ĮThe following information applies to the questions displayed below.J On January 1, Year 1, the general ledger of a company includes the following account balances: Debit $ 25,600 47,200 Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land Credit $ 4,700 20,500 51,000 17,500 Equipment Accumulated Depreciation Accounts Payable Notes Payable (6%, due April 1, Year 2) Common Stock Retained Earnings 2,000 29,000 55,000 40,000 31,100 $161,800 Totals $161,800 During January Year 1, the following transactions occur: January 2 Sold gift cards totaling $9,000. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $152,000. January 15 The comapany sales for the first half of the month total $140,000. All of these sales are on account. The cost of the units sold is $76,300. January 23 Receive $125,900 from customers on accounts receivable. January 25 Pay $95,000 to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $5,300. January 30 The comapany sales for the second half of the month total $148,000. Sales include $10,000 for cash and $138,000 on account. The cost of the units sold is $82,000. January 31 Pay cash for monthly salaries, $52,500.

ĮThe following information applies to the questions displayed below.J On January 1, Year 1, the general ledger of a company includes the following account balances: Debit $ 25,600 47,200 Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land Credit $ 4,700 20,500 51,000 17,500 Equipment Accumulated Depreciation Accounts Payable Notes Payable (6%, due April 1, Year 2) Common Stock Retained Earnings 2,000 29,000 55,000 40,000 31,100 $161,800 Totals $161,800 During January Year 1, the following transactions occur: January 2 Sold gift cards totaling $9,000. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $152,000. January 15 The comapany sales for the first half of the month total $140,000. All of these sales are on account. The cost of the units sold is $76,300. January 23 Receive $125,900 from customers on accounts receivable. January 25 Pay $95,000 to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $5,300. January 30 The comapany sales for the second half of the month total $148,000. Sales include $10,000 for cash and $138,000 on account. The cost of the units sold is $82,000. January 31 Pay cash for monthly salaries, $52,500.

Chapter7: Accounting Information Systems

Section: Chapter Questions

Problem 4EB: For each of the following transactions, state which special journal (Sales Journal, Cash Receipts...

Related questions

Question

![ĮThe following information applies to the questions displayed below.]

On January 1, Year 1, the general ledger of a company includes the following account balances:

Accounts

Debit

Credit

Cash

Accounts Receivable

Allowance for Uncollectible Accounts

$ 25,600

47,200

$ 4,700

Inventory

Land

20,500

51,000

17,500

Equipment

Accumulated Depreciation

Accounts Payable

Notes Payable (6%, due April 1, Year 2)

Common Stock

2,000

29,000

55,000

40,000

31,100

$161,800 $161,800

Retained Earnings

Totals

During January Year 1, the following transactions occur:

January 2 Sold gift cards totaling $9,000. The cards are redeemable for merchandise within one year of the

purchase date.

January 6 Purchase additional inventory on account, $152,000.

January 15 The comapany sales for the first half of the month total $140,000. All of these sales are on

account. The cost of the units sold is $76,300.

January 23 Receive $125,900 from customers on accounts receivable.

January 25 Pay $95,000 to inventory suppliers on accounts payable.

January 28 Write off accounts receivable as uncollectible, $5,300.

January 30 The comapany sales for the second half of the month total $148,000. Sales include $10,000 for cash

and $138,000 on account. The cost of the units sold is $82,000.

January 31 Pay cash for monthly salaries, $52,500.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fe0288c80-ea87-4509-a745-673b052c2a7e%2F106dd0f7-6b97-4c65-8104-146f24f58597%2Fgzackgx_processed.png&w=3840&q=75)

Transcribed Image Text:ĮThe following information applies to the questions displayed below.]

On January 1, Year 1, the general ledger of a company includes the following account balances:

Accounts

Debit

Credit

Cash

Accounts Receivable

Allowance for Uncollectible Accounts

$ 25,600

47,200

$ 4,700

Inventory

Land

20,500

51,000

17,500

Equipment

Accumulated Depreciation

Accounts Payable

Notes Payable (6%, due April 1, Year 2)

Common Stock

2,000

29,000

55,000

40,000

31,100

$161,800 $161,800

Retained Earnings

Totals

During January Year 1, the following transactions occur:

January 2 Sold gift cards totaling $9,000. The cards are redeemable for merchandise within one year of the

purchase date.

January 6 Purchase additional inventory on account, $152,000.

January 15 The comapany sales for the first half of the month total $140,000. All of these sales are on

account. The cost of the units sold is $76,300.

January 23 Receive $125,900 from customers on accounts receivable.

January 25 Pay $95,000 to inventory suppliers on accounts payable.

January 28 Write off accounts receivable as uncollectible, $5,300.

January 30 The comapany sales for the second half of the month total $148,000. Sales include $10,000 for cash

and $138,000 on account. The cost of the units sold is $82,000.

January 31 Pay cash for monthly salaries, $52,500.

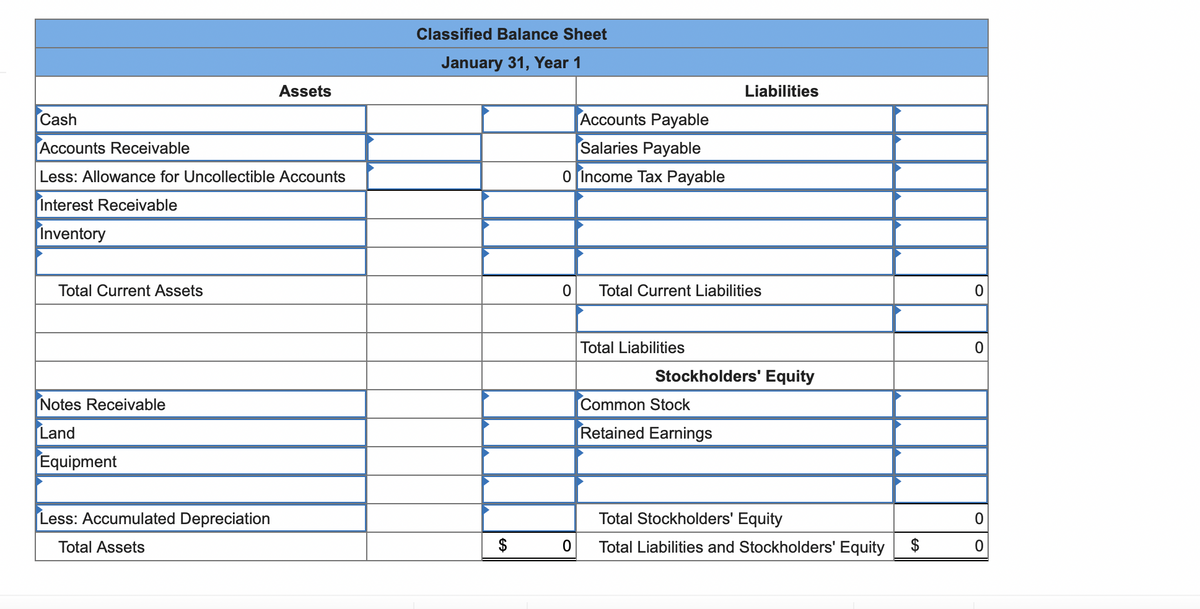

Transcribed Image Text:Classified Balance Sheet

January 31, Year 1

Assets

Liabilities

Cash

Accounts Payable

Accounts Receivable

Salaries Payable

Less: Allowance for Uncollectible Accounts

O Income Tax Payable

Interest Receivable

Inventory

Total Current Assets

Total Current Liabilities

Total Liabilities

Stockholders' Equity

Notes Receivable

Common Stock

Land

Retained Earnings

Equipment

Less: Accumulated Depreciation

Total Stockholders' Equity

Total Assets

$

Total Liabilities and Stockholders' Equity

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning