ition forms, and

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter9: Cost Accounting For Service Businesses, The Balanced Scorecard, And Quality Costs

Section: Chapter Questions

Problem 8P

Related questions

Question

Prepare time sheets, material requisition forms, and a cost sheet

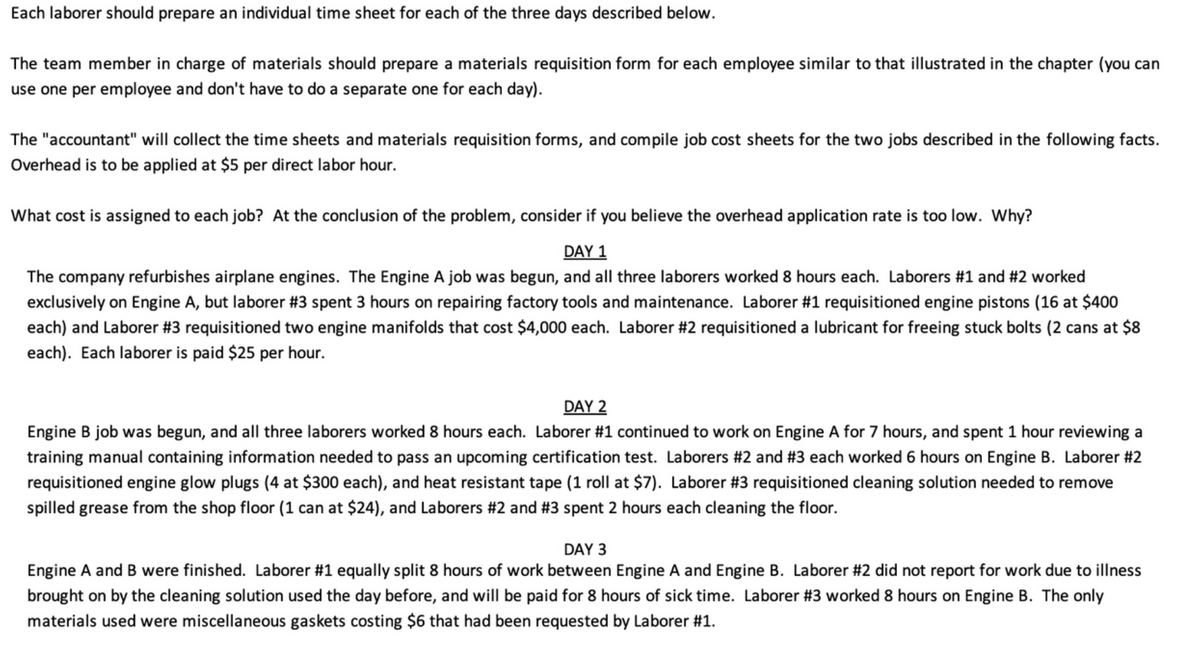

Transcribed Image Text:Each laborer should prepare an individual time sheet for each of the three days described below.

The team member in charge of materials should prepare a materials requisition form for each employee similar to that illustrated in the chapter (you can

use one per employee and don't have to do a separate one for each day).

The "accountant" will collect the time sheets and materials requisition forms, and compile job cost sheets for the two jobs described in the following facts.

Overhead is to be applied at $5 per direct labor hour.

What cost is assigned to each job? At the conclusion of the problem, consider if you believe the overhead application rate is too low. Why?

DAY 1

The company refurbishes airplane engines. The Engine A job was begun, and all three laborers worked 8 hours each. Laborers #1 and #2 worked

exclusively on Engine A, but laborer #3 spent 3 hours on repairing factory tools and maintenance. Laborer #1 requisitioned engine pistons (16 at $400

each) and Laborer #3 requisitioned two engine manifolds that cost $4,000 each. Laborer #2 requisitioned a lubricant for freeing stuck bolts (2 cans at $8

each). Each laborer is paid $25 per hour.

DAY 2

Engine B job was begun, and all three laborers worked 8 hours each. Laborer #1 continued to work on Engine A for 7 hours, and spent 1 hour reviewing a

training manual containing information needed to pass an upcoming certification test. Laborers #2 and #3 each worked 6 hours on Engine B. Laborer #2

requisitioned engine glow plugs (4 at $300 each), and heat resistant tape (1 roll at $7). Laborer #3 requisitioned cleaning solution needed to remove

spilled grease from the shop floor (1 can at $24), and Laborers #2 and #3 spent 2 hours each cleaning the floor.

DAY 3

Engine A and B were finished. Laborer #1 equally split 8 hours of work between Engine A and Engine B. Laborer #2 did not report for work due to illness

brought on by the cleaning solution used the day before, and will be paid for 8 hours of sick time. Laborer #3 worked 8 hours on Engine B. The only

materials used were miscellaneous gaskets costing $6 that had been requested by Laborer #1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning