2,407 $2,347 $2,318 $2,260

Total assets

7,726

7,837

8,077

8,100

8,290

Total debt

3,536

3,533

4,082

4,003

4,438

Total equity.

1,645

1,533

1,377

1,602. 1,192

Per Share Data

Eamings from continuing operations attnibutable to Campbell Soup

Company - basic.

Eamings from continuing operations attributable to Campbell Soup

Company - assuming dilution.

Net earnings attrbutable to Campbell Soup Company - basic

c... .

S 2.91 S 1.82 $ 2.13 $ 2.50 $ 3.00

2.89

1.81

2.13

2.48

2.97

2.91

1.82

2.13

2.76

2.27

decarnings attributable to Campbell Soup Company - assuming

2.89

1.81

2.13

2.74

2.25

Dividends declared

1.40

1248

1 248

1.248

1.16

Other Statistics

Capital expenditures.

Weighted average shares outstanding - basic,

Weighted average shares outstanding - assuming dilution

S 338 $ 341 $ 380 S 347 $ 336

305

309

312

314

314

307

311

313

316

317

(All per share amounts below are on a diluted basis)

In Ma 0014t

Transcribed Image Text:In Apnl 2015, the FASB Issued guidance that requires debt issuance costs to be presented in the balance sheet as a reduction from

the carnying value of the associated debt liability, cosistent with the presentation of a debt discount We adopted the guidance in

2016 and retrospectively adjusted all prior periods.

In November 2015, the FASB issued guidance that requires deferred tax liabilities and assets to be classified as noncurrent in the

balance sheet We adopted the guidance in 2016 on a prospective basis and modified the presentation of deferred taxes in the

Consolidated Balance Sheet as of July 31, 2016.

The 2014 fiscal year consisted of 53 weeks All other periods had 52 weeks

O The 2017 earmings from continuing operations attributable to Campbell Soup Company were impacted by the following a

restructuring charge, related costs and administrative expenses of $37 million ($. 12 per share) associated with restructuring

and cost savings initiatives; gains of S$116 million ($ 38 per share) associated with mark-to-market adjustments for defined

benefit pension and postretirement plans; impairment charges of $180 million ($.59 per share) related to the intangable assets

of the Bolthouse Farms carrot and carrot ingredients reporting unit and the Garden Fresh Gourmet reporting unit; and a tax

benefit and reduction to interest expense of $56 million ($.18 per share) primanily associated with the sale of intercompany

notes receivable to a financial institution.

* The 2016 earnings from continuing operations attributable to Campbell Soup Company were impacted by the following a

restructuring charge and administrative expenses of $49 million ($.16 per share) associated with restructuring and cost savings

initiatives, losses of $200 million ($.64 per share) associated with mark-to-market adjustments for defined benefit pension

and postretirement plans; a gain of $25 million ($.08 per share) associated with a settlement of a claim related to the Kelsen

acquisition, and an impairment charge of$127 million (S.41 per share) related to the intangible assets of the Bolthouse Farms

carrot and carrot ingredients reporting unit.

The 2015 earnings from continuing operations attributable to Campbell Soup Company were impacted by the following a

restructuring charge and administrative expenses of $78 million (S.25 per share) associated with restructuring and cost savings

initiatives and losses of $87 million ($.28 per share) associated with mark-to-market adjustments for defined benefit pension

and postretirement plans.

* The 2014 eamings from continuing operations attributable to Canpbell Soup Company were impacted by the following a

restructuring charge and related costs of $36 million (S.11 per share) associated with restructuring initiatives; losses of $19

million (S.06 per share) associated with mark-to-market adjustments for defined benefit pension and postretirement plans; a

loss of $6 million ($.02 per share) on foreign exchange forward contracts used to hedge the proceeds from the sale of the

European simple meals business, $7 million ($.02 per share) tax expense associated with the sale of the European simple

meals business, and the estimated impact of the additional week of $25 million (S.08 per share). Eamings from discontinued

operations included a gain of $72 million ($23 per share) on the sale of the European simple meals business.

O The 2013 eamings from continuing operations attributable to Campbell Soup Conpany were impacted by the following a

restructuring charge and related costs of $87 millhon (S.27 per share) associated with restructuring initiatives; gains of $183

million (S 58 per share) associated with mark-to-market adjustments for defined benefit pension and postretirement plans.

and $7 million (S.02 per share) of transaction costs related to the acquisition of Bolthouse Farms. Eamings from discontunued

operations were impacted by an impairment charge on the intangible assets of the simple meals business in Europe of $263

mullion ($ 83 per share) and tax expense of $18 million ($ 06 per share) representing taxes on the difference between the book

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning