Concept explainers

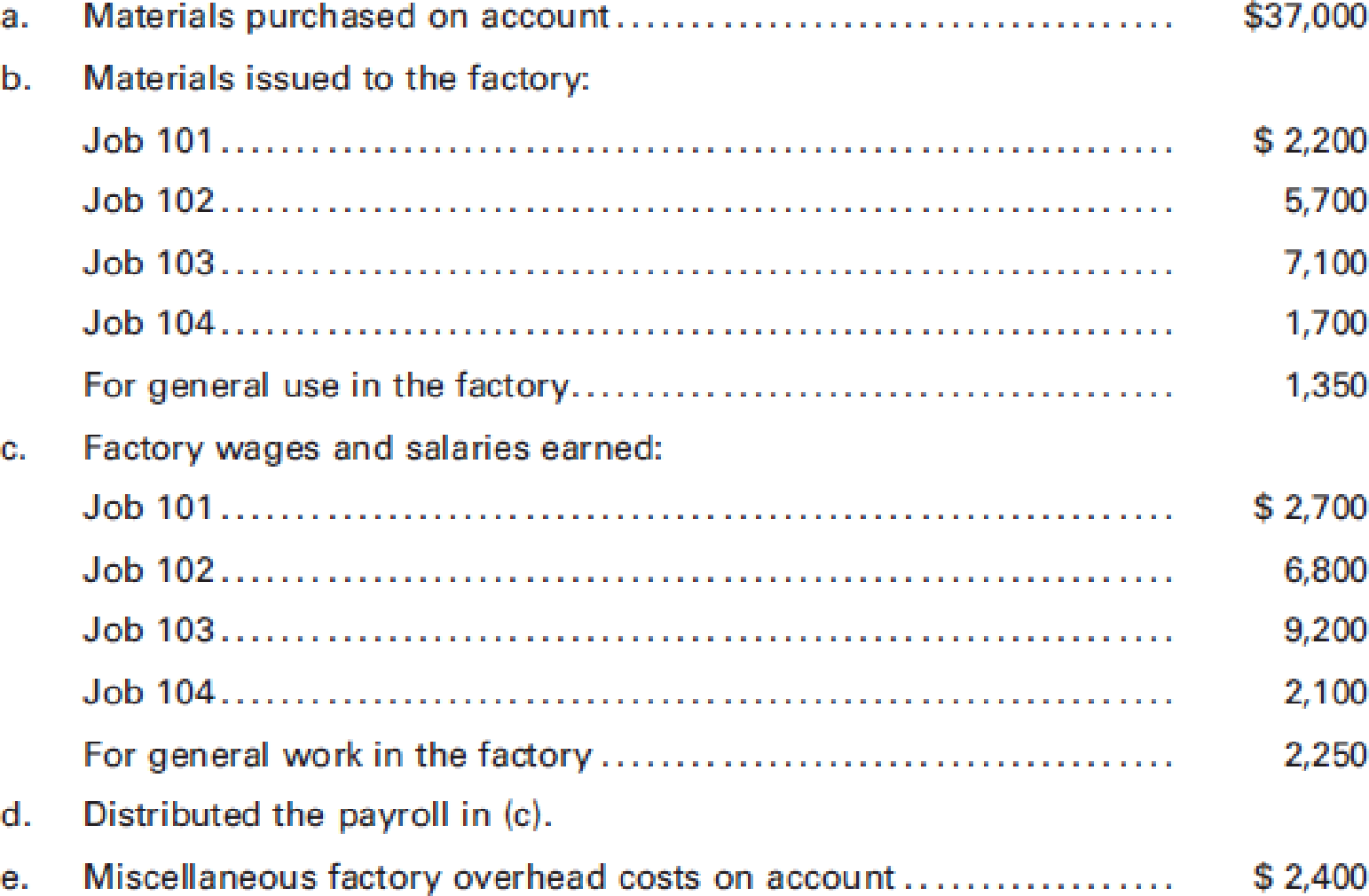

Sultan, Inc. manufactures goods to special order and uses a

Required:

- 1. Prepare a schedule reflecting the cost of each of the four jobs.

- 2. Prepare

journal entries to record the transactions. - 3. Compute the ending balance in Work in Process.

- 4. Compute the ending balance in Finished Goods.

1.

Prepare a schedule that reflects the cost of all four jobs.

Explanation of Solution

Prepare a schedule that reflects the cost of all four jobs.

| Particulars |

Job 101 ($) | Job 102 ($) | Job 103 ($) |

Job 104 ($) |

Total Cost ($) |

| Direct Materials | 2,200 | 5,700 | 7,100 | 1,700 | 16,700 |

| Direct Labor | 2,700 | 6,800 | 9,200 | 2,100 | 20,800 |

| Factory Overhead | 1,200 | 2,000 | 3,800 | 1,000 | 8,000 |

| Total | 6,100 | 14,500 | 20,100 | 4,800 | 45,500 |

Table (1)

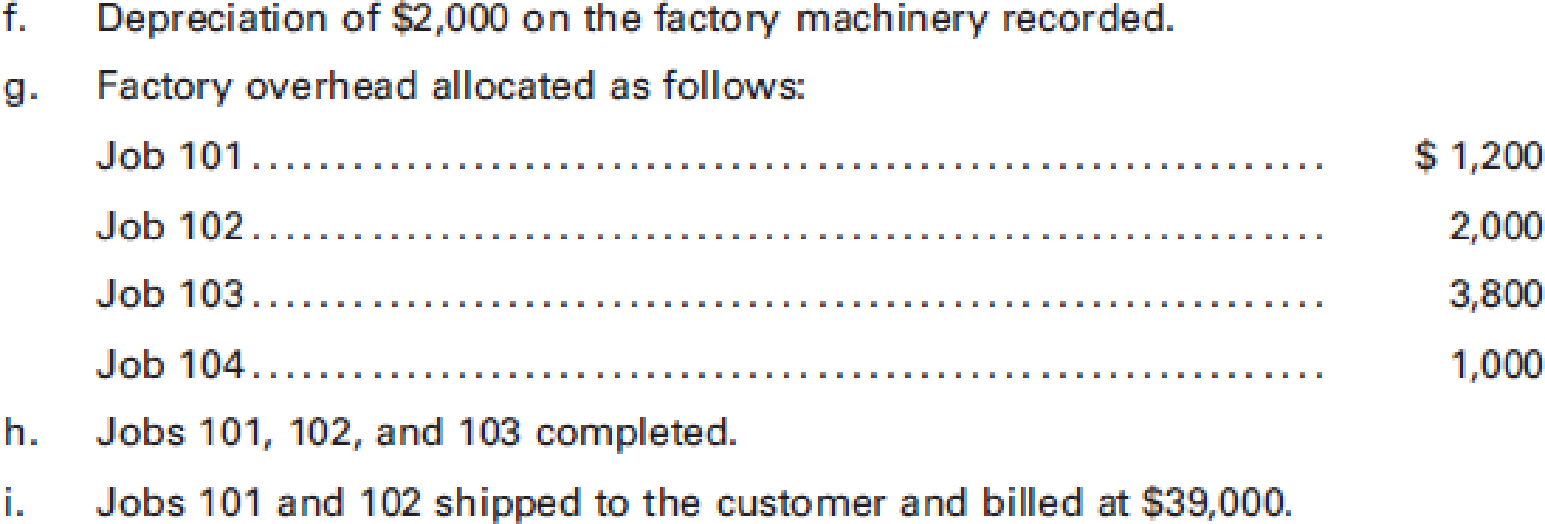

2.

Provide journal entry to record the given transactions.

Explanation of Solution

Provide journal entry to record the given transactions.

| Date | Accounts title and explanation | Debit ($) | Credit ($) |

| a | Materials | 37,000 | |

| Accounts payable | 37,000 | ||

| (To record materials purchased on account) | |||

| b | Work in Process | 16,700 | |

| Factory overhead | 1,350 | ||

| Materials | 18,050 | ||

| (To record issue of direct materials and indirect materials) | |||

| c | Payroll | 23,050 | |

| Wages Payable | 23,050 | ||

| (To record factory wages and salaries) | |||

| d | Work in Process | 20,800 | |

| Factory overhead | 2,250 | ||

| Payroll | 23,050 | ||

| (To record payment of wages to the labor) | |||

| e | Factory overhead | 2,400 | |

| Accounts payable | 2,400 | ||

| (To record factory overhead costs on account) | |||

| f. | Factory overhead | 2,000 | |

| Accumulated Depreciation - Machinery | 2,000 | ||

| (To record depreciation on factory machine) | |||

| g. | Work in Process | 8,000 | |

| Factory Overhead | 8,000 | ||

| (To record transfer of factory overhead to Work-in process) | |||

| h. | Finished Goods (1) | 40,700 | |

| Work in Process | 40,700 | ||

| (To record the transfer of cost of completed work to finished goods) | |||

| i | Accounts receivable | 39,000 | |

| Sales | 39,000 | ||

| (To record the sale made on account) | |||

| Cost of goods sold (2) | 20,600 | ||

| Finished goods | 20,600 | ||

| (To record the cost of goods sold) |

Table (2)

Working note 1: Calculate the cost of completed work (finished goods).

Working note 2: Calculate the cost of goods sold.

3.

Calculate the ending balance in work-in process.

Explanation of Solution

Calculate the ending balance in work-in process.

Hence, the ending balance in work-in process is $4,800.

4.

Calculate the ending balance in finished goods.

Explanation of Solution

Calculate the ending balance in finished goods.

Hence, the ending balance in finished goods is $20,100.

Want to see more full solutions like this?

Chapter 1 Solutions

Principles of Cost Accounting

- Gerken Fabrication Inc. uses the job order cost system of accounting. The following information was taken from the companys books after all posting had been completed at the end of March: a. Compute the total production cost of each job. b. Prepare the journal entries to charge the costs of materials, labor, and factory overhead to Work in Process. c. Prepare the journal entry to transfer the cost of jobs completed to Finished Goods. d. Compute the unit cost of each job. e. Compute the selling price per unit for each job, assuming a mark-on percentage of 50%.arrow_forwardLeen Production Co. uses the job order cost system of accounting. The following information was taken from the companys books after all posting had been completed at the end of May: a. Compute the total production cost of each job. b. Prepare the journal entry to transfer the cost of jobs completed to Finished Goods. c. Compute the selling price per unit for each job, assuming a mark-on percentage of 40%. d. Prepare the journal entries to record the sale of Job 1065.arrow_forwardChannel Products Inc. uses the job order cost system of accounting. The following is a list of the jobs completed during March, showing the charges for materials issued to production and for direct labor. Assume that factory overhead is applied on the basis of direct labor costs and that the predetermined rate is 200%. Required: Compute the amount of overhead to be added to the cost of each job completed during the month. Compute the total cost of each job completed during the month. Compute the total cost of producing all the jobs finished during the month.arrow_forward

- Use the space provided below to prepare six summary journal entries for the month of August. These entries record (1) cost of direct materials used, (2) cost of direct labor, (3) cost of applied overhead, (4) cost of jobs completed, (5) cost of goods sold, and (6) total sales on account. Then set up T-accounts for Work in Process, Finished Goods, Cost of Goods Sold, and Sales. Post the entries to the appropriate accounts and then balance each account. Finally, prepare a supporting schedule by job number showing the cost of ending work in process, finished goods, and cost of goods sold.arrow_forwardBangor Products Co. obtained the following information from its records for April: Required: 1. Prepare, in summary form, the journal entries that would have been made during the month to record issuing materials to production, the distribution of labor, and overhead costs; the completion of the jobs; and the sale of the jobs. 2. Prepare schedules computing the following for April: a. The gross profit or loss for each job completed and for the business as a whole. b. For each job, the gross profit or loss per unit. (Round to the nearest cent.)arrow_forwardSpokane Production Co. obtained the following information from its records for July: Required: 1. Prepare, in summary form, the journal entries that would have been made during the month to record issuing materials to production, the distribution of labor, and overhead costs; the completion of the jobs; and the sale of the jobs. 2. Prepare schedules computing the following for July: a. The gross profit or loss for each job completed and sold, and for the business as a whole. b. For each job, the gross profit or loss per unit. (Round to the nearest cent.)arrow_forward

- Terrills Transmissions uses a job order cost system. A partial list of the accounts being maintained by the company, with their balances as of November 1, follows: The following transactions were completed during November: a. Materials purchases on account during the month, 74,000. b. Materials requisitioned during the month: 1. Direct materials, 57,000. 2. Indirect materials, 11,000. c. Direct materials returned by factory to storeroom during the month, 1,100. d. Materials returned to vendors during the month prior to payment, 2,500. e. Payments to vendors during the month, 68,500. Required: 1. Prepare general journal entries for each of the transactions. 2. Post the general journal entries to T-accounts. 3. Balance the accounts and report the balances of November 30 for the following: a. Cash b. Materials c. Accounts Payablearrow_forwardBrady Furniture Company manufactures wooden oak furniture. The company employs a job cost system to trace manufacturing costs to jobs. Each job represents a batch of furniture of the same type. Information regarding direct materials on selected jobs throughout the year is as follows: Dining tables are the most difficult furniture item in Bradys catalog to manufacture. Thus, the most skilled employees are scheduled to make dining tables, unless they are required for other jobs. a. Determine the material cost per unit for each job. b. Use the January material cost per unit for each type of furniture as the base material cost. For each month and each type of furniture, determine the unit material cost as a percent of the base unit material cost. Round percent to one decimal place. Use the following table format: c. Develop a line chart of the percent of unit material cost to the base unit material cost. Place the months on the horizontal axis and use three lines for the three different types of furniture. d. Interpret the chart. What is happening to the dining tables?arrow_forwardPrepare Job-Order Cost Sheets, Predetermined Overhead Rate, Ending Balance of WIP, Finished Goods, and COGS At the beginning of March, Mendez Company had two jobs in process, Job 86 and Job 87, with the following accumulated cost information: During March, two more jobs (88 and 89) were started. The following direct materials and direct labor costs were added to the four jobs during the month of March: At the end of March, Jobs 86, 87, and 89 were completed. Only Job 87 was sold. On March 1, the balance in Finished Goods was zero. Required: 1. Calculate the overhead rate based on direct labor cost. (Note: Round to three decimal places.) 2. Prepare a brief job-order cost sheet for the four jobs. Show the balance as of March 1 as well as direct materials and direct labor added in March. Apply overhead to the four jobs for the month of March, and show the ending balances. 3. Calculate the ending balances of Work in Process and Finished Goods as of March 31. 4. Calculate the Cost of Goods Sold for March.arrow_forward

- The following information, taken from the books of Herman Brothers Manufacturing represents the operations for January: The job cost system is used, and the February cost sheet for Job M45 shows the following: The following actual information was accumulated during February: Required: 1. Using the January data, ascertain the predetermined factory overhead rates to be used during February, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Prepare a schedule showing the total production cost of Job M45 under each method of applying factory overhead. 3. Prepare the entries to record the following for February operations: a. The liability for total factory overhead. b. Distribution of factory overhead to the departments. c. Application of factory overhead to the work in process in each department, using direct labor hours. (Use the predetermined rate calculated in Requirement 1.) d. Closing of the applied factory overhead accounts. e. Recording under- and overapplied factory overhead and closing the actual factory overhead accounts.arrow_forwardJOURNAL ENTRIES FOR MATERIAL. LABOR, OVERHEAD, AND SALES Alert Enterprises had the following job order transactions during the month of April. Record the transactions in the general journal, including issuance of materials, labor, and factory overhead applied; completed jobs sent to finished goods inventory; closing of the under- or overapplied factory overhead to the cost of goods sold account; and sale of finished goods. Make compound entries for both transactions dared April 25, with separate debits for each job.arrow_forwardHughes Products Inc. uses a job order cost system. Selected transactions dealing with factory items for the month follow: a. Requisitioned indirect materials from storeroom, 3,200. b. Purchased, on account, factory supplies for future needs, 4,400. c. Purchased parts, on account, for repairing a machine, 1,400. d. Requisitioned factory supplies from storeroom, 900. e. Returned other defective factory supplies to vendor, 700. f. Factory rent accrued for the month, 2,400. g. Returned previously requisitioned factory supplies to store room, 350. h. Depreciation of machinery and equipment, 2,800. i. Payroll taxes liability for month, 3,200. j. Heat, light, and power charges payable for the month, 6,400. k. Expired insurance on inventories, 1,350. l. Factory overhead applied to production, 34,600. m. Indirect labor for the month, 2,600. n. Goods completed and transferred to finished goods: materials, 14,400; labor, 40,400; factory overhead, 30,400. Required: Record the previous transactions. Assume that the records include a control account and a subsidiary ledger for factory overhead, to which the entries will be posted at some later date.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning